EUR/USD

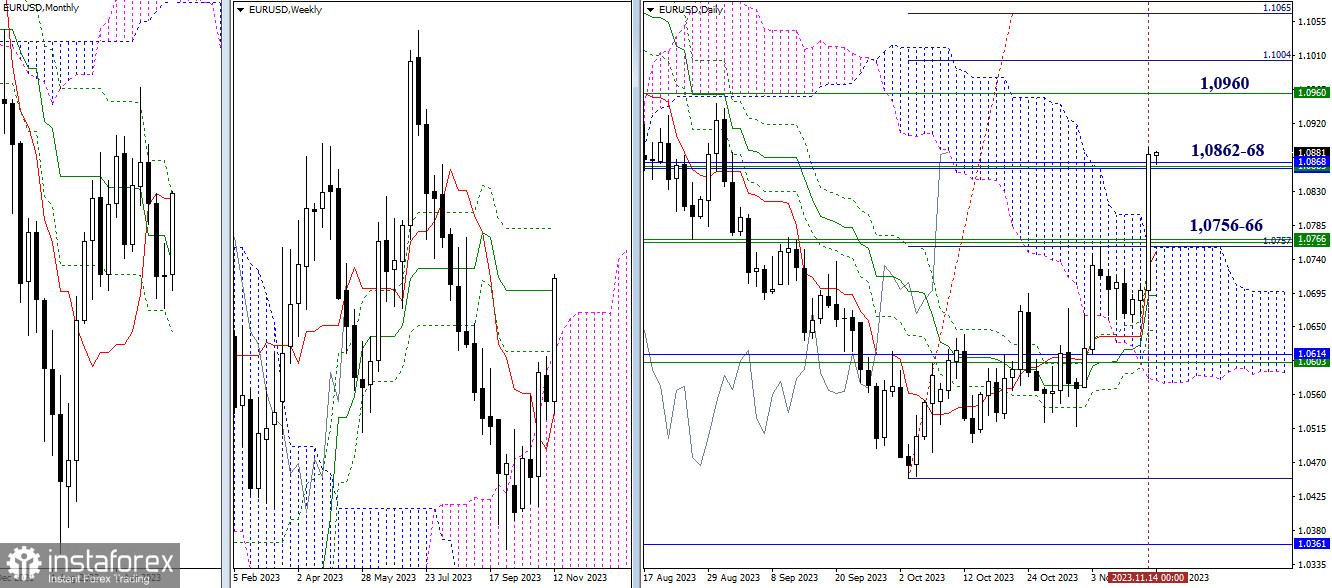

Higher Timeframes

After reflection and indecision, bulls showed record activity and productivity yesterday, immediately surpassing many important resistance levels of this area. Maintaining what has been achieved and strengthening it to new heights is the main task of the current time. Next, the attention of higher timeframes will be directed towards eliminating the weekly death cross (1.0960 final level) and achieving the target set yesterday for breaking through the daily Ichimoku cloud (1.1004 – 1.1065).

At the moment, the attraction and influence on the market, restraining the development of the situation, may be exerted by the region of significant resistances reached yesterday, 1.0862 – 1.0868 (weekly medium-term trend + monthly levels). If bullish players do not sustain what has been achieved and surrender the initiative to the opponent, then the accumulation of levels (1.0766 – 1.0756), passed unnoticed yesterday, may provide support to the market.

