EUR/USD

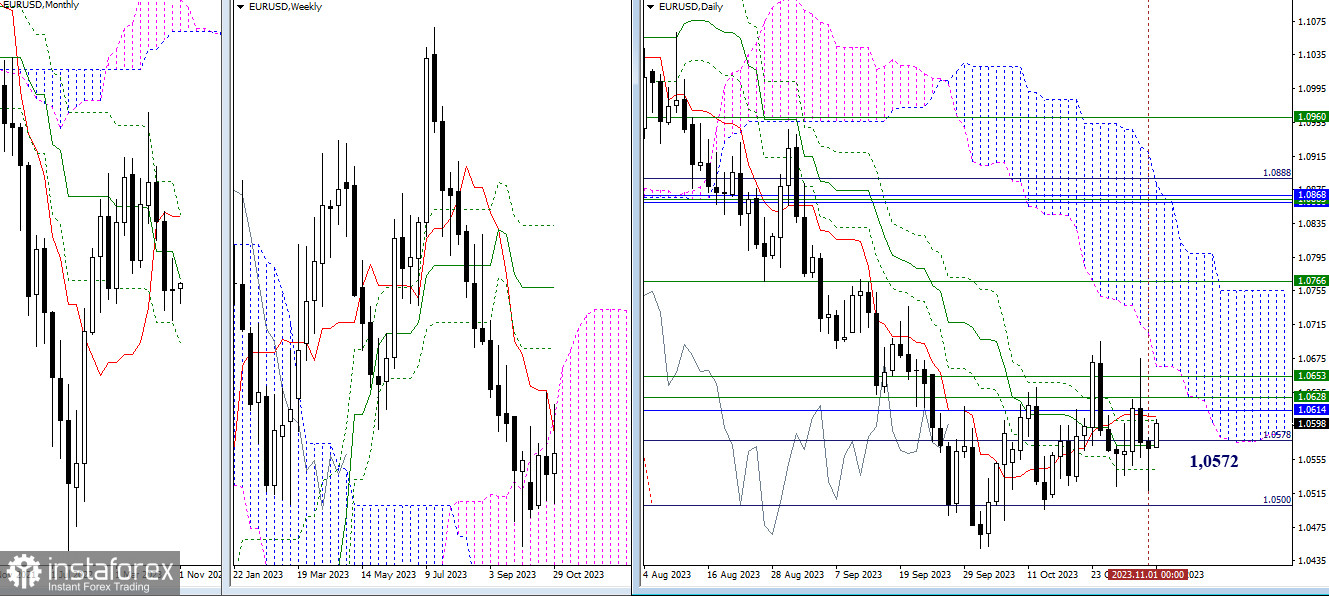

Higher Timeframes

The bears were unable to change the situation yesterday. Despite casting a long shadow, they eventually returned to the zone of attraction of the daily medium-term trend (1.0572) by the end of the day. As a result, the main conclusions and expectations remain unchanged. The immediate tasks for the bulls still revolve around breaking through resistance levels (1.0614-28-53), reaching a new high (1.0695), and entering the daily cloud. The prospects for the bears in the current situation include overcoming support levels at 1.0500 - 1.0449 (the daily target level + the low) and continuing the decline.

