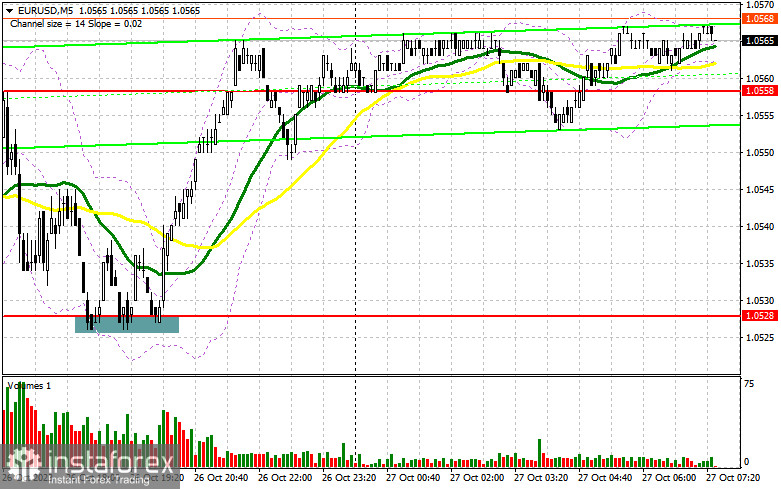

Yesterday, the pair formed several strong entry signals. Let's have a look at what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.0528 as a possible entry point. The price declined in the first half of the day but failed to test the level of 1.0528, missing just a few pips. The lack of important statistical data and anticipation of the ECB decision on interest rates impacted the volatility of the market in the first half of the day. In the course of the North American session, a false breakout at 1.0554 generated a good entry point for selling the euro, leading to an immediate fall towards 1.0525. Accumulation of strength at this level allowed the bulls to withstand the selling pressure and create a buy signal which resulted in a rise of 30 pips.

For long positions on EUR/USD

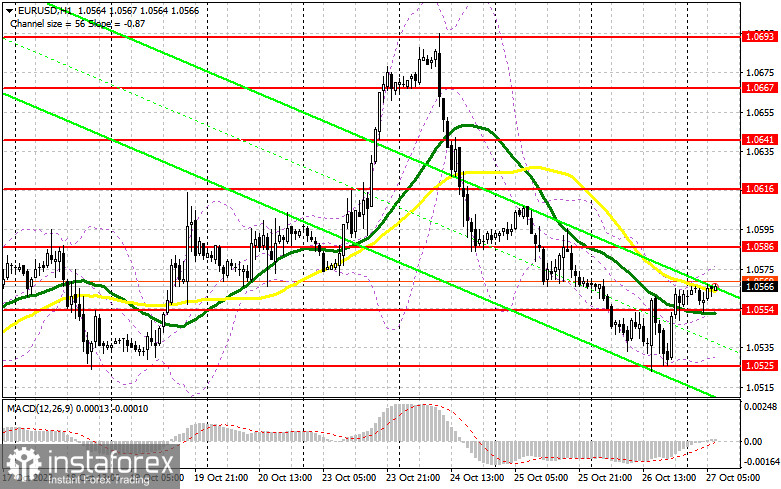

The anticipation of unchanged interest rates in the Eurozone, coupled with fairly good growth rate data from the US economy, maintained market balance, providing EUR with an opportunity for a bullish correction as the week is coming to an end. Given that no Eurozone statistics are expected today, the primary task for buyers will be to defend the immediate support at 1.0554, where the moving averages (MA) are located. A false breakout at this level could present an attractive entry point for long positions targeting resistance at 1.0586. Breaking and updating this range from above could fuel a surge towards 1.0616, with an ultimate target at the 1.0641 zone, where I will be taking profits. If EUR/USD declines and lacks momentum at 1.0554 during the morning session, there may be a shift pressuring the euro and leading to a more significant downward movement towards the week's low. In this scenario, only a false breakout around 1.0525 would signal a market entry. I would initiate long positions immediately on a rebound from 1.0497, aiming for a bullish correction of 30-35 pips within the day.

