Yes, the U.S. labor market report was disappointing, but it wasn't weak. Yes, the Treasury planned a smaller bond issuance volume than initially anticipated, but the scale is still significant. Yes, Jerome Powell pondered whether to raise the federal funds rate, but he did not explicitly state that the Fed's monetary tightening cycle is over. Perhaps the EUR/USD bulls mistook their wishes for reality?

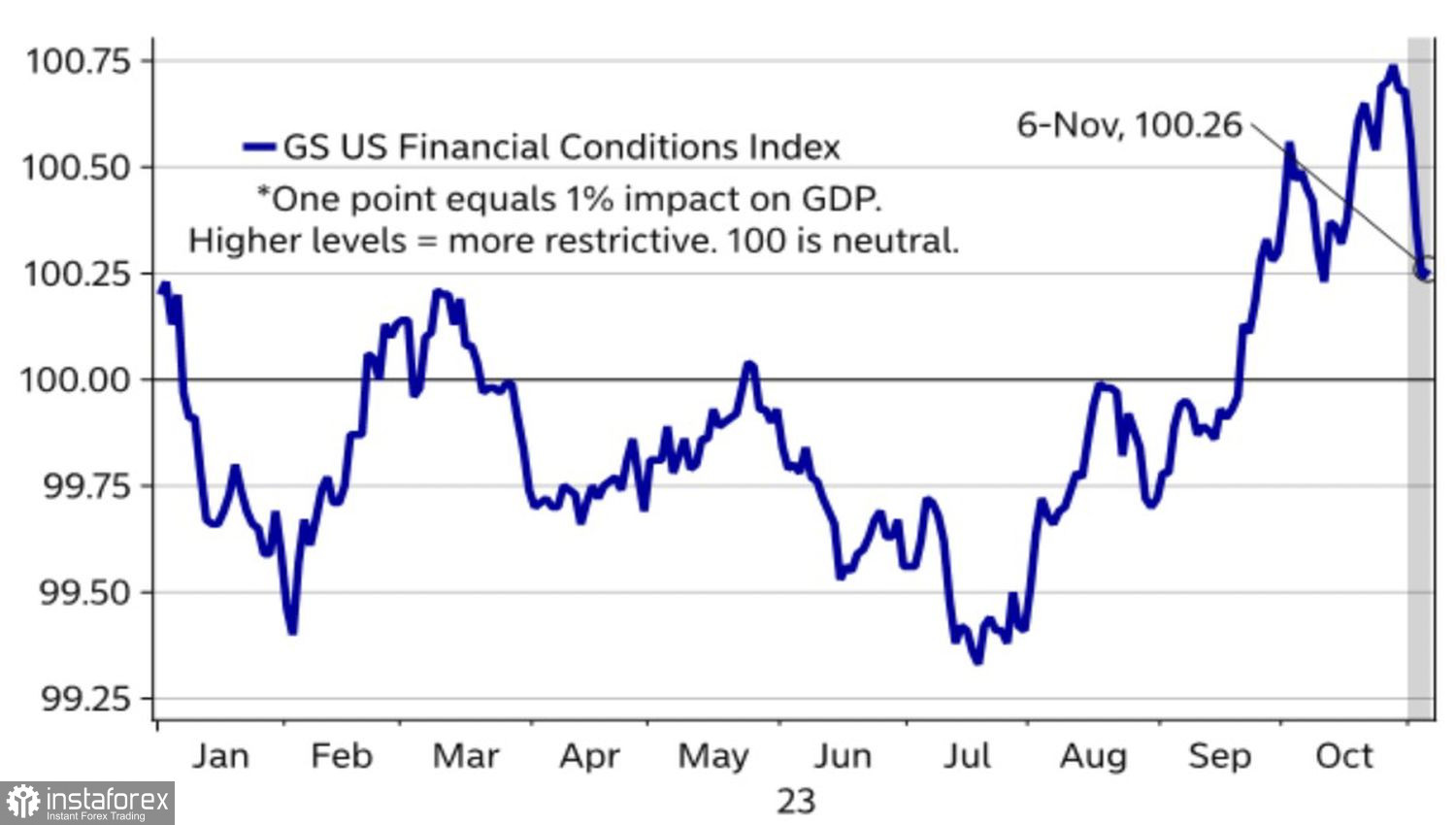

A quick unwinding of speculative shorts on U.S. Treasury bonds at record highs led to a drop in yields. As a result, the S&P 500 marked its longest winning streak in two years, and EUR/USD quotes left the consolidation range of 1.05–1.07. The U.S. dollar and financial conditions have weakened. The Fed's battle against inflation has become more complicated. Should we be surprised by the hawkish rhetoric of FOMC members?

Dynamics of Financial Conditions in the U.S.

