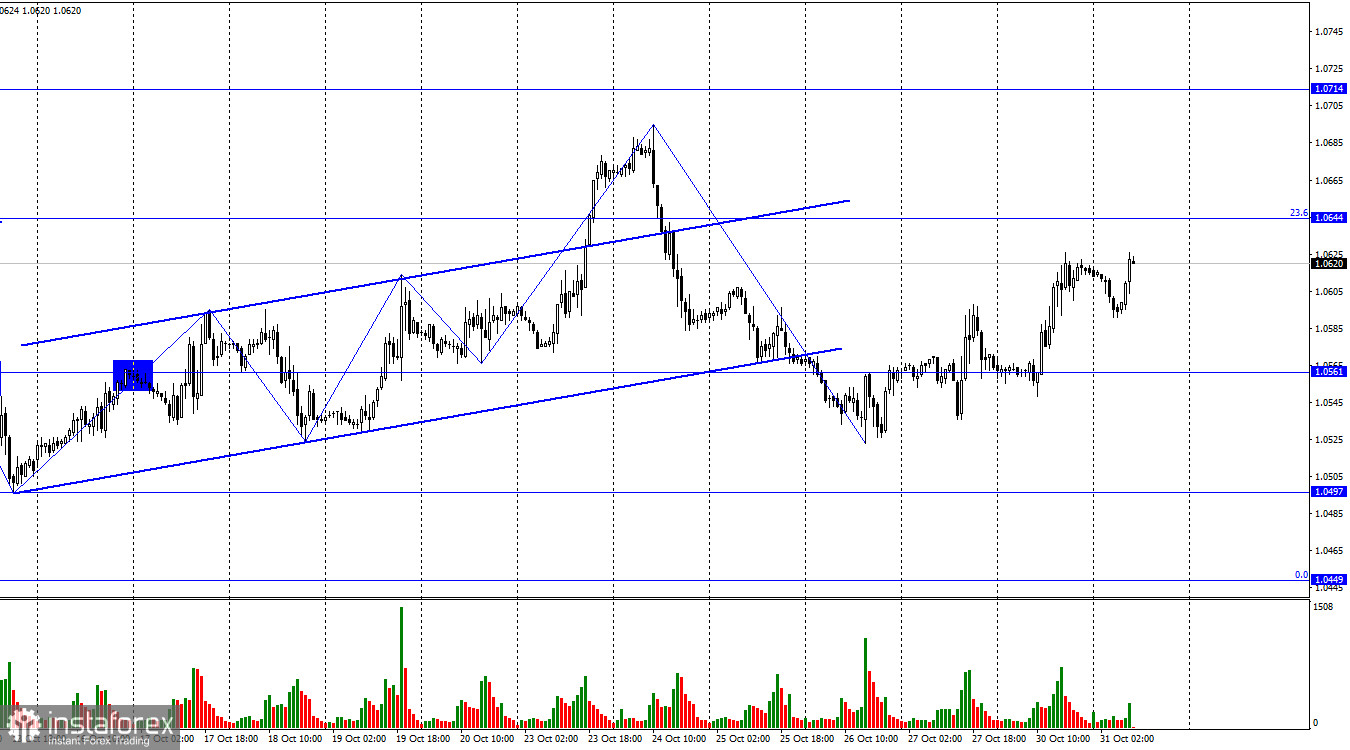

On Monday, the EUR/USD pair rebounded from the level of 1.0561, reversed in favor of the European currency, and resumed its upward movement towards the corrective level of 23.6% (.0644). A rebound from this level would work in favor of the US dollar and lead to a resumption of the decline towards 1.0561. Closing quotes above the level of 1.0644 will increase the likelihood of further growth towards the next level at 1.0714.

The wave situation has become clearer but also more confusing. The last completed wave was bearish. It was so strong that it surpassed the low of the previous wave, which was also quite strong. However, we have been observing the formation of an upward wave for almost three days now, which does not change the trend to "bullish" because the last downward wave was even stronger. As a result, we may face a situation where the pair reaches the last peak and the trend switches back to "bullish," but soon a new "bearish" trend will begin. Too many alternating waves make analysis very challenging.

The news background supported bullish traders yesterday. There were only two reports in Germany, which usually have a weak impact on the European currency. However, this time the figures were quite optimistic, so the market did not ignore them. Inflation in Germany has already dropped to 3.8%, and in a few hours, European inflation may show even slower growth. Germany's GDP decreased by 0.1% in the third quarter, but traders expected a 0.3% decline, so this report also supported the euro. Today, the EU's GDP may officially show 0% growth, but the actual value may be slightly higher, providing additional strength for buyers. Thus, today the pair's rise may continue quite freely, which I personally would like to avoid because the wave situation will get even more confusing.

On the 4-hour chart, the pair has established itself below the corrective level of 100.0% (1.0639), which allows us to count on a decline towards the corrective level of 127.2% (1.0466). However, today, quotes have returned to this level. Therefore, we need to wait for a new rebound or a closing above this level to give traders an indication of the expected direction.

No impending divergences are observed among any of the indicators today.

