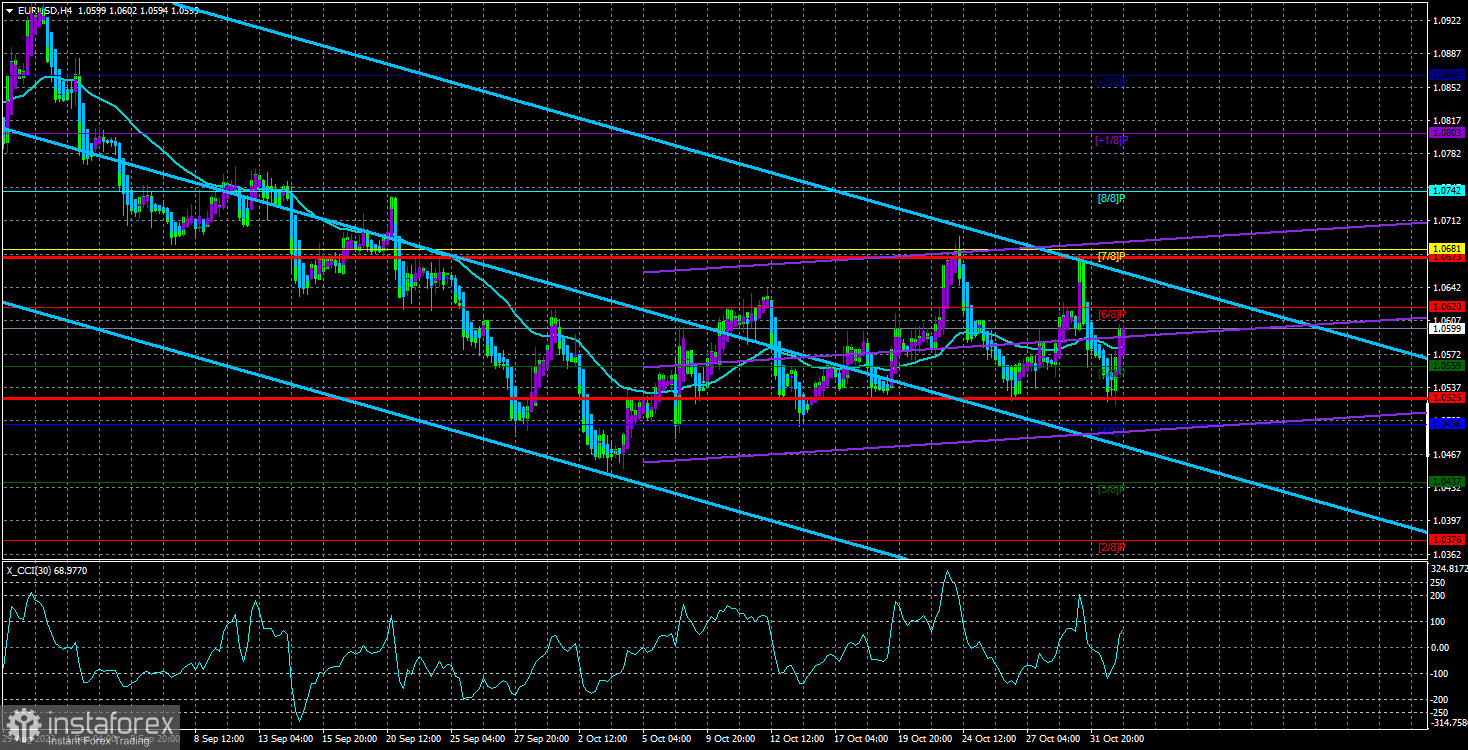

The currency pair EUR/USD once again did not show any interesting movements on Wednesday. The pair has once again crossed the moving average line, but as mentioned earlier, the current nature of movement allows it to cross the moving average line almost every day. It seems like we're not dealing with a classic flat, but at the same time, the price is not in a hurry to move up within the correction scenario, nor is it in a hurry to decline within the medium-term downtrend. Therefore, the current movement still best fits the description of a "flat." And flats are always bad for traders.

The macroeconomic data from across the ocean on Wednesday turned out to be fairly weak, but there are contradictions here as well. Yes, the ISM index for the manufacturing sector unexpectedly fell below 50. Yes, the number of new jobs, according to ADP data, was lower than expected. However, it is important to remember that the US labor market remains strong, the economy grew by 4.9% in the third quarter, and the ADP report is just the "younger brother" of non-farm payrolls. Traders will make their final assessment based on nonfarms. Therefore, yesterday's weak reports are more of an exception to the rule. The American economy continues to impress with its stability and strength, despite many analysts having predicted a recession for a year now. However, there are no signs of a recession so far, even with a Fed rate of 5.5%. Therefore, we still adhere to the view that the dollar will continue to appreciate. The question is when the new leg of the pair's decline will begin.

In the 24-hour time frame, the technical picture remains unchanged. The euro is desperately trying to correct itself, but it lacks strength and support. We have repeatedly stated that there are no significant reasons for the euro to rise. Nothing has changed at this time. Therefore, in the near future, the pair may struggle to move upward, possibly remaining flat, but we do not expect strong growth in any case. It may be possible on Friday if American nonfarms and unemployment figures disappoint. But that would be an isolated case.

