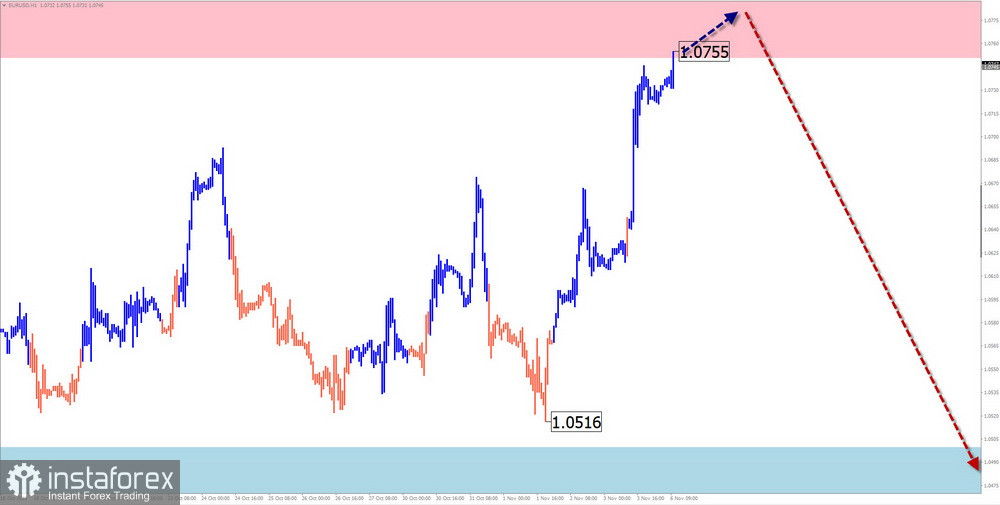

EUR/USD

Analysis:

In the short term, an ascending wave structure is relevant. For the main trend, this is a correction. It has been counting since the end of September and has not been completed yet. The wave extremes form a shifting plane on the chart. The structure appears to be complete, but there are no signals of an imminent reversal. The price is testing the resistance zone of the daily time frame.

Forecast:

In the upcoming week, the main direction of the euro exchange rate is expected to be predominantly sideways. In the next couple of days, short-term pressure on resistance is possible. Then a reversal and a decrease are likely, down to the lower support boundary. Increased volatility can be expected in the second half of the week.

Potential Reversal Zones

Resistance:

- 1.0750/1.0800

Support:

- 1.0500/1.0450

Recommendations:

Selling: After the appearance of confirmed signals in the support area, it may become the main direction of trading deals.

Buying: Has no potential.

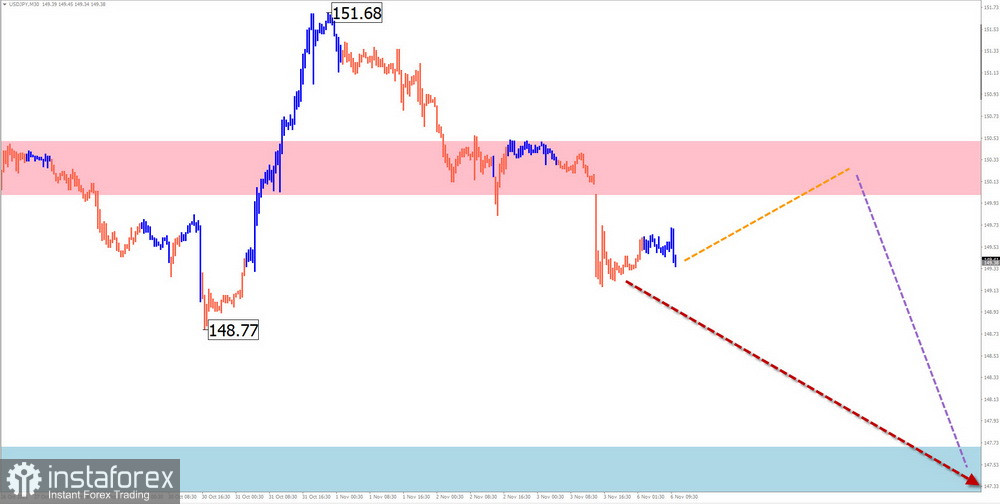

USD/JPY

Analysis:

The trend of the Japanese yen weakening against the US dollar has been observed since the beginning of last year. The quotes of the major yen pair exceeded a 24-year-old record. In the wave structure, an unfinished section is correctional, counting from October 31. The downward movement has reversal potential, and upon confirmation, it will mark the beginning of a full correction.

Forecast:

At the beginning of the week, the most likely scenario is the continuation of a "sideways" movement along the resistance zone. Further on this part of the chart, a reversal is expected, with a resumption of the decline. Calculated support sets a limit on the weekly downward range.

Potential Reversal Zones

Resistance:

- 150.00/150.50

Support:

- 147.70/147.20

Recommendations:

Selling: This may be recommended after the appearance of corresponding signals in the support area of your trading systems.

Buying: Due to their small potential, they are risky and may result in losses.

