The new week kicked off with the euro trading higher. Germany released GDP and inflation reports, showing that GDP contracted less than the market expected, and inflation decreased more than anticipated. The single currency was up by a few dozen pips after these reports. However, there was negative news as well, which will probably prevent the euro from rising further.

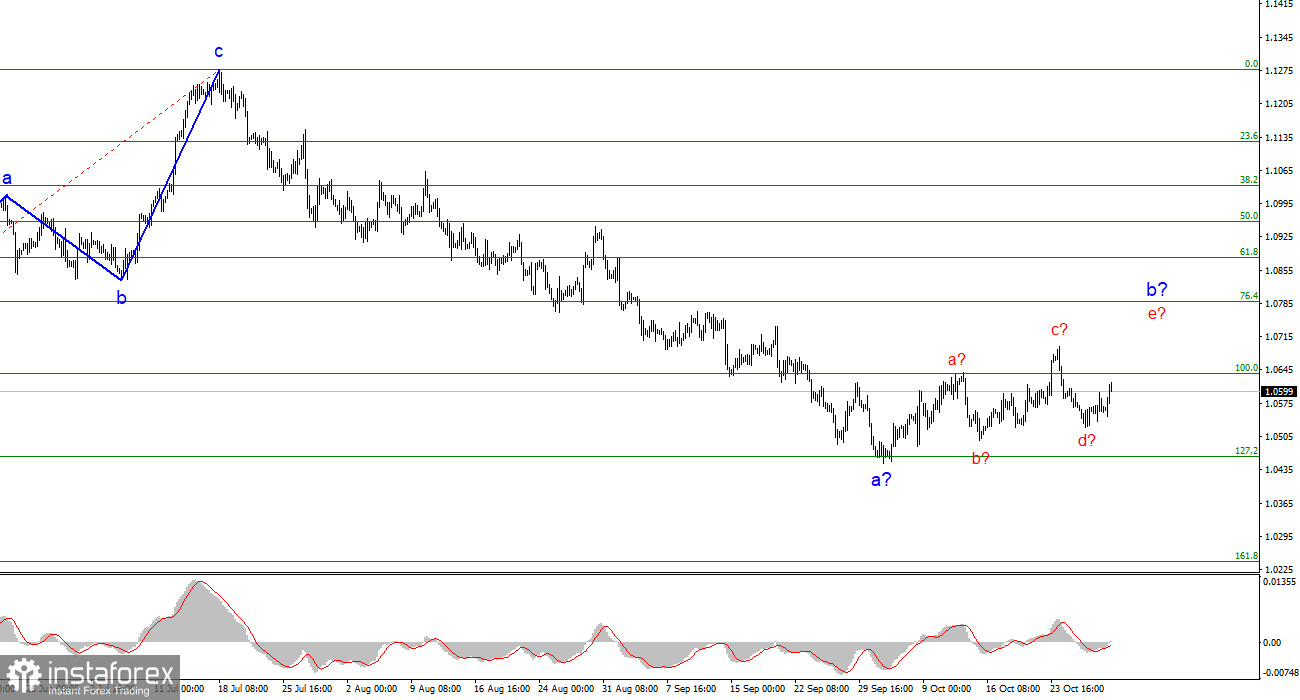

I'd like to highlight that I firmly adhere to wave analysis and believe that after the end of Wave 2 or B, the instrument will start a new downward movement. The third wave may turn out to be less powerful than the first one, but it should be present. So, regardless of the news background, whether it's positive or negative, I still expect the euro to fall. The question is how far it will fall. For now, there is an increased demand for the euro, allowing the instrument to form a more complex Wave 2 or B.

On Monday, two members of the European Central Bank's Governing Council, Peter Kazimir and Boris Vujcic, provided their comments on monetary policy. Their stance did not support the euro. Kazimir stated that the ECB's rate will remain at its peak for the next several quarters, implying no plans for a rate hike. He certainly mentioned that a new rate hike is possible if incoming data necessitates it. However, at the moment, there are no signs of a new rate hike.

Vujcic was more categorical. He stated that, at the moment, the rate hike process is complete. Vujcic noted that inflation should return to 2% by 2025 and, as long as the figure is on a downward trajectory, there is no reason for concern.

Based on everything, it follows that the ECB may only raise the key rate as an exception if there is a sharp and strong increase in inflation. There is enough time until 2025 for the Consumer Price Index to gradually reach the target level. In addition, we learned that inflation in Germany has decreased to 3.8%, and on Tuesday, the eurozone inflation report may show a figure of 3.1%.

Based on the analysis, I conclude that a bearish wave pattern is still being formed. The pair has reached the targets around the 1.0463 level, and the fact that the pair has yet to breach this level indicates that the market is ready to build a corrective wave. A successful attempt to break through the 1.0637 level, which corresponds to the 100.0% Fibonacci level, would indicate the market's readiness to complete the formation of Wave 2 or Wave b. However, this wave may take on a more complex form, so if you are thinking of selling, it should be done in small volumes. The main decline may start a bit later.

The wave pattern for the GBP/USD pair suggests a decline within the downtrend segment. The most that we can expect from the pound in the near future is the formation of Wave 2 or b. However, there are currently significant issues even with the corrective wave. At this time, I would not recommend new shorts, but I also wouldn't recommend longs because the corrective wave appears to be relatively weak. In any case, it's a corrective wave. You can consider shorts if the pair successfully breaches the 1.2120 mark, but you should still be cautious.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română