The currency pair EUR/USD attempted to correct itself once again on Tuesday, but it didn't go very well. This time, the price couldn't even reach its previous local maximum and dropped again. It should be noted that the movements yesterday were not the most logical since the rise of the European currency clearly couldn't have been triggered by macroeconomic statistics. The first report on German retail sales was a clear disappointment. So, if the euro had started falling early in the morning, it would have been much more logical.

Next, two reports were published in the European Union: on GDP in the third quarter and on inflation for October. Here too, not everything was logical. GDP contracted by 0.1%, which did not align with experts' expectations of 0%. However, inflation dropped not to 3.1% y/y as expected but to 2.9%. It was precisely after these reports that the euro started to decline. As for the reports themselves, we'll discuss them shortly below, but for now, it's worth noting that the market doesn't always react to GDP, and a -0.1% figure is not a shock to an economy that has not shown any growth for four quarters. Regarding inflation, its slowdown undoubtedly decreases the likelihood of further tightening of the ECB's monetary policy. However, it's already been known for about three months that the regulator has no plans to raise rates any further.

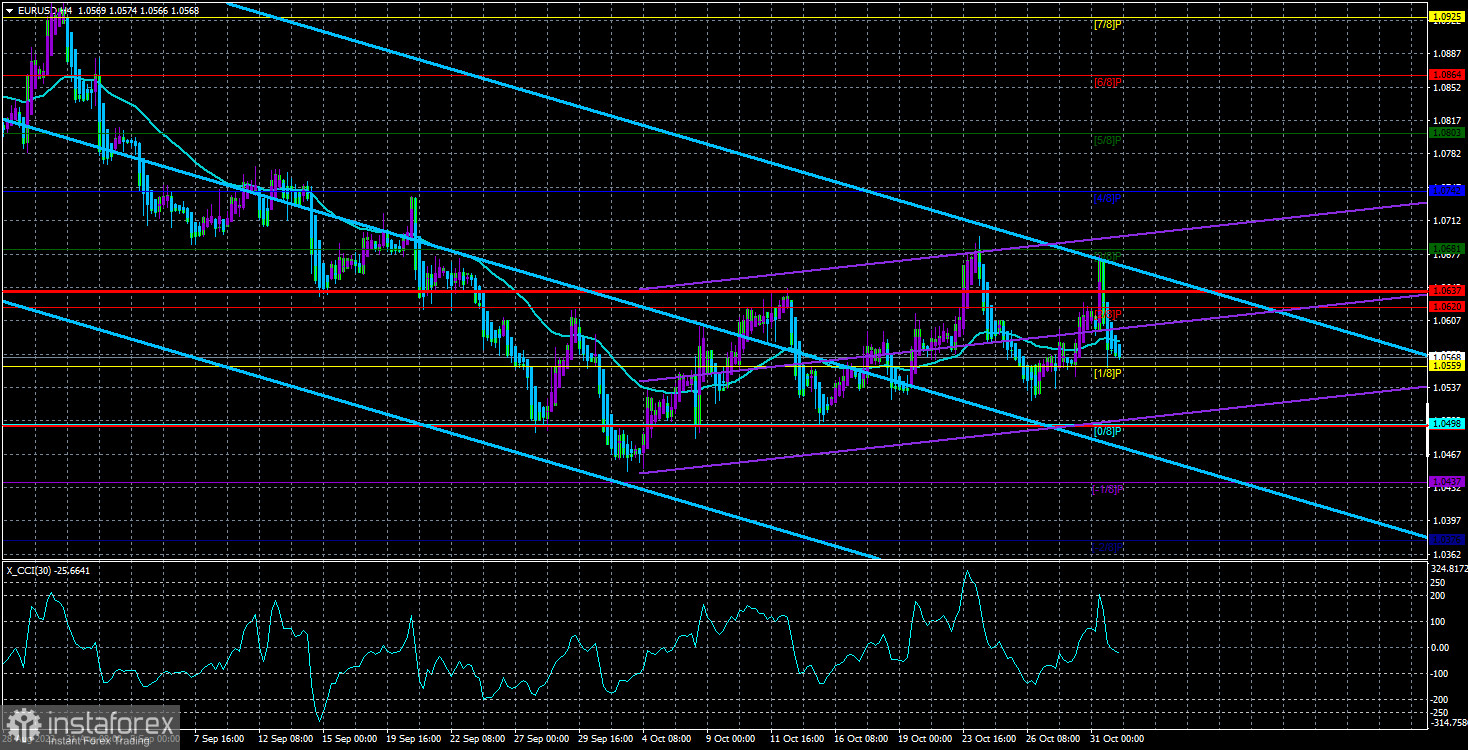

Thus, the reports turned out to be noteworthy, but the market interpreted them in its own way. However, we warned at the beginning of the week that movements could be diverse and sharp due to the strong background this week. As a result, the price once again settled below the moving average, and we should remember that relying on the moving average at this time is not the best idea. We observe a weak upward correction with frequent pullbacks. Therefore, the price crosses the moving average almost every day. It's essential to understand that the pair is still correcting, but in the medium term, we expect a prolonged decline down to the 1.00–1.02$ range.

