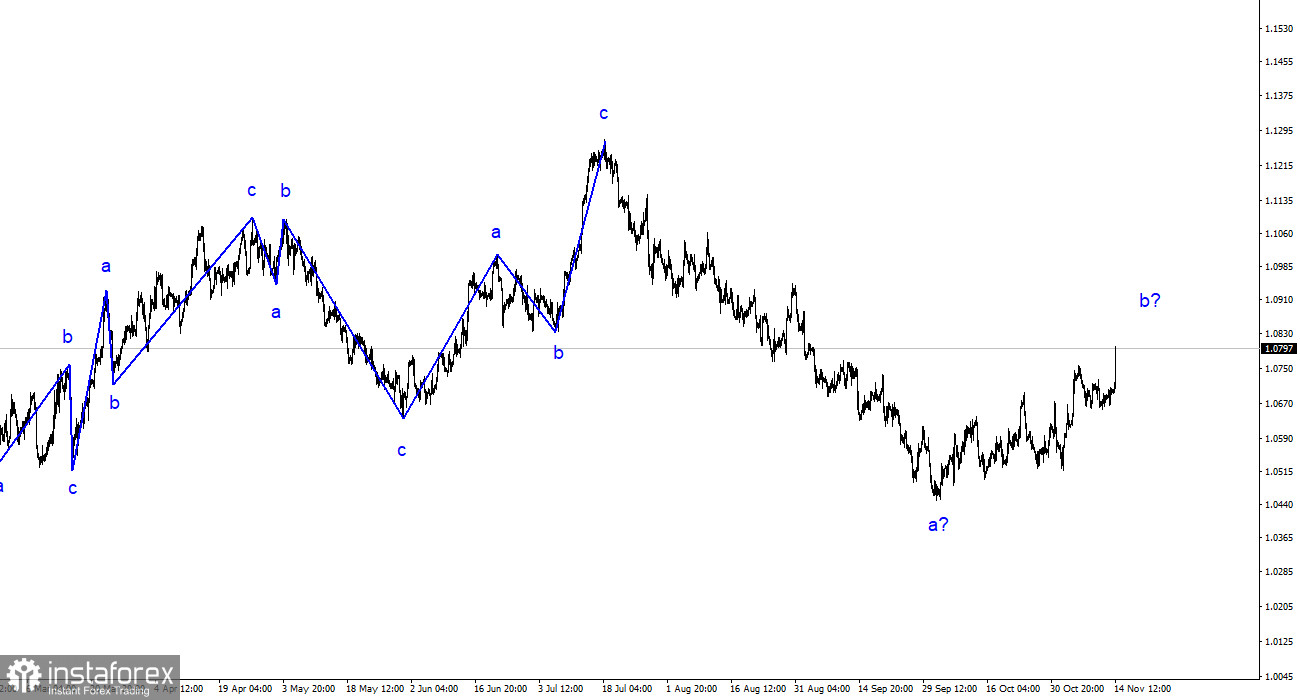

The wave analysis of the 4-hour chart for the euro/dollar pair remains quite clear. Over the past year, we have seen only three wave structures that constantly alternate with each other. Over the past months, I have regularly mentioned that I expect the pair near the 5th figure, where the construction of the last upward three-wave structure began. This target was reached after a two-month decline. After reaching this target, the construction of corrective wave 2 or b began, which has already taken a clear five-wave form, but the inflation report led to this wave taking an even more complex form. Nevertheless, the working scenario remains the same – wave 3 or c construction.

Regardless of how wave 2 or b turns out in the end (I warned that it could be much more complicated), the overall decline of the European currency will not be completed because, in any case, the construction of the third wave of the downward trend requires further development. Now, wave e in 2 or b will take a five-wave form, after which the quote rise will be completed.

GDP in the Eurozone was negative in the third quarter.

On Tuesday, the euro/dollar pair's exchange rate rose by 100 basis points. Everyone understands that the reason for such a sharp drop in demand for the dollar was not the GDP report in the European Union. Today, the second of three estimates was released, according to which the European economy contracted by 0.1% in the third quarter. The market practically did not react to this report. Also, the ZEW economic sentiment indices in the EU and Germany were released in the morning. Both turned out to be better than market expectations, and these indices allowed the European currency to increase slightly in price in the morning.

