Last week, gold maintained its recent successes, driven by the ongoing conflict in the Middle East. Despite the high yield of bonds continuing to pose obstacles for the precious metal, prices continued to rise ahead of the weekend. Spot gold was once again trading above $2,000 per ounce.

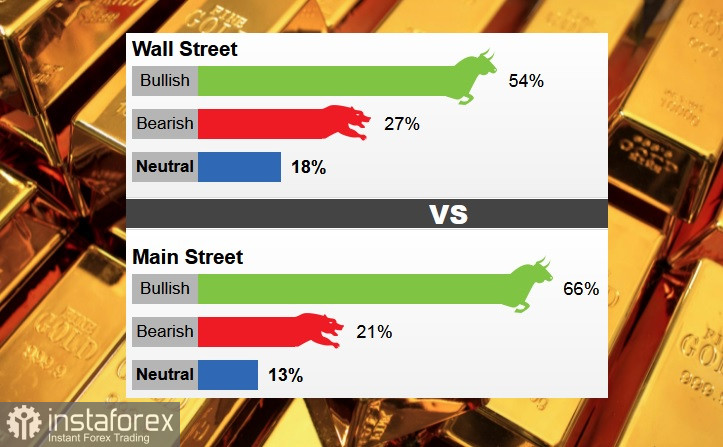

According to the latest weekly gold survey, retail investors remain optimistic about the precious metal. Most market analysts are also optimistic, but a significant minority expects either a pullback or consolidation.

Colin Cieszynski, Chief Market Strategist at SIA Wealth Management, holds a neutral position, reasoning that the Fed will continue its hawkish stance. While current inflation indicators have been favorable enough, and there is no immediate need to raise rates again, it has not declined rapidly enough for the Fed to decide to end its hawkish stance. He added that on the other side of the equation, there is uncertainty about what will happen in the Middle East in the future.

Michael Moor, creator of Moor Analytics, thinks even if there is a moderate pullback, the overall technical picture remains optimistic.

This time, 11 Wall Street analysts participated in the gold survey. Six of them, or 54%, expect the price to rise. Three analysts, or 27%, expect a price decline, while two, or 18%, are neutral.

In an online poll, 602 votes were cast. Of these, 395 retail investors, or 66%, expect gold to rise. Another 126 people, or 21%, believe the price will fall, and 81 respondents, or 13%, were neutral.

On Wednesday, the Federal Reserve's decision on interest rates will be the main economic event of the week. There is a 94.2% probability of another interest rate hold, as priced into the markets. Friday will see the release of the October non-farm employment report, which should also be closely watched.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română