US inflation slowed dramatically in October, from 3.7% to 3.2%, and this exerted immense pressure on the dollar. The pound jumped more than 200 points in a moment. This was quite justified, as cooling inflation will allow the Federal Reserve to forgo any more interest rate hikes and to start cutting rates instead. And even thoughts about such a scenario can become the cause of a fairly long downtrend for the dollar. But today, there's a good chance that the pair might retreat or even lose back all the gains it achieved from the US inflation data. The thing is that the market expects an even more significant decline in UK inflation. The growth rate of consumer prices may slow down from 6.7% to 4.9%. And quite recently, during the last Bank of England meeting, three board members spoke in favor of raising the rate. They did not even consider rate cuts. It seems that the sentiments within the BoE may take a sharp pivot, which will contribute to the pound's weakness.

However, even if the pound falls, this wouldn't last long, as the forecasts for today's US reports are purely negative. In particular, the growth rate of retail sales is likely to slow down from 3.8% to 2.1%. And such a noticeable decline in consumer activity, which is the locomotive of economic growth, cannot support the dollar. So today, we expect the pair to show sideways movement. But in the final analysis, the dollar will somewhat improve its position. This is also due to a fairly significant decline, as it is necessary for a rebound to follow.

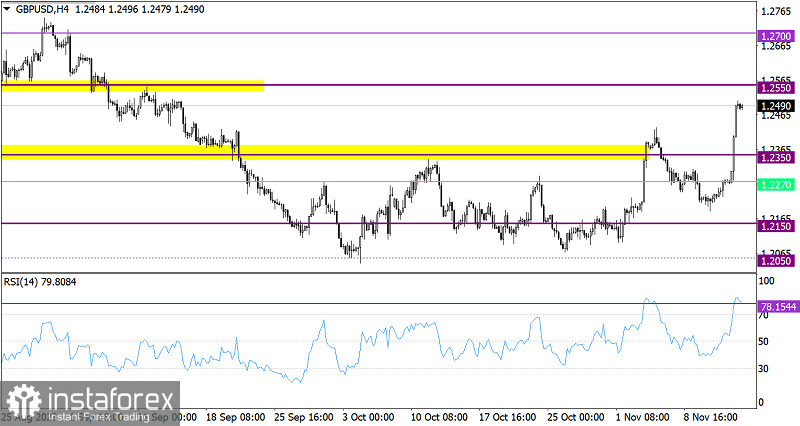

The British pound strongly rallied against the backdrop of a widespread dollar sell-off. At its peak, the exchange rate strengthened by approximately 1.8%, which is about 230 points, allowing the pound to reach the 1.2500 level.

On the four-hour chart, the RSI indicator shows a signal of the pound's overbought conditions in the intraday period. The indicator reached a level of 82.48, the highest overbought level since May 2021.

On the same chart, the Alligator's MAs are headed upwards, which reflects the quote's movement.

Outlook

Considering the pound's excessive overbought condition, we can expect a retracement phase to follow. In this case, the dollar may partially recover its value and move towards the 1.2350 level.

However, an alternative scenario suggests extending the upward cycle, due to the current momentum, where speculators may ignore the currency's overbought condition. This scenario will come into play if the price settles above the 1.2500 level.

Complex indicator analysis provides a bullish signal in the short-, medium- and long-term timeframes.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română