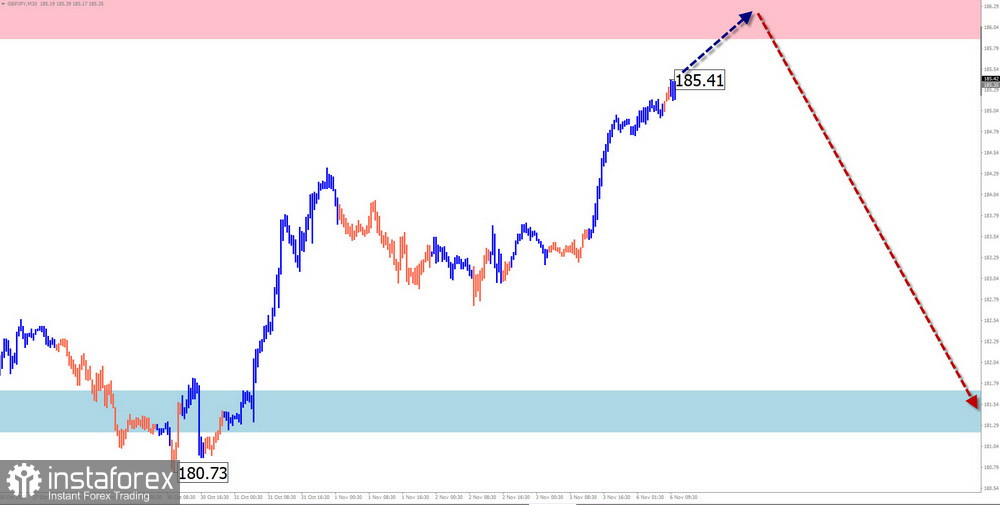

GBP/JPY

Analysis:

The large-scale chart of the British pound against the Japanese yen shows the dominance of an ascending trend. An unfinished section started on September 26. Over the past three weeks, quotes have formed a correctional part (B) in the form of an elongated plane. The structure of this part of the wave does not indicate its completion to this day.

Forecast:

In the first days of the upcoming week, a general sideways movement is likely with an ascending vector. The upward price movement has the potential to reach the upper boundary of support. In the second half, a reversal can be expected, with a resumption of the rate's rise. A decline in quotes is possible, down to the support zone.

Potential Reversal Zones

Resistance:

- 185.90/186.40

Support:

- 181.70/181.20

Recommendations:

Buying: Has a small potential. It's safer to reduce the trading volume.

Selling: Recommended in trading deals after the appearance of corresponding signals in your trading systems.

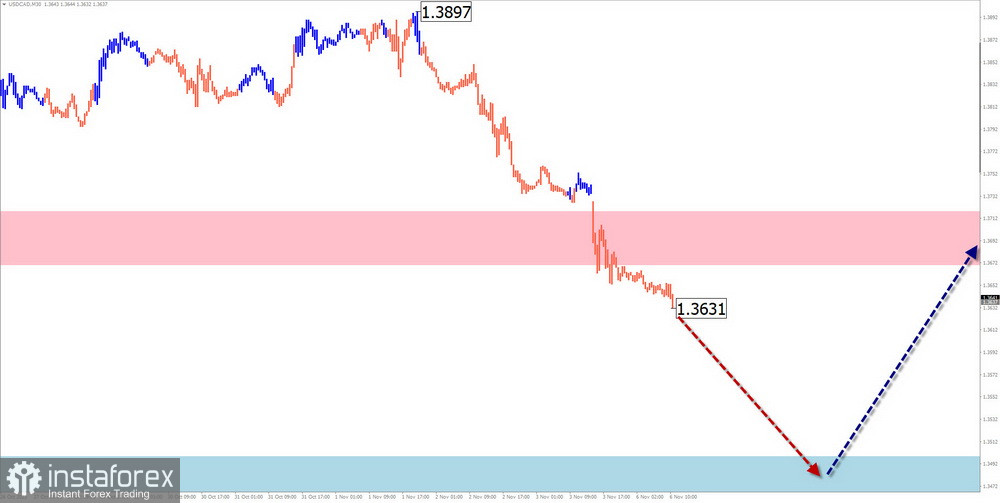

USD/CAD

Analysis:

On the chart of the main Canadian currency pair, the development of an ascending wave that began in July continues. The corrective wave structure starting on October 5 does not have reversal potential and stays within the boundaries of the correction. The structure of this part is close to completion. The wave extremes form a "stretched plane" on the chart.

Forecast:

In the next couple of days, the downward movement of the pair will continue. In the support zone, you can expect a halt and the formation of conditions for a reversal. A change in direction is likely closer to the weekend. Resistance levels demonstrate the upper boundary of the expected weekly range for the pair.

Potential Reversal Zones

Resistance:

- 1.3670/1.3820

Support:

- 1.3500/1.3450

Recommendations:

Selling: Can be used after the appearance of confirmed signals on your trading systems.

Buying: Risky and can lead to losses.

