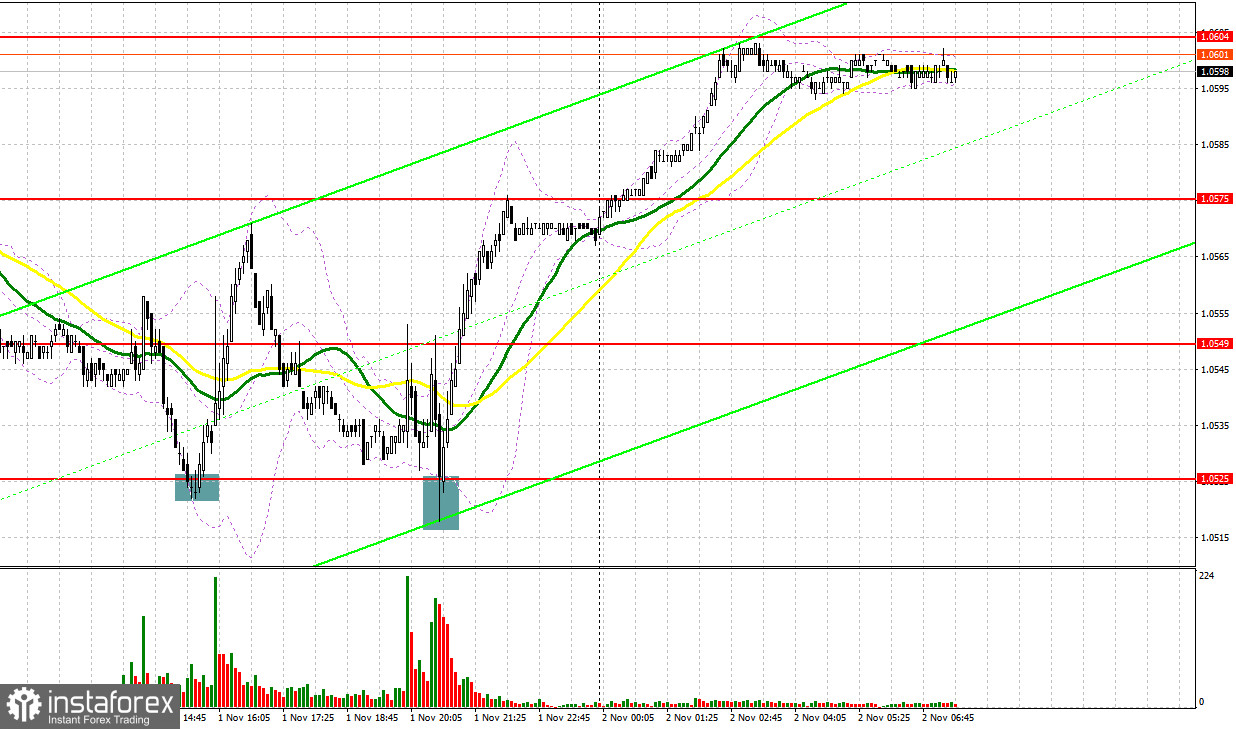

Yesterday, the pair formed several entry signals. Let's have a look at what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.0580 as a possible entry point. The pair grew, but a false breakout was not formed near 1.0580. For this reason, I was not able to enter short positions. In the afternoon, protecting the support level at 1.0525 and a false breakout at this mark produced a good buy signal. As a result, the pair was up 50 pips. The same thing happened after the Federal Reserve announced its decision to leave rates unchanged, which gave me another buy signal at 1.0525 with a similar 50 pips move.

For long positions on EUR/USD:

The Fed kept interest rates unchanged, suggesting that rate hikes may be kept on hold for the rest of the year, as current lending conditions have already tightened very much recently. This resulted in the euro's growth and the dollar's fall. We might witness the same trend today, but I intend to act on dips near the nearest support at 1.0575. Weak eurozone Manufacturing PMI, as well as the German unemployment rate and the speech of European Central Bank Executive Board member Philip Lane may help the EUR/USD in correcting higher, which you should take advantage of. A false breakout near the support level at 1.0575 will serve as a confirmation of an entry point for long positions in hopes of building an uptrend and a test of the resistance level at 1.0604, which is where the pair is currently trading. A breakout and a downward retest of this range can pave the way for a surge up to 1.0633. The ultimate target is found at 1.0661 where I plan to take profits. If EUR/USD declines and shows a lack of activity at 1.0575, nothing terrible will happen, but the pressure on the euro will increase, which will push the pair down to 1.0548. In such a scenario, only a false breakout at this mark would provide an entry signal. I would immediately go long on a bounce from 1.0521, aiming for an intraday upward correction of 30-35 pips.