GDP is falling, and inflation is falling. The fact that GDP contracted in the third quarter is not surprising, and the deviation from the forecast is minimal. Therefore, we believe that the cause of the euro's decline is not even the GDP report but the inflation report, which could have triggered both an increase and a decrease. Let's explain. The fact of declining inflation by itself is good for the economy. However, if there was previously talk of the ECB's key rate remaining unchanged for a long time, now discussions may start about the imminent easing of monetary policy because inflation has already dropped below 3% and there is very little left to reach the target of 2%. If inflation falls, for example, to 2.5% by the end of the year, we might see a reduction in the key rate next year, possibly in the first few months. Naturally, a rate cut is a bearish factor for the currency, and the market may have already priced this in.

At the same time, the Federal Reserve (FRS) can very well raise the rate once or twice more, although it's unlikely to happen today. Inflation in the U.S. is rising again and currently stands at 3.7%. As we can see, it's still far from the target level, and the mere fact of rising inflation is unlikely to let the FRS rest easy. So, what do we have as a result? The FRS can very well raise the rate again, for example, in December, while the ECB at the beginning of next year may well move towards a rate cut. We believe that this is a favorable background for a new decline in the euro and the strengthening of the dollar, as we have been predicting for several months.

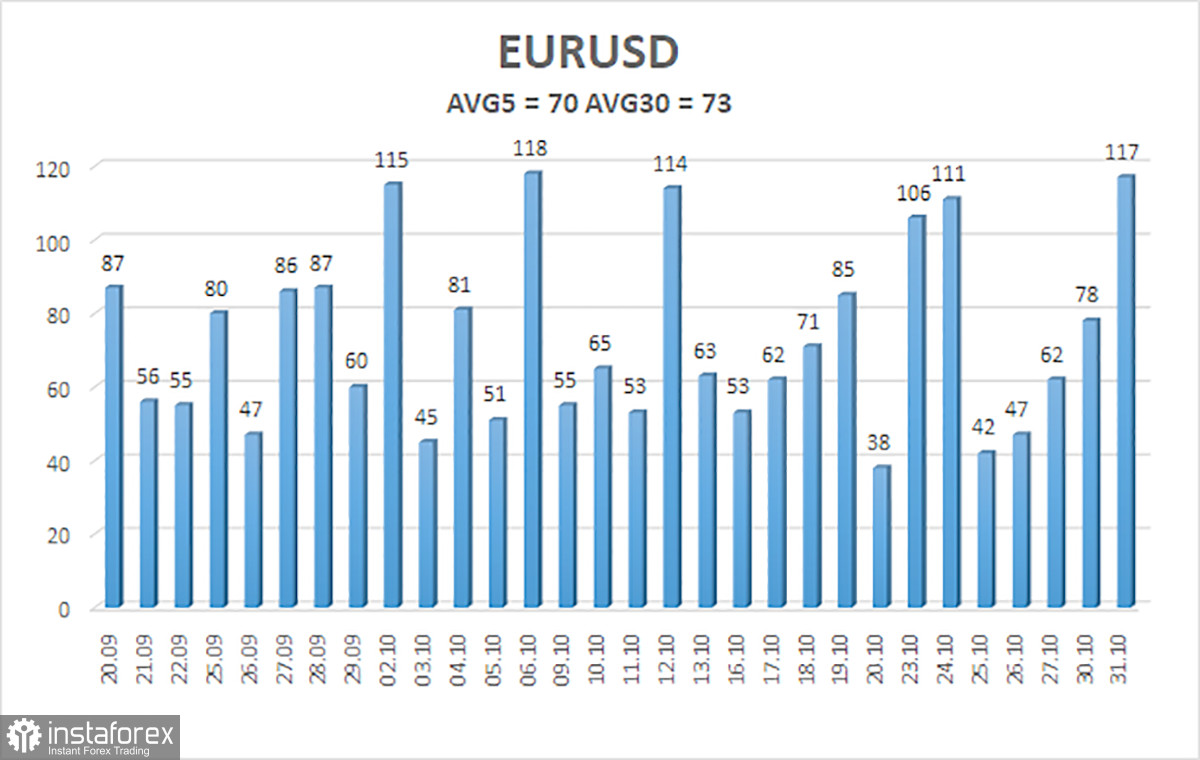

The average volatility of the EUR/USD currency pair over the past 5 trading days as of November 1st is 70 points and is characterized as "medium." Therefore, we expect the pair to move between the levels of 1.0496 and 1.0637 on Wednesday. A reversal of the Heiken Ashi indicator upwards will indicate a possible new upswing in the correction.

Next support levels:

S1 - 1.0559

S2 - 1.0498

S3 - 1.0437

Nearest resistance levels:

R1 - 1.0620

R2 - 1.0681

R3 - 1.0742

Trading recommendations:

The EUR/USD pair continues to change its direction almost every day. Therefore, relying on the moving average at this time is not a good idea. We believe that from the current positions, it is advisable to consider selling, but the fundamental and macroeconomic background in the remaining days of the week could provoke a new rise in the European currency.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both are pointing in the same direction, it means the trend is strong at the moment.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murrey levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will trade over the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) indicates that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română