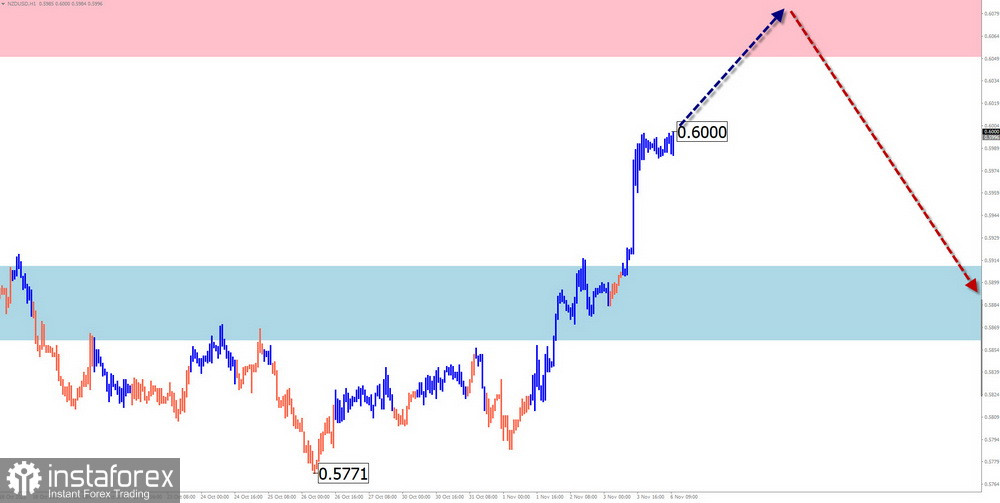

NZD/USD

Brief Analysis:

Since mid-August, a horizontal wave structure in the New Zealand dollar has been observed on the chart in the form of an elongated plane. At the time of analysis, the wave structure does not show completeness. In the last decade, the price rebounded from the upper boundary of the wide potential reversal zone of the weekly scale.

Weekly Forecast:

In the current week, you can expect a continuation of the overall upward movement. In the first days, a sideways flat or short-term decrease is not ruled out below the support zone. The end of the rise and a change in direction can be expected towards the end of the week. The calculated support shows the lower boundary of the expected weekly range of the instrument.

Potential Reversal Zones

Resistance:

- 0.6050/0.6100

Support:

- 0.5910/0.5860

Recommendations:

Buying: Can be used with a fractional lot within separate sessions.

Selling: Premature until the current rise is complete.

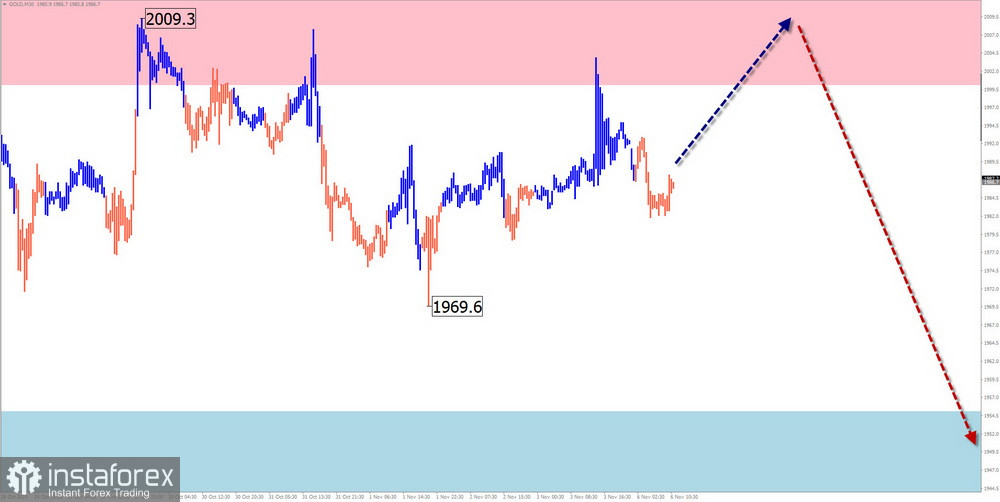

GOLD

Analysis:

The current wave structure from a short-term perspective is ascending, starting on October 3. In the structure of this wave, over the past two weeks, a correctional part (B) has been forming along with strong resistance. The wave has the appearance of a horizontally stretched plane.

Forecast:

In the next few days, the completion of the upward movement in gold is expected. In the resistance zone, you can expect a sideways flat and the formation of conditions for a reversal. The start of the decline can be expected towards the end of the week. The calculated support shows the lower boundary of the expected weekly range of the instrument.

Potential Reversal Zones

Resistance:

- 2000.0/2015.0

Support:

- 1955.0/1940.0

Recommendations:

Buying: Highly risky. Trades may result in losses.

Selling: Becomes relevant after the appearance of reversal signals in the resistance area of your trading systems.

Explanations: In simplified wave analysis (SWA), all waves consist of 3 parts (A, B, and C). Only the last unfinished wave is analyzed for each time frame. Dotted lines represent expected movements.

Attention: The wave algorithm does not consider the duration of instrument movements over time!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română