Today, the euro received a short-term bullish impulse at the beginning of the European trading session due to the publication of weakly positive macroeconomic statistics from the Eurozone.

Although the second estimate of the European GDP for the third quarter coincided with the first estimate (-0.1% and +0.1% year-on-year, respectively), euro buyers reacted positively to today's block of macroeconomic statistics from the Eurozone. This gave the euro a short-term bullish impulse.

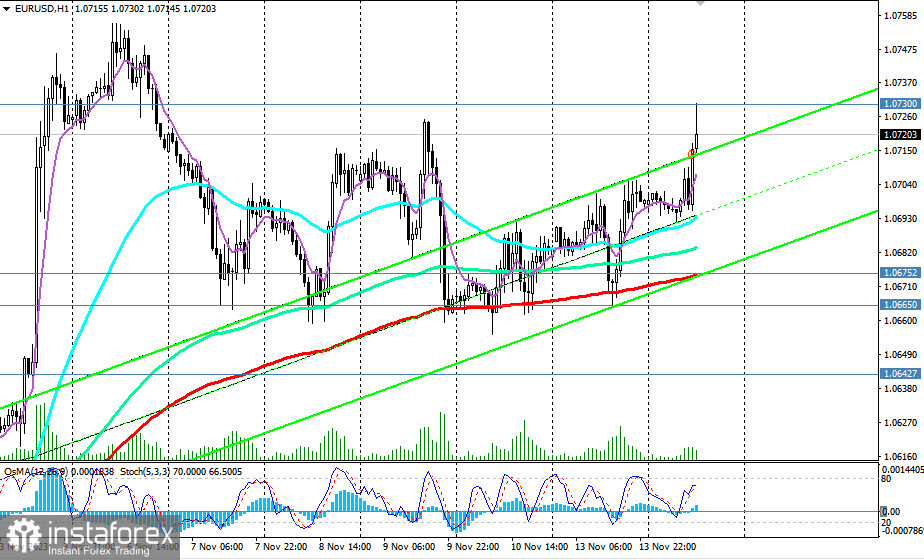

In the moment, the EUR/USD pair rose by 15 points, reaching the intraday high and the highest level since November 7th at 1.0730. This level represents a key resistance level, separating the medium-term bullish market from the bearish one, in the form of the 200-period moving average on the daily chart of EUR/USD.

Now, market participants monitoring the dynamics of the dollar, including in the EUR/USD pair, is shifting their attention to the publication (at 13:30 GMT) of the CPI indices for the U.S. in October.

A decrease in the indicators is expected, while the core CPI is forecasted to remain at the same level in October.

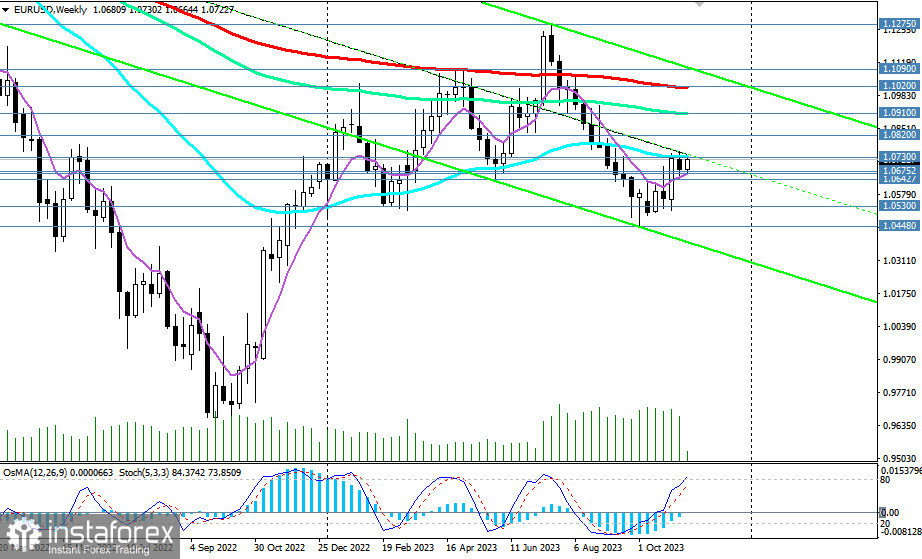

If the expected U.S. CPI figures disappoint dollar buyers, then we should expect a breakout of the key resistance level at 1.0730 (200 EMA, 144 EMA, upper boundary of the downward channel on the daily chart, 50 EMA on the weekly chart), and further growth of EUR/USD towards the important long-term resistance level at 1.0910 (144 EMA on the weekly chart) with intermediate targets at local resistance levels of 1.0800, 1.0820.

Otherwise, in the main scenario, we expect a breakdown of support levels at 1.0675 (200 EMA on the 1-hour chart), 1.0665 (50 EMA on the daily chart), and a resumption of decline. In this case, short positions will remain preferable.

A breakdown of the short-term support level at 1.0643 (200 EMA on the 4-hour chart) will strengthen the negative dynamics of the pair, returning it to the global downward trend. The nearest target, in this case, is the local support level of 1.0530, and the "fastest" signal for new short positions is the breakdown of the local support level of 1.0692.

Support levels: 1.0700, 1.0692, 1.0675, 1.0665, 1.0643, 1.0600, 1.0530, 1.0500, 1.0448, 1.0400

Resistance levels: 1.0730, 1.0800, 1.0820, 1.0900, 1.0910, 1.1000, 1.1020, 1.1090, 1.1200, 1.1275, 1.1300, 1.1400, 1.1500, 1.1600

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română