For short positions on EUR/USD:

The Fed's decision did not support the bears' initiative and now they need to protect the nearest resistance level at 1.0604, which, to be fair, will be quite difficult to do. In the first half of the day, only disappointing eurozone data and a false breakout at this mark will generate a good sell signal, with a prospect of a decline towards the 1.0575 support, which is in line with the bullish moving averages. A breakout and consolidation below this range, as well as its upward retest, will give another sell signal with the target at 1.0548. The ultimate target will be this month's low at 1.0521 where I will take profits. If EUR/USD rises during the European session and bears are absent at 1.0604, which is where things are headed, the bulls will surely try to return to the market, although it is unlikely. In this scenario, I will delay going short until the price hits the resistance at 1.0633. I may consider selling there but only after a failed consolidation. I will go short immediately on a rebound from the high of 1.0661, aiming for a downward correction of 30-35 pips.

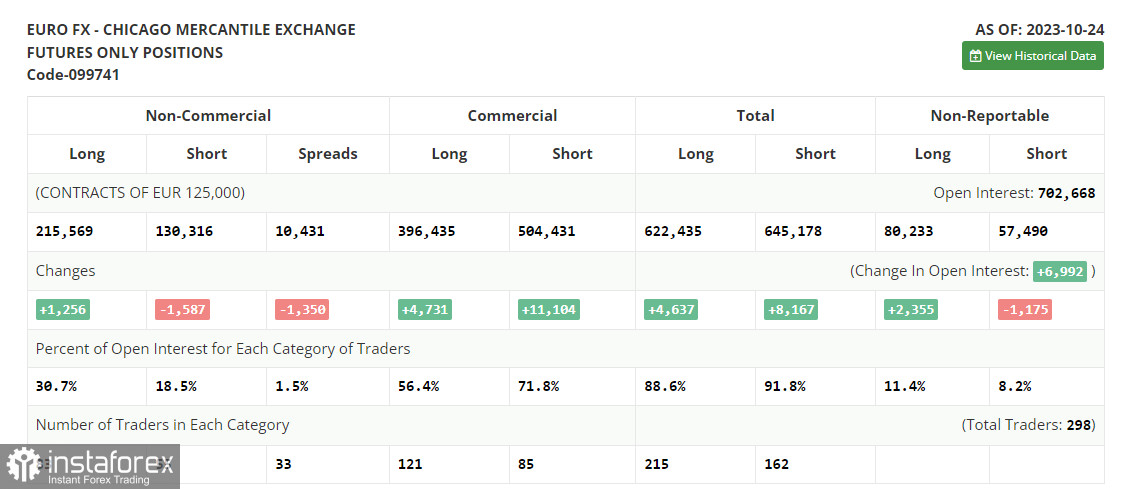

COT report:

The Commitments of Traders report for October 24 showed an increase in long positions and a decrease in short ones. Considering that everyone expected the European Central Bank to stop the cycle of interest rate hikes, its decision did not affect the balance of forces in the market, and as we see it, it actually helped the euro to recover its positions against the dollar. This week, the US Federal Reserve will likely leave interest rates unchanged at the upcoming policy announcement. But given the post US data, it is possible that the committee members will hint at the possibility of the last rate hike in December this year, which will push the dollar higher. The COT report reveals that non-commercial long positions increased by 1,256 to 215,569, while non-commercial short positions declined by 1,587 to 130,316. This resulted in the spread between long and short positions shrinking by 1,350. The closing price rose to 1.0613 compared to 1.0596, confirming the euro's bullish correction.

Indicator signals:

Moving averages:

The instrument is trading above the 30 and 50-day moving averages. It indicates that EUR/USD is likely to rise further.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If EUR/USD declines, the indicator's lower border near 1.0520 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română