And then, the report on American inflation came out. Although market expectations almost 100% coincided with the real value (3.3% against 3.2% y/y), the report caused the effect of a detonated bomb. It should be understood that the reaction followed not to the report itself but to the reaction of the Fed. To be more precise, to the change in the mood of the American regulator, which is now inevitable. What am I talking about? The Fed does not need to raise rates again since inflation fell from 3.7% to 3.2% in October. This is precisely the scenario that a certain part of the market was counting on. Moreover, during the last speeches, Jerome Powell touched upon a possible rate hike, fueling the markets. The fall in inflation means that the period of its growth is over. Therefore, the FOMC will not raise the rate at the next two meetings with a probability of 90%.

General conclusions.

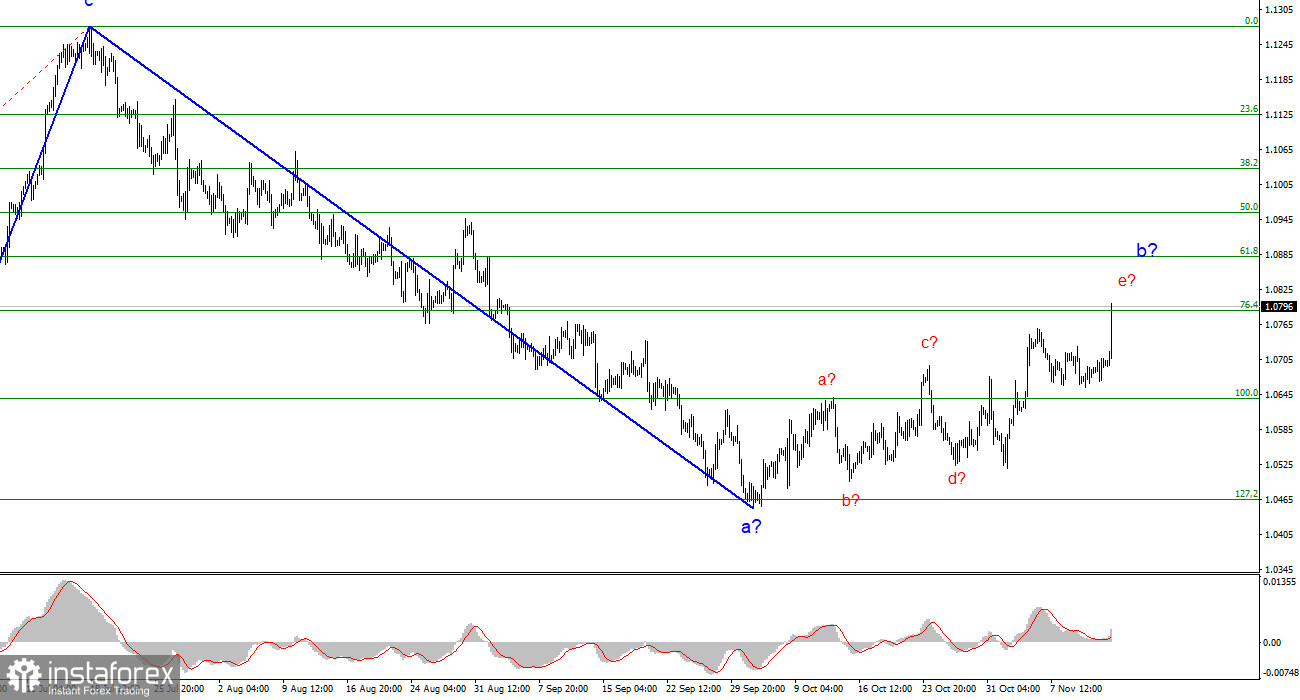

Based on the analysis conducted, the construction of a bearish set of waves continues. Targets around the 1.0463 level have been perfectly worked out, and the unsuccessful attempt to break through this level indicated a transition to the construction of a corrective wave. Wave 2 or b has taken a completed form, so in the near future, I expect the construction of an impulse downward wave 3 or c with a significant decline in the pair. I still recommend selling with targets below the low of wave 1 or a. Wave 2 or b may take a more prolonged form, so sales should be cautious at first.

On the senior wave scale, the wave analysis of the ascending segment of the trend took on an extended form but is likely completed. We saw five waves up, which are most likely the structure of a-b-c-d-e. Then, the pair built four three-wave structures: two down and two up. Now, it has moved on to building another prolonged downward three-wave structure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română