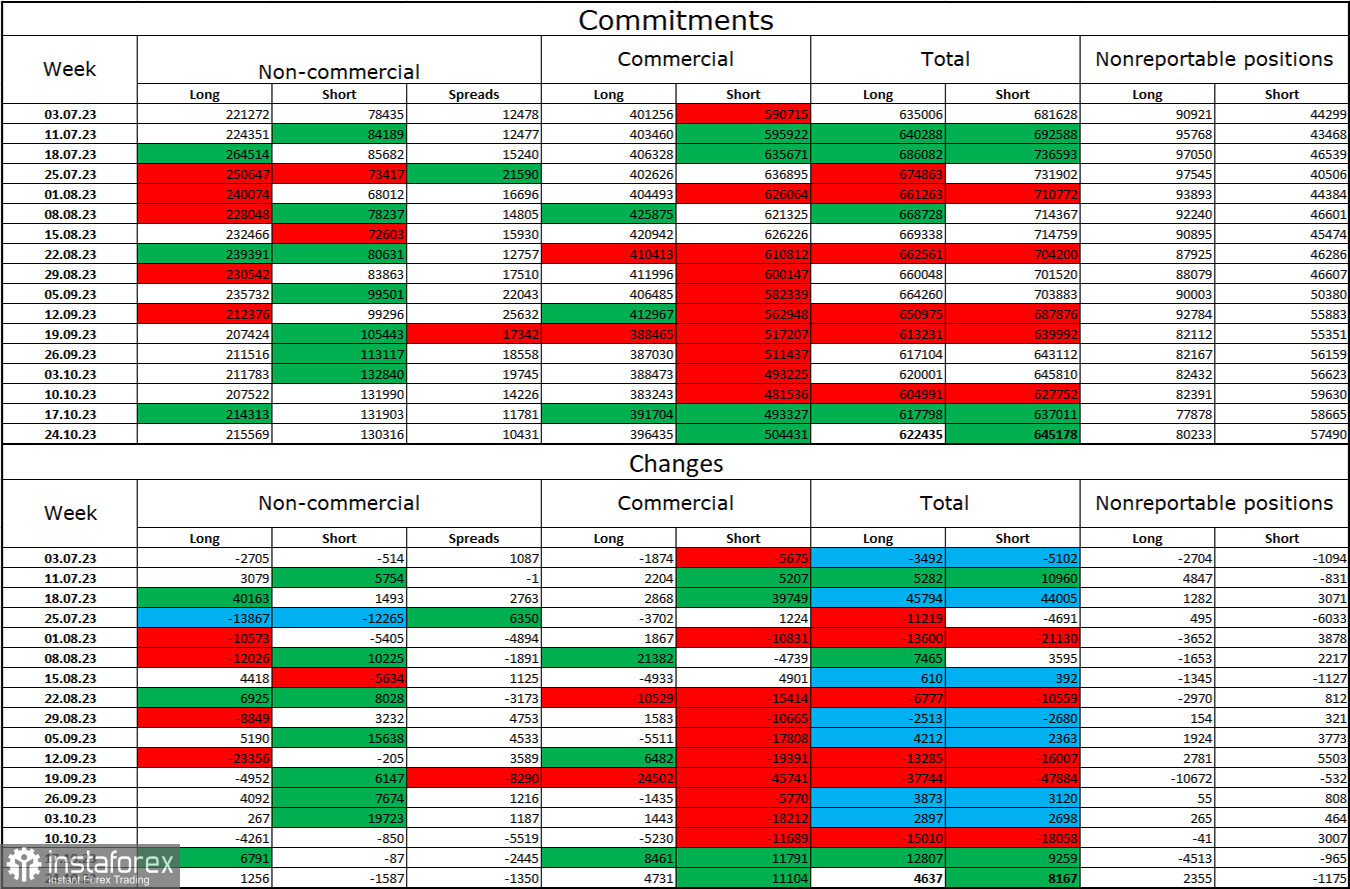

Commitments of Traders (COT) report:

During the last reporting week, speculators opened 1256 long contracts and closed 1587 short contracts. The sentiment of major traders remains "bullish," but it has been noticeably weakening over the past weeks and months. The total number of long contracts concentrated in the hands of speculators now stands at 215 thousand, while the short contracts amount to 130 thousand. The difference is now less than double, whereas a few months ago, the gap was threefold. I believe the situation will continue to shift in favor of the bears. Bulls have dominated the market for too long, and they now need strong news to initiate a new "bullish" trend. Such a news background is currently lacking. Professional traders may continue to close their long positions in the near future. I think the current figures allow for the euro's decline in the coming months.

News calendar for the US and the European Union:

European Union - Retail Sales Volume in Germany (07:00 UTC).

European Union - Consumer Price Index (CPI) (10:00 UTC).

European Union - GDP in the third quarter (10:00 UTC).

USA - Consumer Confidence Index (CB) (14:00 UTC).

On October 31, the economic events calendar includes four entries, of which two can be considered important. The impact of the news background on traders' sentiment on Monday can be of moderate strength.

Forecast for EUR/USD and trader recommendations:

Buying the pair is possible today if it consolidates on the 4-hour chart above the level of 1.0639 with a target of 1.0714. I recommend selling today on a rebound from the level of 1.0644 on the hourly chart, with a target of 1.0561.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română