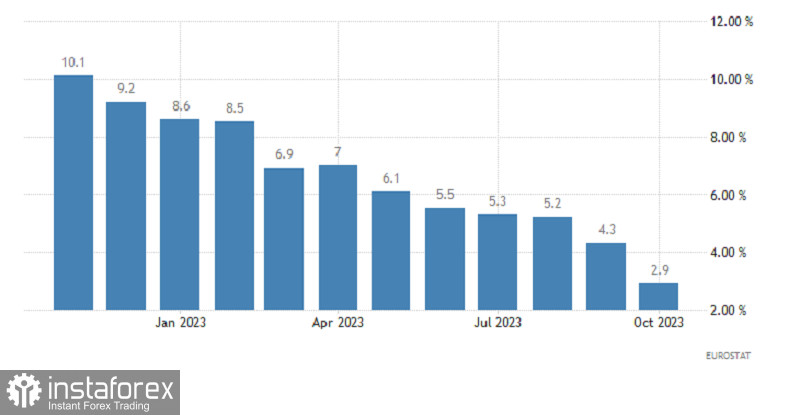

The market was certainly expecting a significant slowdown in eurozone inflation, but not even the most optimistic minds could have imagined that inflation across the bloc would drop to a two-year low of 2.9% in October. Just a month ago, inflation was at 4.3%. So, such a substantial decrease in inflation essentially removes all questions regarding the European Central Bank's future course of actions. It's quite obvious that there won't be any interest rate hikes anymore. It's time to talk about monetary easing. Not this year, of course, but probably early next year. So, quite soon. It's not surprising that as soon as the preliminary inflation data was published, the euro traded lower.

And the single currency will likely fall further. This time, it's due to the Federal Reserve. Of course, interest rates will remain unchanged, as the U.S. central bank intends to maintain a pause and monitor inflation dynamics. In the United States, consumer price growth rates are significantly higher than in Europe. Therefore, Fed Chair Jerome Powell will likely reiterate the potential for further interest rate hikes. This will probably be the reason why the U.S. dollar will rise further.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română