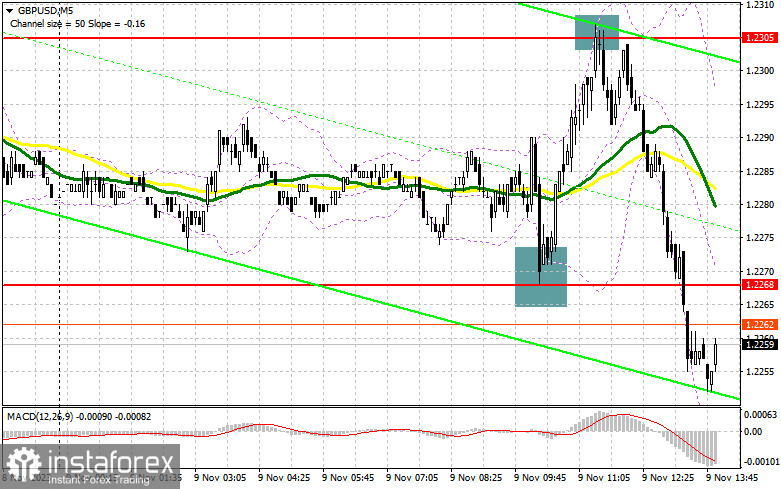

In my morning forecast, I drew attention to the level of 1.2268 and recommended making decisions on market entry based on it. Let's take a look at the 5-minute chart and figure out what happened there. The decline and the formation of a false breakout at this level led to an excellent entry point for buying the pound, resulting in an upward movement of more than 35 points. Active defense by bears at 1.2305 and the formation of a false breakout there allowed entry into the market, but already for selling the pound, which led to a decline in the pair by 50 points. The technical picture changed slightly for the second half of the day.

To open long positions on GBP/USD, the following is required:

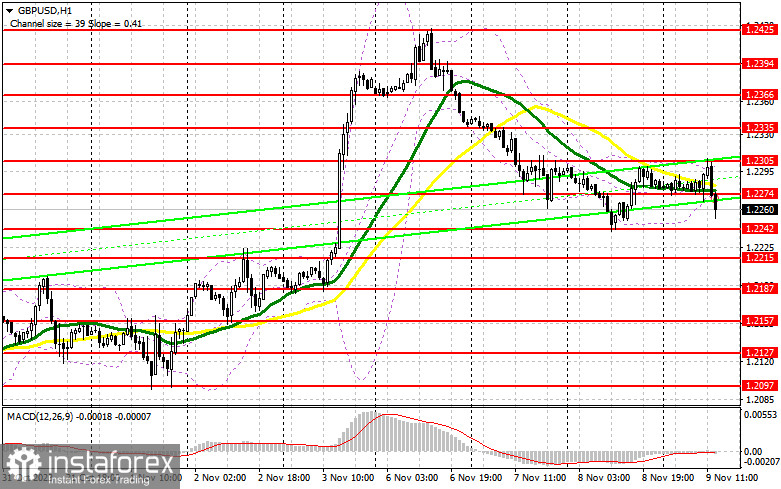

The tough stance of the Fed representatives can increase pressure on the British pound, as there is nothing new to expect from the speech of Fed Chairman Jerome Powell, and weekly labor market data is unlikely to lead to a strong surge in market volatility. For purchases, the focus is best placed on the nearest support at 1.2242, where the pound is currently heading. The formation of a false breakout there will provide an entry point for long positions with the aim of returning to the middle of the sideways channel at 1.2247, formed at the end of the first half of the day. Breaking and consolidating above this range will allow buyers to feel more confident in the market, giving a signal to open long positions with an exit to 1.2305. The ultimate target will be the area of 1.2335, where I will take a profit. In the scenario of a pair's decline and the absence of activity by buyers at 1.2242 in the second half of the day, you can completely say goodbye to bullish sentiments. In this case, only a false breakout in the area of the next support at 1.2215 will signal the opening of long positions. I plan to buy GBP/USD only on a rebound from 1.2187 with the goal of a correction of 30-35 points within the day.

