European Central Bank President Christine Lagarde is scheduled to give a speech today (at 12:30 GMT), where she may shed light on the bank's plans regarding the prospects of monetary policy in the Eurozone. Her new hawkish statements could support the euro.

Then the attention of market participants tracking the dynamics of the dollar, including in the EUR/USD pair, will shift to the publication (at 15:00 GMT) of the preliminary Consumer Sentiment Index from the University of Michigan. If it turns out to be significantly worse than the forecast (63.7) and previous values, it will be another reason (after Lagarde's speech) to book profits at the end of the week in long positions on the dollar and, accordingly, short positions in the EUR/USD pair.

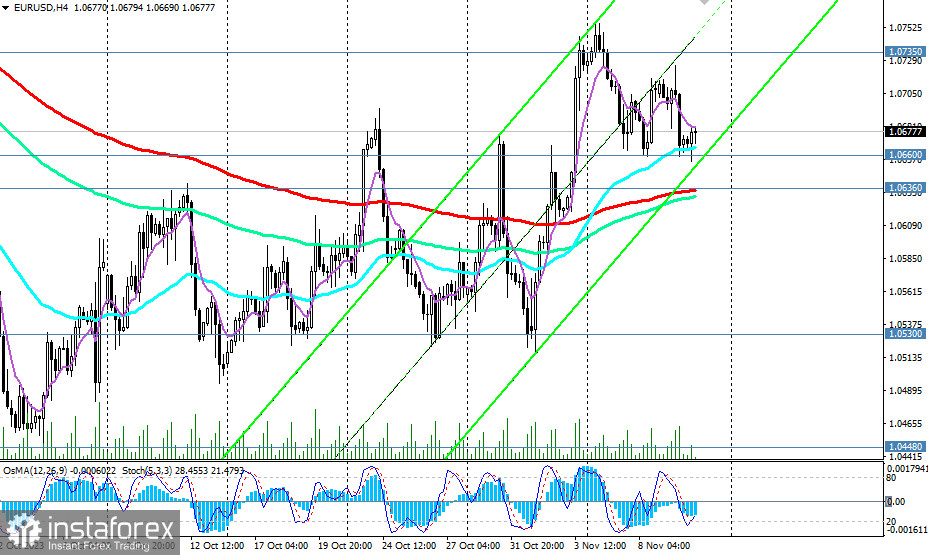

Whether it can again rise to the level of 1.0735 (200 EMA, 144 EMA, upper boundary of the downward channel on the daily chart) or even attempt to break it will be shown by the reaction to Lagarde's speech and the publication of the University of Michigan Consumer Sentiment Index.

A breakout of the resistance level at 1.0685 (200 EMA on the 15-minute chart) and stabilization above it could signal the opening of long short-term positions.

However, in general, we expect a breakdown of support at the level of 1.0660 (50 EMA on the daily chart, 200 EMA on the 1-hour chart) and a resumption of decline.

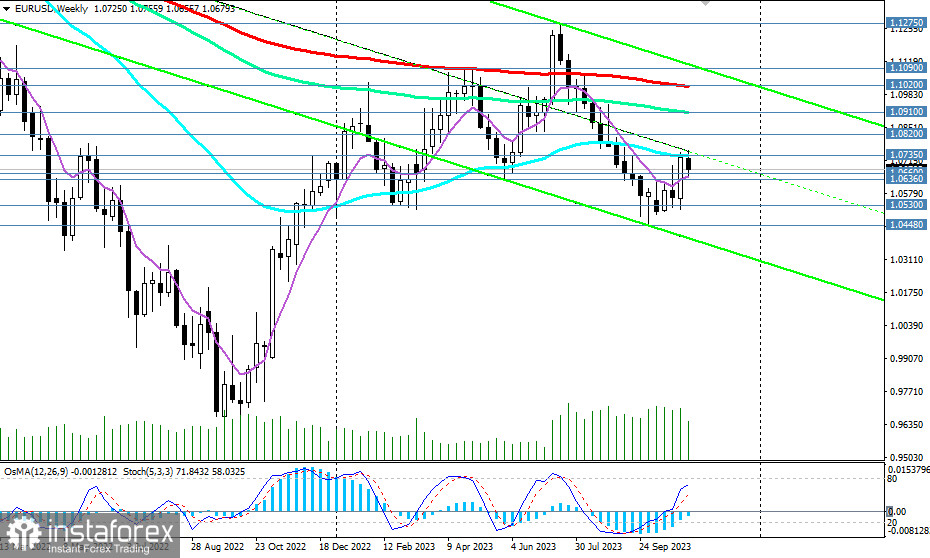

A breakdown of the short-term support level at 1.0636 (200 EMA on the 4-hour chart) will strengthen the negative dynamics of the pair. It continues to trade in a bearish market zone, medium-term—below the resistance level of 1.0735, long-term—below the key resistance level of 1.1020 (200 EMA on the weekly chart). In this case, the nearest target for decline is the local support level of 1.0530.

For now, short positions remain preferable.

Support levels: 1.0660, 1.0636, 1.0600, 1.0530, 1.0500, 1.0448, 1.0400

Resistance levels: 1.0685, 1.0700, 1.0735, 1.0800, 1.0820, 1.0900, 1.0920, 1.1000, 1.1020, 1.1090, 1.1200, 1.1275, 1.1300, 1.1400, 1.1500, 1.1600

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română