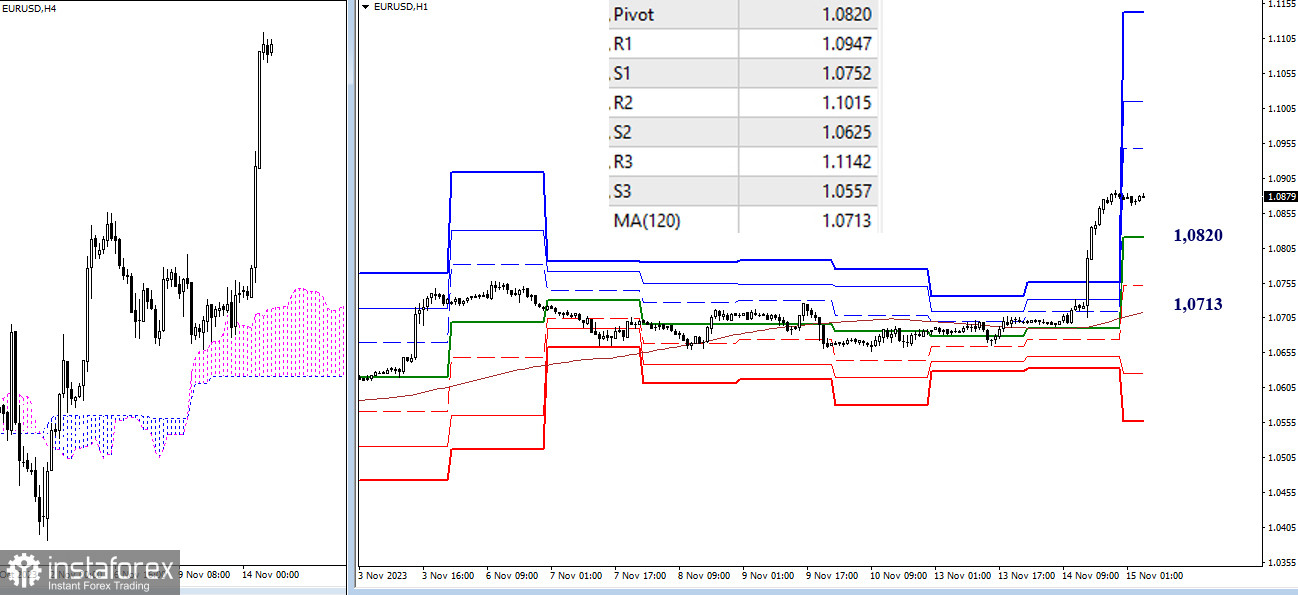

H4 – H1

The pair yesterday soared well above the reference points indicated by classic pivot points on lower timeframes, so today, this instrument, responding to market demands, expanded its capabilities. In the case of a continued rise, intraday upward targets today can be marked at 1.0947 – 1.1015 – 1.1142 (classic pivot points). In the case of corrective decline, attention will shift to the supports of key levels 1.0820 (central pivot point) and 1.0713 (weekly long-term trend).

