USD/JPY

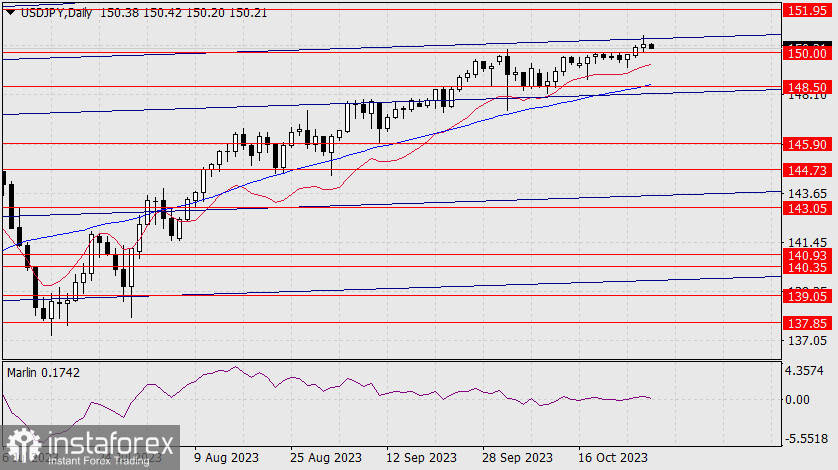

The yen has struggled to reach the target level of 150.53 for a long time, which is the embedded line of the price channel. Yesterday, it reached the target, and today, we witnessed a bearish reversal. The Marlin oscillator has failed to develop an upward movement and at the moment, it seems that it intends to return below the zero line.

If the price consolidates below 150.00, the pair will likely move towards the target of 151.95, and if that happens, the next target will be 148.50. The MACD line has already reached this mark, strengthening the support level. Overcoming this support level will initiate a medium-term and possibly even long-term decline for the currency pair.

On the 4-hour chart, the price is consolidating below the level of 150.53 in the short-term period, specifically under the price channel line marked on the daily chart. The price is progressing above both indicator lines, and the Marlin oscillator is still in the uptrend territory, despite indicating a reversal. All these factors maintain the potential for growth, so today the yen will assess the strengths of both the bulls and the bears while waiting for the upcoming Federal Reserve meeting.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română