To open short positions on GBP/USD, the following is required:

Sellers did everything they needed to do and now continue to control the market. In the case of a soft tone from the Fed Chairman, similar to yesterday, the pair may make a leap upward. A false breakout at 1.2274 will allow you to make sure of the presence of large sellers in the market, giving a chance for further correction and a signal to open short positions with the expectation of an update to 1.2242. Breaking and retesting this range from bottom to top will deal a more serious blow to the positions of buyers, leading to the removal of stop orders and opening the way to 1.2215. The more distant target will be the area of 1.2187, where I will take a profit. Testing this level will be evidence of building a new bear market. In the case of an increase in GBP/USD and the absence of activity at 1.2274 in the second half of the day, demand for the pound will return, and buyers will have a chance to stop this bear market. In this case, I will postpone sales until a false breakout at 1.2335. In the absence of downward movement, I will sell GBP/USD immediately on the rebound from 1.2366, but only in anticipation of a pair correction down by 30-35 points within the day.

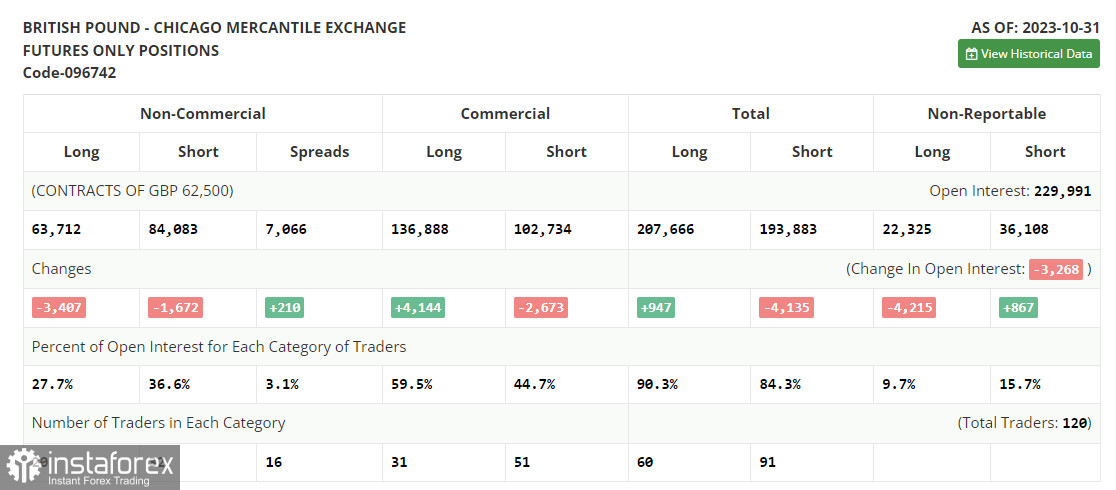

In the COT report (Commitment of Traders) for October 31, there was a reduction in both long and short positions, but this did not particularly change the balance of power, as the data does not take into account the latest important report on the state of the US labor market. The market almost did not react to the fact that the US Federal Reserve left the policy unchanged, but the reaction to weak job growth figures led to an active rise in GBP/USD at the end of last week, which may affect the future medium-term trend of the pair. The more talks there are about the fact that in December of this year, US rates may remain unchanged due to the first signs of economic weakness, the stronger the pressure on the US dollar and the more expensive the pound will be. In the last COT report, it is stated that long non-commercial positions decreased by 3,407 to the level of 63,712, while short non-commercial positions fell by 1,672 to the level of 84,083. As a result, the spread between long and short positions increased by 210. The weekly price decreased and amounted to 1.2154, up from 1.2165 the week before.

Indicator signals:

Moving averages

Trading is conducted below the 30 and 50-day moving averages, indicating the possibility of further declines in the pound.

Note: On the hourly chart H1, the author sets the period and prices for moving averages, which are different from the standard definition of traditional daily moving averages on the daily chart D1.

Bollinger Bands

In case of a decline, the lower boundary of the indicator will act as support in the area of 1.2260.

Description of indicators:

Moving average (MA) is an indicator of the current trend by smoothing volatility and noise. Period 50. Marked on the chart in yellow.Moving average (MA) is an indicator of the current trend by smoothing volatility and noise. Period 30. Marked on the chart in green.MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Fast EMA period 12. Slow EMA period 26. SMA period 9Bollinger Bands (Bollinger Bands). Period 20Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.Long non-commercial positions represent the total long open positions of non-commercial traders.Short non-commercial positions represent the total short open positions of non-commercial traders.The total non-commercial net position is the difference between short and long positions of non-commercial traders. English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română