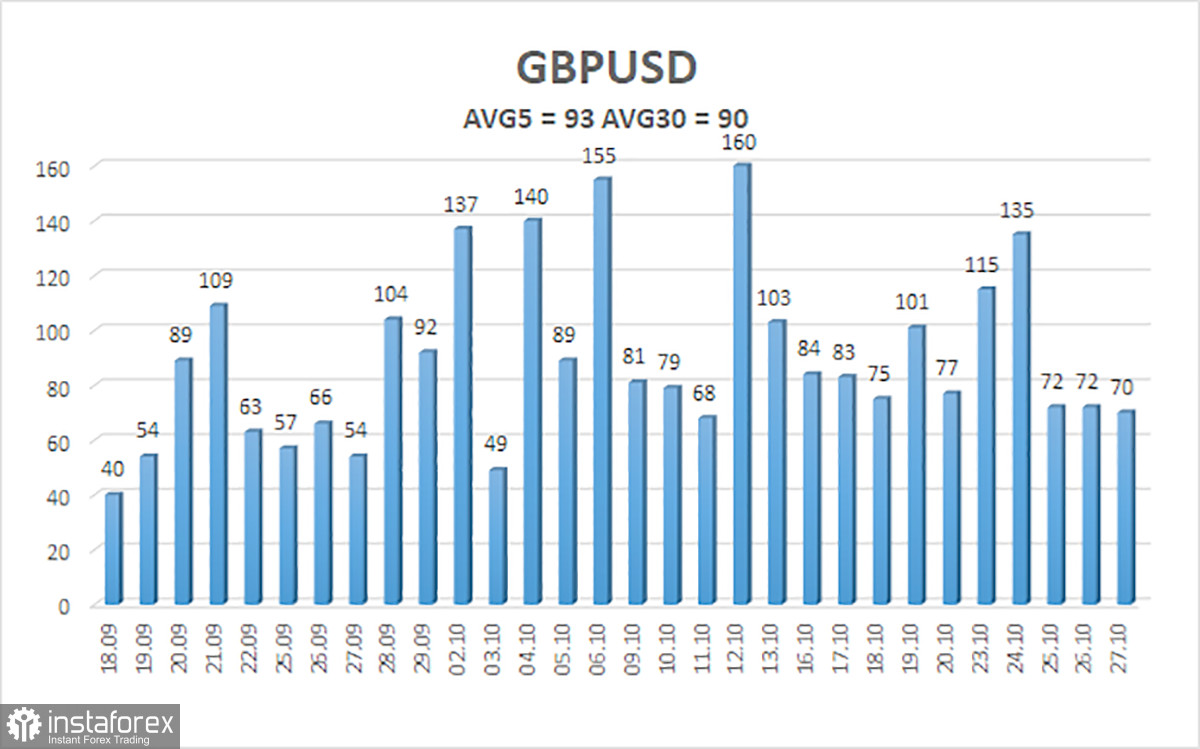

The currency pair GBP/USD also didn't show any interesting movements on Thursday, but the volatility reached about 70 points. How should we regard such volatility on the day when the results of the ECB meeting and the publication of two important (and no less important) reports from the United States were announced? Yes, it wasn't zero, but at the same time, for the pound, 70 points is the same as 50 points for the euro. So, both major currency pairs showed very weak movement and almost no reaction to significant events.

It turns out that the market reacted more seriously to business activity indices on Tuesday than to yesterday's events. And what the rise of the pair on Monday was associated with is completely unclear because the economic calendar was empty. So what do we have in the end? On Monday, there was volatility of 115 points with an empty economic calendar. On Tuesday, there was a volatility of 135 points and a sharp drop in the pair, even though the statistics from the UK did not imply such a significant decline in the pound. On Thursday, when the reports were most important, there was a volatility of 70 points. There is no logic in the pair's movements this week.

And this is what we already mentioned in the EUR/USD review. The market has not yet made a definite decision to resume the downward trend or maintain the correction. The pair seems to have corrected upward, but not strongly enough. There are all the necessary reasons for the pair to fall, but the correction is not completed. As a result, the price can move both up and down from its current position. Any scenario won't surprise us.