Usually, after the end of a monetary tightening cycle, interest rates are lowered. However, does the market pricing, which assumes that the Fed will lower borrowing costs by 100 basis points to 4.5% in 2024, seem too aggressive? In reality, it is more likely that the ECB will resort to stimulus measures, as the Eurozone's economy is clearly weaker than the American one.

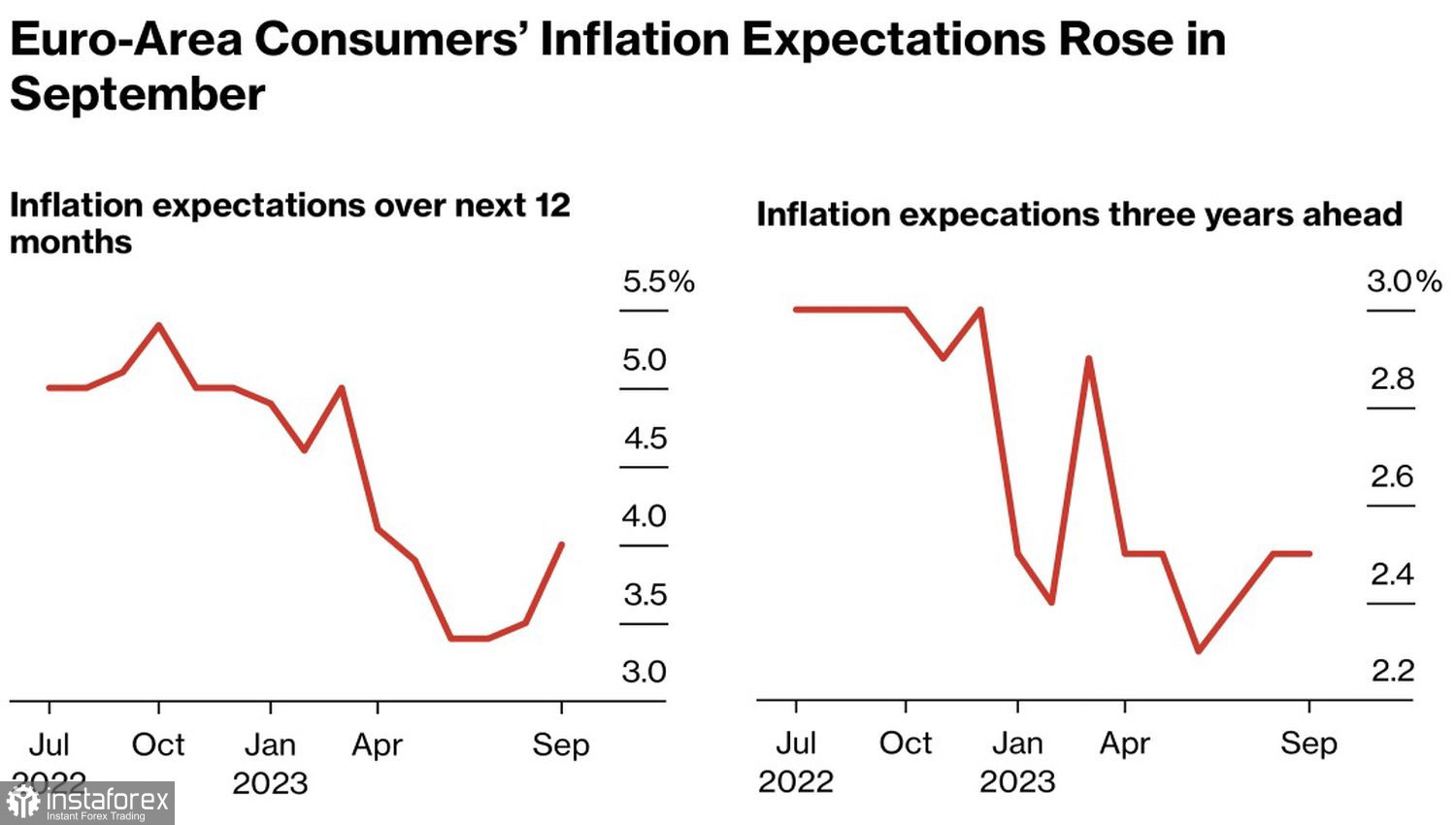

So far, the rise in inflation expectations in the currency bloc from 3.5% to 4% over the next 12 months indicates that it is too early for the European Central Bank to abandon its policy of keeping deposit rates flat. But what about tomorrow?

Dynamics of Inflation Expectations in the Eurozone

Nordea predicts that the ECB will start easing monetary policy in the summer of 2024, while the Fed will keep borrowing costs at 5.5% until 2025. Divergence in monetary policy creates a tailwind for EUR/USD bears. Nevertheless, there are risks to the pair's growth. It is difficult to imagine that the U.S. economy will remain as strong as it is now. It is more likely that the dollar will lose its ace, which is American exceptionalism. A soft landing in the Eurozone, along with China's GDP acceleration, will boost global risk appetite, strengthening the euro's position. This allows companies to forecast EUR/USD consolidation around the 1.08 level over the next several months.

