The European Central Bank kept all three key interest rates unchanged. The market's reaction was altogether surprising, strange, expected, and logical. The euro initially rose by 25 pips but then it also lost the same amount in three hours. So the market's response to this significant event can be characterized by a 25-pip move. However, while the event itself was important, its results were not. As mentioned, the rates remained the same, and ECB President Christine Lagarde was quite neutral during the press conference. Here's what she talked about.

First, Lagarde said that she believed the current rates are at levels that will make a substantial contribution to returning inflation to the Bank's 2% target. Rates will need to be kept at their current levels for a sufficiently long duration, but eventually, the ECB will achieve its goal. Decisions on rates will be made based on incoming economic and financial data, and the dynamics of underlying inflation. The APP and PEPP programs (monetary stimulus programs) continue to reduce the ECB's balance sheet at a moderate pace, following the general plan.

Lagarde also said that rate decisions will be made from meeting to meeting. This suggests that Lagarde keeps the door open for further rate hikes but the chances of seeing new tightening in the near future are extremely slim.

I believe that the results of the meeting turned out to be neutral. I previously mentioned that there were no other options besides keeping rates at their current levels. However, I allowed for the possibility that Lagarde might hint at future rate hikes "if necessary" or, conversely, announce when policy easing would begin. Neither of these scenarios was mentioned. Based on this, I conclude that the market's 25-pip reaction was quite in line with the meeting's outcomes.

However, the trading instrument could and should have shown much greater movement, given that two important reports were published in the United States, which turned out to be significantly stronger than market expectations. However, it seems that even these reports were ignored. Thus, the market's reaction to the ECB meeting was logical but if we look at the bigger picture, it actually wasn't. We expected the lack of market activity with such results, but it was quite strange to see such an outcome in conjunction with the GDP and durable goods orders reports in the United States.

Based on the analysis, I conclude that a bearish wave pattern is still being formed. The pair has reached the targets around the 1.0463 level, and the fact that the pair has yet to break through this level indicates that the market is ready to build a corrective wave. A successful attempt to break through the 1.0637 level, which corresponds to the 100.0% Fibonacci level, would indicate the market's readiness to complete the formation of Wave 2 or Wave b. That's why I recommended selling. But we have to be cautious, as Wave 2 or Wave b may take on a more complex form.

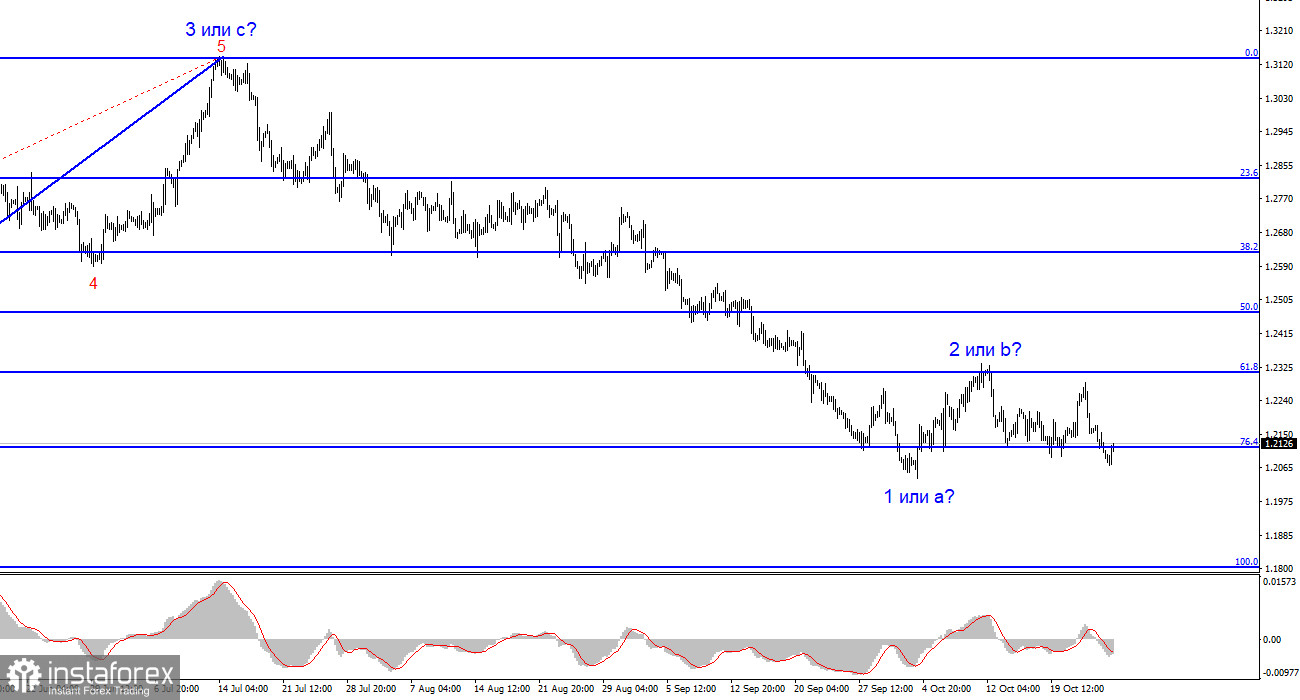

The wave pattern for the GBP/USD pair suggests a decline within the downtrend segment. The most that we can expect from the pound in the near future is the formation of Wave 2 or b. However, there are currently significant issues even with the corrective wave. At this time, I would not recommend new short positions, but I also wouldn't recommend longs because the corrective wave appears to be quite weak. In any case, it's a corrective wave. You can consider shorts if the pair successfully breaches the 1.2120 mark, but you should still be cautious.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română