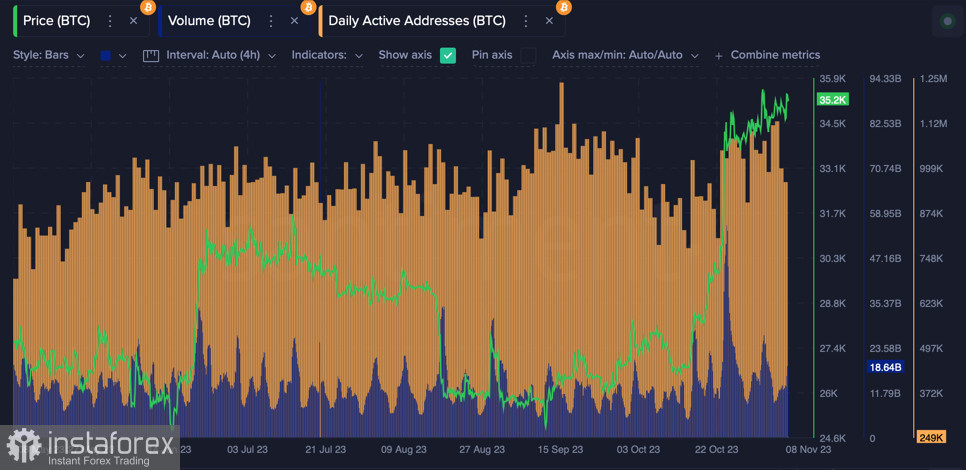

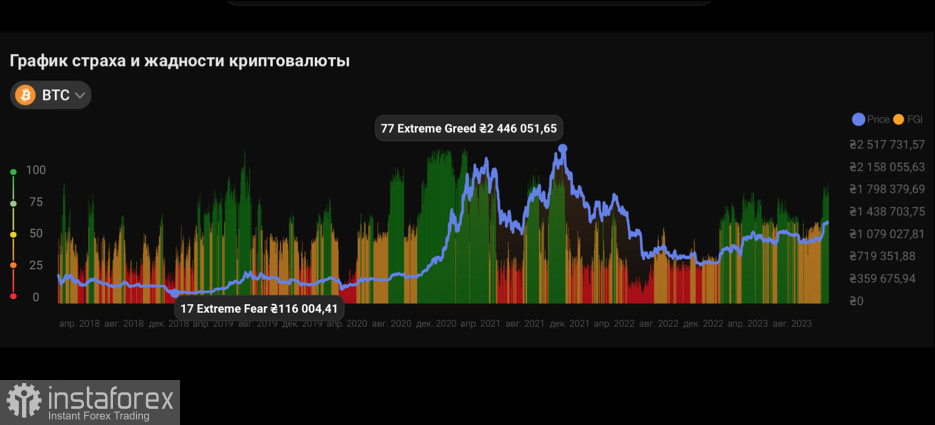

Over the past two weeks, Bitcoin has increased its market capitalization many times over and updated several local highs. However, recently, there has been a trend towards a decrease in investment activity in the BTC network. The level of dominance of the cryptocurrency continues to fall, and the increase in commissions on the asset network reduces the transaction load, which is also an undeniable sign of upward movement.

In such a situation, BTC\USD reduces its growth rate and forms a local upward channel, where the highs are slowly updated. Yesterday was no exception, and after a retest of the lower boundary of the channel at $34.4k, Bitcoin resumed its upward movement and consolidated above the $35k level, which gives great hope for further growth in quotes. However, at the same time, more and more signs of BTC overheating are appearing, and therefore, the likelihood of a correction increases.

Macro data

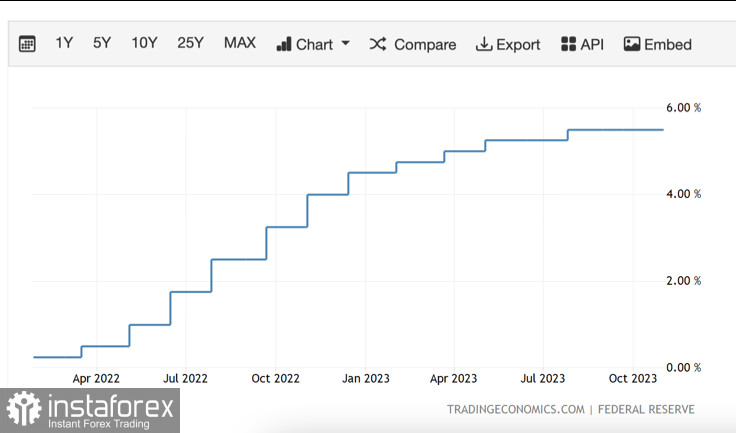

Among the key news that could indirectly influence the consolidation of BTC above $35k, it is worth highlighting the statement from Guggenheim. Analysts believe the Fed will cut rates by 150 bps next year, and eventually, the interest rate level will fall below 3%. At the same time, Minneapolis Federal Reserve Bank President Neel Kashkari said the agency has not finished raising rates in the current cycle.

In connection with these statements, today's speech by the head of the Federal Reserve, Jerome Powell, becomes an even more important and potentially volatile event. And despite the fact that investors expect soft rhetoric from the official, they should expect an increased level of volatility and impulsive price movement in high-risk assets like Bitcoin.

BTC\USD Analysis

Following yesterday's trading day, there was a significant increase in trading activity on the part of sellers and buyers. The bears managed to retest the support zone near the $34.5k level, which provoked a strong reaction from buyers, who absorbed bearish volumes intraday and closed the trading session above $35k.

As of November 8, Bitcoin is trading near the $35.3k level and retains significant chances to continue its upward movement towards $36k. It is worth noting that the Asian session began with a decrease in BTC\USD quotes from the initial $35.8k, with daily trading volumes around $18.6 billion. Bitcoin continues to move within the local upward channel of October 27, updating the local low above $34.5k.

At the same time, the $36k mark is becoming an increasing problem for short-term investors, who are beginning to lose faith in the further price rally and are taking short-term profits. Also, a divergence begins to form in the RSI, which signals an imminent decline. The stochastic oscillator also maintains a downward direction, and the increase in commissions in the BTC network confirms that the moment of "overheating" is approaching.

Considering the above trends, there is every reason to believe that Bitcoin will soon stop updating local lows and move on to full consolidation within the $34k-$35.6k range. This process will undoubtedly cause profit-taking by some investors, which will trigger a local stage of capital redistribution.

A full-fledged correction may begin if the volumes of fixed positions provoke a breakdown of the $34k level. In this case, among the potential targets for correction, it is worth highlighting the $33.2k and $32.1k levels. With the rapid absorption of free volumes of BTC and the resumption of upward movement above $36k, operational space opens up for buyers to reach the $40k mark.

Conclusion

Bitcoin is approaching the final exhaustion of its upward potential near the $36k mark. We looked at three scenarios where the most likely scenario is consolidation within $34k-$35.6k followed by a local correction to $33k. Bitcoin is overheated, network fees are reaching local highs, investors are focused on altcoins, and sellers are not allowing it to go above $36k. And despite the need for correction, the medium-term target for BTC remains bullish—$40k.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română