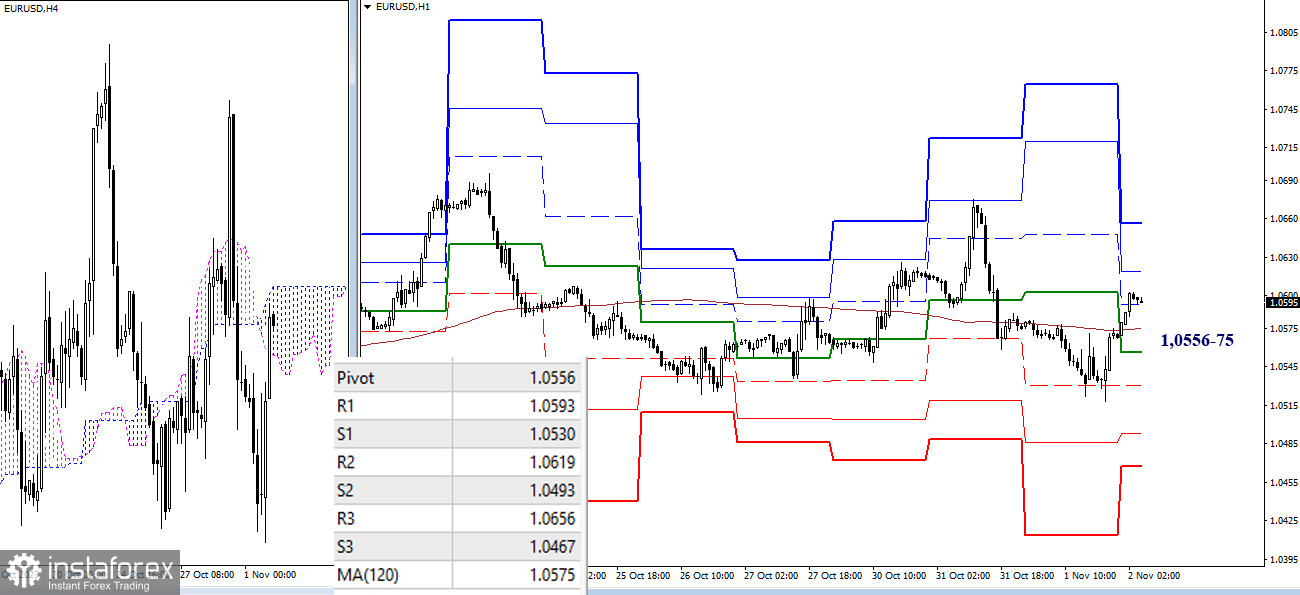

H4 - H1

The uncertainty of the lower timeframes forces the bulls to revolve around key levels, which are currently located in the range of 1.0556 - 1.0575 (central pivot point + weekly long-term trend). In the event of an upward movement, the targets within the day will be the resistances of classic pivot points R2 (1.0619) and R3 (1.0656). If the price consolidates below the key levels and enters another stage of decline, the support levels of classic pivot points (1.0530 - 1.0493 - 1.0467) will come into play.

