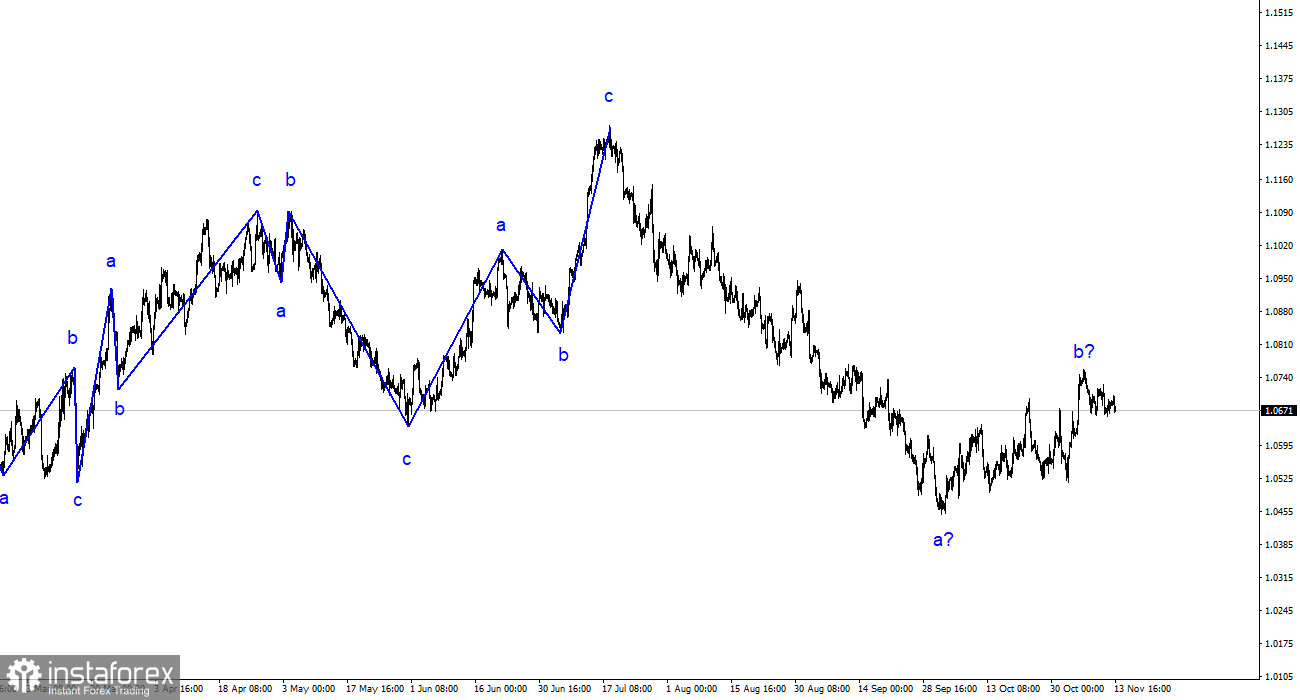

The wave analysis of the 4-hour chart for the euro/dollar pair remains quite clear. Over the past year, we have seen only three wave structures that constantly alternate with each other. Over the past few months, I have regularly mentioned that I expect the pair to reach around the 5th figure, where the construction of the last upward three-wave structure began. This target was reached after a two-month decline. Predictably, after reaching this target, the construction of corrective wave 2 or b began, which has already taken on a clear five-wave and completed form. This means that the depreciation of the euro currency could resume this week.

Regardless of how wave 2 or b turns out (it can be much more complex), the overall decline in the European currency will only be complete if, in any case, the construction of the third wave of the downward trend is required. Five internal waves are visible inside the first wave, so it is completed. Five waves are also visible inside the second wave, which may already be completed. I expect the construction of wave 3 or c.

Martin Kazaks believes the peak has yet to be reached. The euro/dollar pair's rate decreased by 15 basis points on Monday. The amplitude of movements today did not exceed 20 points. We observed a continuation of Friday when movements were practically absent. Since there is no movement, there are no changes in wave labeling either. I still believe that wave 2 or b is completed; therefore, we have entered the stage of building an impulsive wave 3 or c. The market can use something other than the necessary news background for sales. In this case, wave analysis is enough for the pair to continue its decline. Unfortunately, the market is currently at a standstill as the news background is absent. Nevertheless, the wave picture looks very convincing, following classical patterns, so I have no doubts about the pair's further decline.

Today, one ECB policymaker, Martin Kazaks, stated that the interest rate peak has yet to be reached. He noted some inflation-related risks, and the wage growth rate peak still needs to be visible. He also stated that the regulator needs a clear plan for interest rates; decisions are made at each meeting. How should Kazaks's words be interpreted? The market needs to understand whether there will be another tightening of policy. But almost all ECB officials do not give a direct answer to this question. The euro has no more chances for growth after Kazaks's relatively hawkish speech.

General Conclusions.

Based on the analysis conducted, the construction of a bearish wave set continues. Targets around the 1.0463 level have been perfectly worked out, and the unsuccessful attempt to break through this level indicated a transition to the construction of a corrective wave. Wave 2 or b has taken on a completed form, so in the near future, I expect the construction of an impulsive downward wave 3 or c with a significant decline in the pair. I still recommend selling with targets located below the low of wave 1 or a. At first, be cautious, as wave 2 or b could take an extended form.

On a larger wave scale, the upward trend's wave labeling has taken on an extended form but is likely completed. We saw five upward waves, which are likely to be a-b-c-d-e structure. Next, the pair built four three-wave structures: two downward and two upward. Now, it has entered the stage of building another extended downward three-wave structure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română