This assessment contradicts the consensus forecasts of Reuters experts, who expect the euro to rise to $1.07 in three months, $1.08 in six months, and $1.11 in twelve months. 72 currency strategists expect the U.S. dollar to weaken against major world currencies. However, they have been doing this for most of 2023 and have been consistently wrong. What will happen this time?

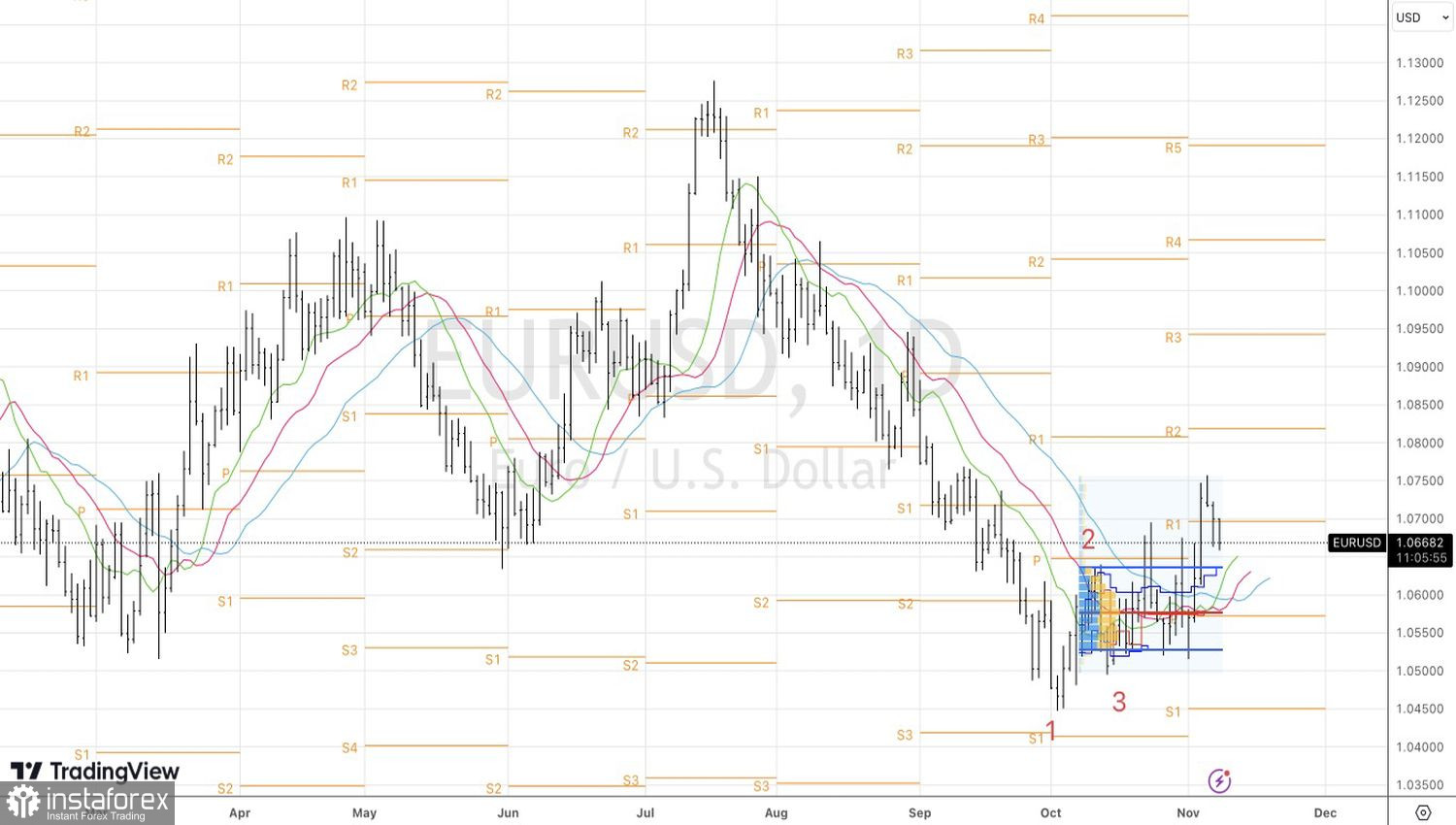

Technically, the bearish attack on EUR/USD continues. However, to reestablish the downward trend, they need to push quotes below 1.058 and thus activate the False Breakout pattern. Until that happens, the bulls have a chance for a comeback. Therefore, the return of the euro to $1.0705 or a rebound from $1.0635–1.0645 should be used for buying opportunities.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română