***

GBP/USD

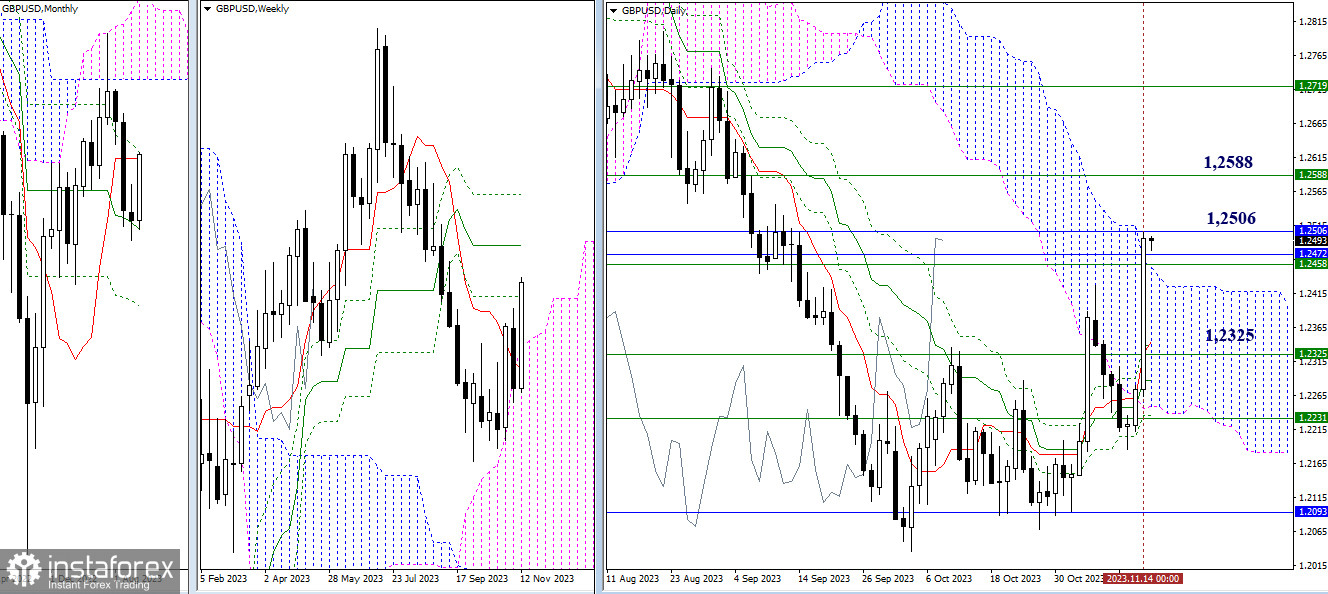

Higher timeframes

The bulls managed to lift the market to monthly resistances (1.2472 – 1.2506) over the past day. The result of this interaction may determine the further development of the situation. A breakout and continuation of the ascent will shift focus to the weekly medium-term trend (1.2588). A rebound and interception of initiative by the opponent, after losing the current accumulation of levels 1.2153 – 1.2458 – 1.2472 – 1.2506, which currently exerts attraction and support, will open the way to the next support levels, today located at 1.2344, and the upper boundary of the weekly cloud (1.2325).

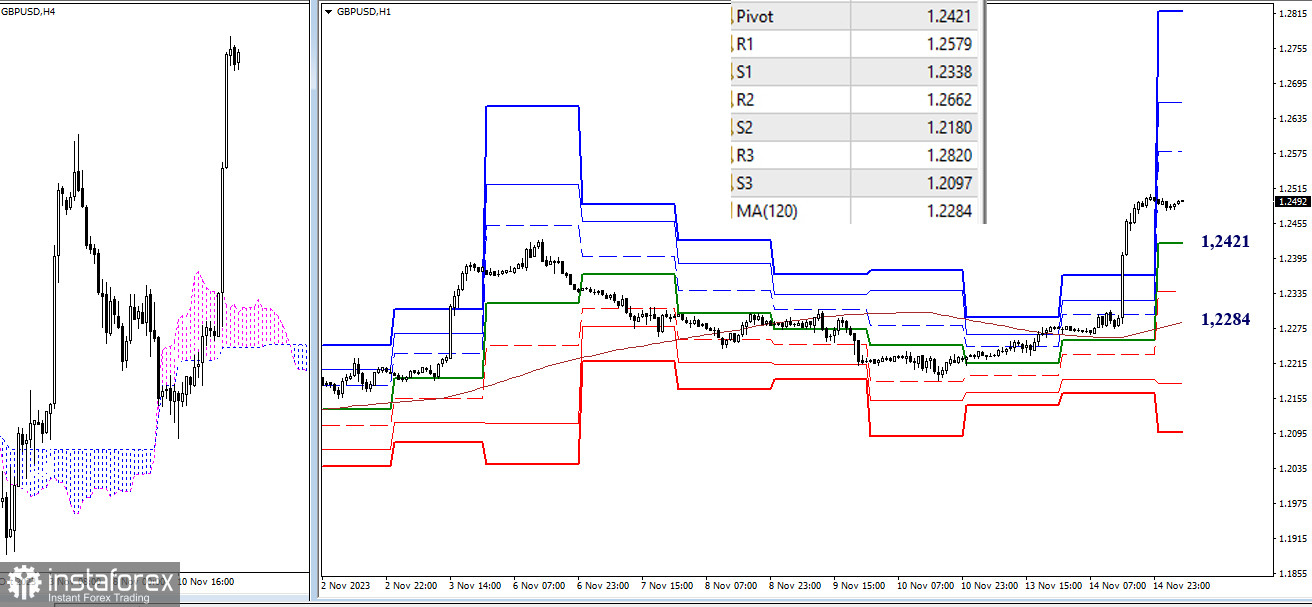

H4 – H1

Bulls used their advantage yesterday and, within the day, managed to go far beyond the classic pivot points, which took into account the experience and today expanded their boundaries to 1.2579 – 1.2662 – 1.2820. In the case of a change in sentiment and the development of corrective decline, the levels 1.2421 (central pivot point) – 1.2338 (S1 of classical pivot points) – 1.2284 (weekly long-term trend) will act as supports today.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română