***

GBP/USD

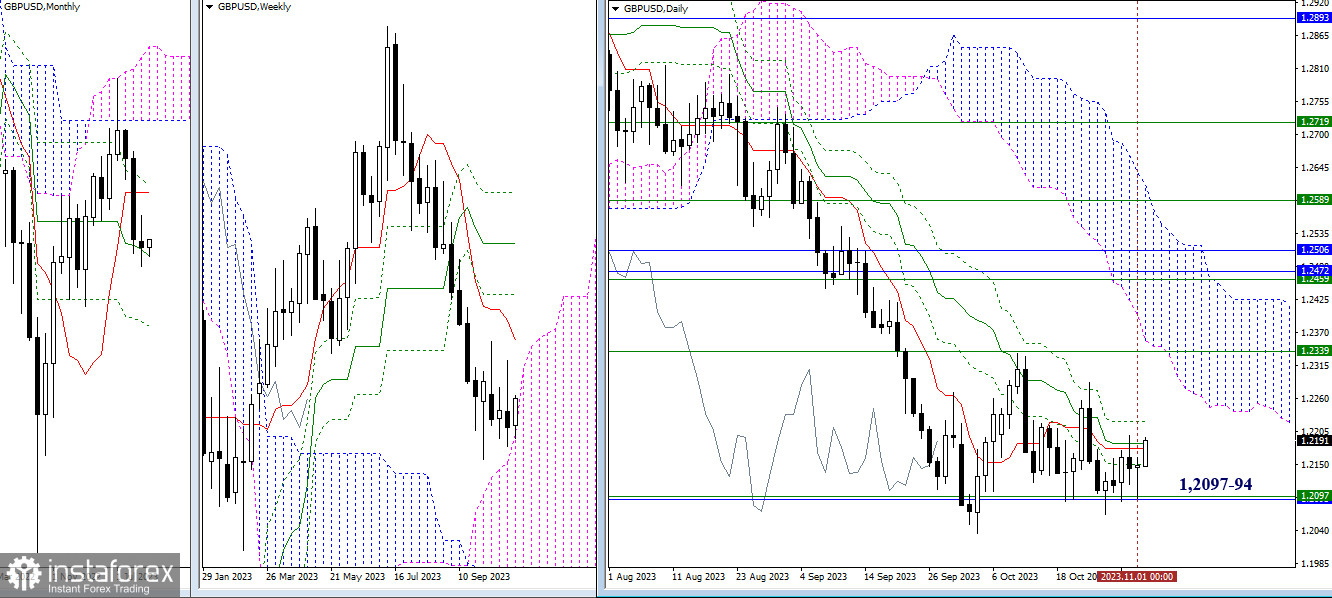

Higher Timeframes

The market could not break out of the consolidation zone and free itself from the influence of such strong levels as the monthly medium-term trend (1.2094) and the upper boundary of the weekly cloud (1.2097) yesterday. It's worth noting that all the immediate targets have retained their positions and values. For the bulls to change the situation and gain new perspectives, they must overcome the attraction of the daily cross levels (1.2151 - 1.2178 - 1.2186 - 1.2221) and gain the support of the weekly short-term trend (1.2339). The main task for the bears in the current segment requires getting rid of the attraction of levels 1.2094 - 1.2097 and restoring the downward trend (1.2036).

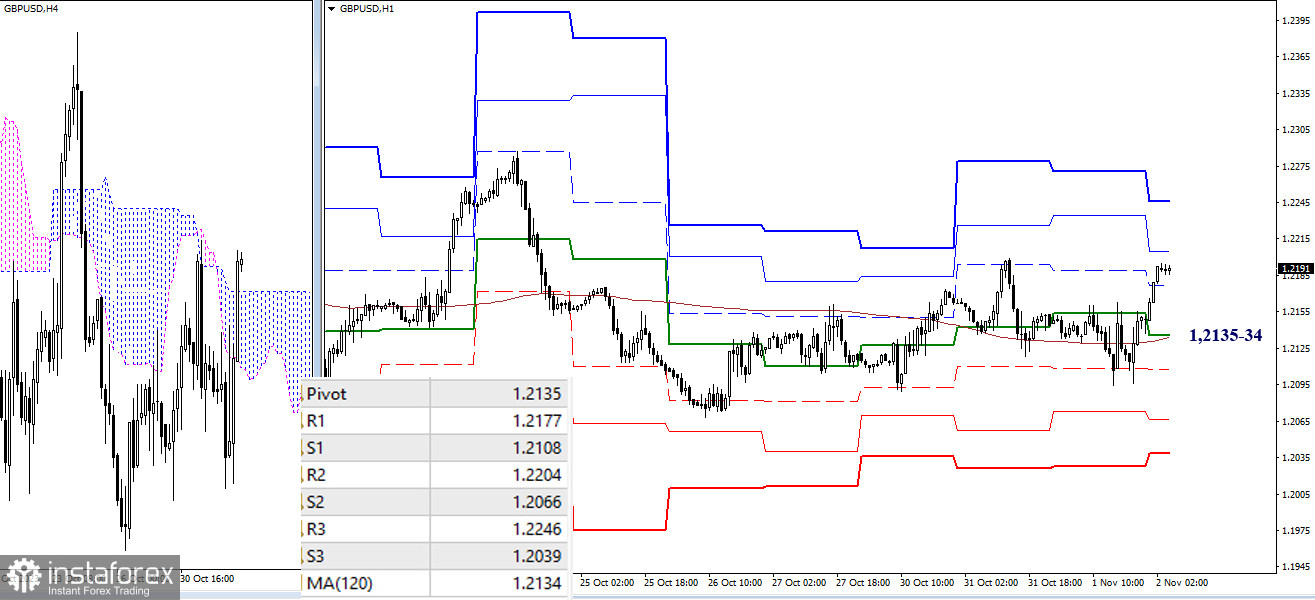

H4 - H1

The bulls managed to maintain their position above the weekly long-term trend (1.2134) yesterday, so the main advantage is still on their side. Today, the bullish players seek to strengthen their positions by capitalizing on the current upward movement. They have managed to rise above R1 (1.2177), and their path continues through R2 (1.2204) and R3 (1.2246). The loss of key levels, which have practically merged today at the 1.2135-34 level (weekly long-term trend + central pivot point of the day), will shift the current balance of power in the lower timeframes, directing attention within the day towards the supports of classic pivot points (1.2108 - 1.2066 - 1.2039).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română