For short positions on EUR/USD

Sellers reached all their targets yesterday. However, given the dollar's substantial gains against the euro this week even before the data release, buyers managed to create an upward momentum after hitting the weekly lows. Now, the primary objective for sellers is to defend the 1.0586 level. A false breakout here in the first half of the day can provide a compelling sell signal, further driving the pair down towards the 1.0554 support. Upon breaching and consolidating below this range, and with the lack of Eurozone data, I anticipate another selling opportunity, targeting the 1.0525 level. The furthest target would be the low of 1.0497, where I would look to take profits. If EUR/USD trends upward during the European session and there's a lack of bearish activity at 1.0586, buyers might try to re-enter the market. Under such circumstances, I would postpone going short until the 1.0616 resistance is reached. Selling here is viable, but only after a failed consolidation. I would initiate short trades immediately on a rebound from the high of 1.0641, targeting a bearish correction of 30-35 pips.

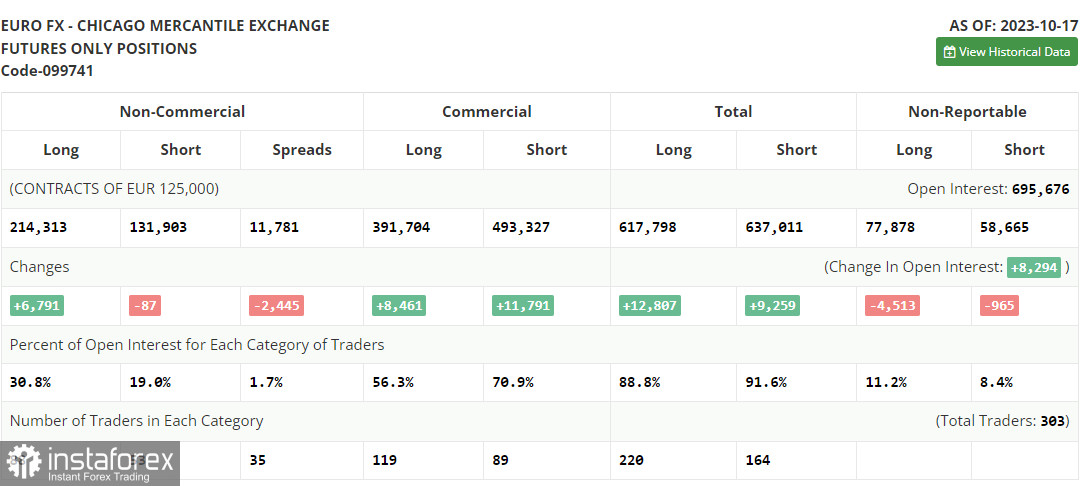

COT report

The Commitments of Traders report for October 17 indicated a noticeable increase in long positions, accompanied by a slight decrease in short positions. Recent US data has been indicating strong economic performance, especially in areas such as retail sales and the labor market, signaling a potential need for a further rate hike. However, as we approach the traditional "quiet period" when members of the Federal Reserve tend to stay silent ahead of committee meetings, several statements from policymakers suggest that rates will not be raised during the upcoming November meeting. This speculation weakened the demand for the dollar and rejuvenated confidence among EUR buyers. The prevailing sentiment suggests this trend might continue in the near term. According to the COT report, non-commercial long positions saw an increase of 6,791 to a total of 214,313, while non-commercial short positions only decreased slightly by 87 to stand at 131,903. As a result, the spread between long and short positions narrowed by 2,445. The closing price decreased to 1.0596 compared to the previous value of 1.0630, confirming an upward correction for the euro.

Indicator signals:

Moving Averages

Trading around the 30- and 50-day moving averages indicates a range-bound market.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If the pair declines, the lower band of the indicator at 1.0525 will act as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română