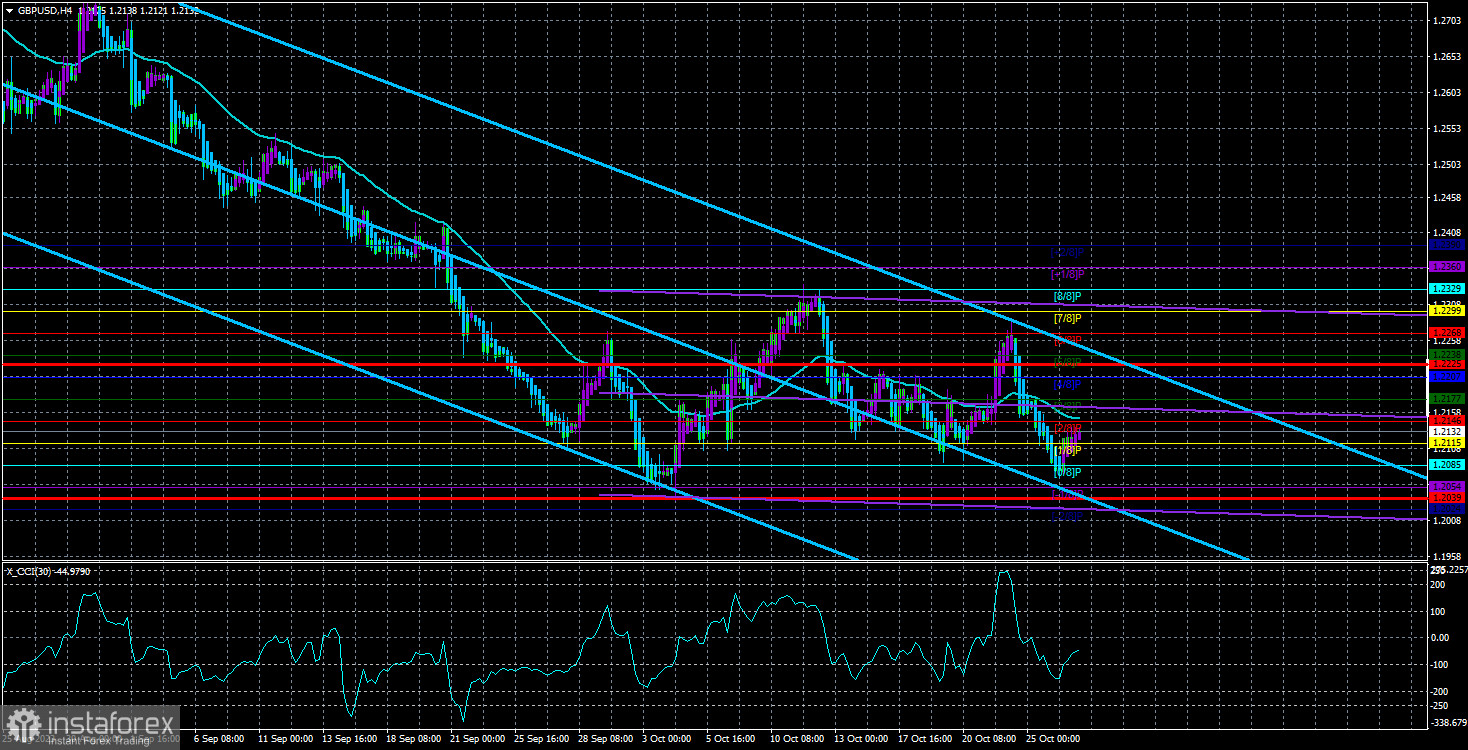

In the 24-hour timeframe, the price remains below the critical line and the level of 1.2300, maintaining a downward trend without question. However, if the market decides to form another correction cycle, both of these levels can be overcome. Since the correction is unlikely to be strong, these could be false breakouts that would further confuse the technical picture. We also consider the possibility of consolidation or a flat for some time.

The dollar gains an additional advantage. Despite the complete lack of market reaction to U.S. statistics, the statistics themselves mean a lot. The GDP in the third quarter grew by 4.9% q/q. Recall that the value for the second quarter was 2.1%, and market forecasts were at 4.3%. It's important to note that the GDP not only exceeded expectations but did so at a time when many were predicting a recession in the U.S. economy in 2024 and expecting a decline in the fourth quarter. So, the situation is as follows: economists are "burying" the economy, but it continues to grow from quarter to quarter. And it's doing so with the Fed's key rate at 5.5%.

What does this report mean? It simply means that the Fed now needs to raise the key rate again. The stronger the economy accelerates, the higher the likelihood that inflation will also rise. It's worth noting that high rates are intentionally used to "cool down" the economy and business activity, reduce demand, and prevent prices from rising amid financial prosperity for the American population. High rates encourage Americans to invest more in bank deposits and Treasury bonds rather than buying goods and services, thus boosting demand and driving prices up. Therefore, the GDP report by itself should support the dollar, but it also has a favorable impact on the prospects of another key rate hike.

The report on long-term durable goods orders by itself is less important, but its actual value (4.7%) exceeded forecasts by almost three times in September. So, this report should have triggered the strengthening of the U.S. currency, which we did not see. So far, everything points to the fact that the dollar will rise again.

The average volatility of the GBP/USD pair over the last 5 trading days as of October 27th is 93 points. For the pound/dollar pair, this value is considered "average." On Friday, October 27th, we expect movements within the range between 1.2039 and 1.2225. A Heiken Ashi indicator reversal downward will signal a possible resumption of the downward movement.

Nearest support levels:

S1 – 1.2115

S2 – 1.2085

S3 – 1.2054

Nearest resistance levels:

R1 – 1.2146

R2 – 1.2177

R3 – 1.2207

Trading recommendations:

In the 4-hour timeframe, the GBP/USD pair might have completed its sluggish correction attempts. Therefore, you can continue to hold short positions with targets at 1.2054 and 1.2039 in case of a price bounce from the moving average. In the event of the price settling above the moving average, long positions with targets at 1.2225 and 1.2268 will become relevant.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both are pointing in the same direction, it means the trend is currently strong.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will trade over the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) signifies an approaching trend reversal in the opposite direction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română