The Fed maintains the status quo. It was clear from the beginning that the Federal Reserve would not raise rates. The main focus was on Jerome Powell's speech. And it must be said that Powell has confused the market more than clarified the situation. The head of the Fed stated that there is currently no talk of lowering the rate, the decision to raise the rate in the December meeting has not been made yet, and the regulator has done enough for price stability, so it will act with the utmost caution going forward. At the same time, Powell noted that the cycle of monetary policy tightening is not yet complete but did not specify when the rate might be raised again. The head of the Fed also mentioned that the return of inflation to 2% would be a long and difficult process, and the regulator is not confident that the current level of policy "tightness" is sufficient to bring the CPI back to the target level. Two more inflation reports and two labor market and unemployment reports will be published before the December meeting, and they may influence the regulator's decision at the last meeting of the year.

In simpler terms, Powell's statement can be summarized as follows: "We can raise the rate if necessary, but we don't intend to do so in the near future. We have done a lot, but we can do more, but we don't want to." Therefore, in this case, we agree with the market and its reaction in the form of selling the US currency. Powell did not provide any specifics, and the probability of a rate hike in December remains low. There was no reason for the dollar to resume its rise yesterday. And if we see weak data on nonfarms and unemployment on Friday, the situation for the US currency may worsen further.

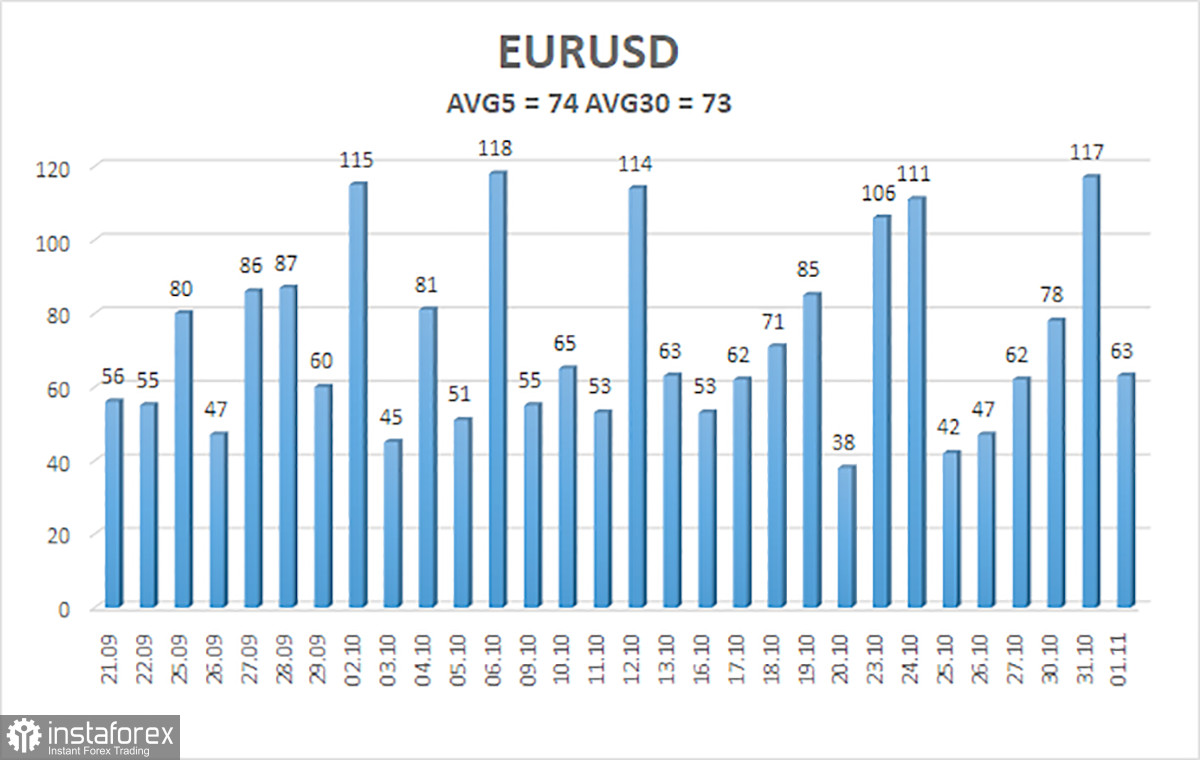

The average volatility of the EUR/USD currency pair over the past 5 trading days as of November 2 is 74 points and is characterized as "average." Therefore, we expect the pair to move between the levels of 1.0525 and 1.0673 on Thursday. A reversal of the Heiken Ashi indicator back down will indicate a new leg of downward movement within the flat.

Nearest support levels:

S1 – 1.0590

S2 – 1.0559

S3 – 1.0529

Nearest resistance levels:

R1 – 1.0620

R2 – 1.0651

R3 – 1.0681

Trading recommendations:

The EUR/USD pair continues to change its direction almost every day. Therefore, relying on the moving average is a risky business at the moment. From our current positions, we consider it advisable to consider selling, but the fundamental and macroeconomic background in the remaining days of the week could provoke a new rise in the European currency.

Explanations for the illustrations:

Linear regression channels – help determine the current trend. If both are pointing in the same direction, it means the trend is currently strong.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and direction for trading.

Murray levels – target levels for movements and corrections.

Volatility levels (red lines) – the likely price channel in which the pair will trade over the next day based on current volatility indicators.

CCI indicator – its entry into the overbought territory (below -250) or the oversold territory (above +250) indicates that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română