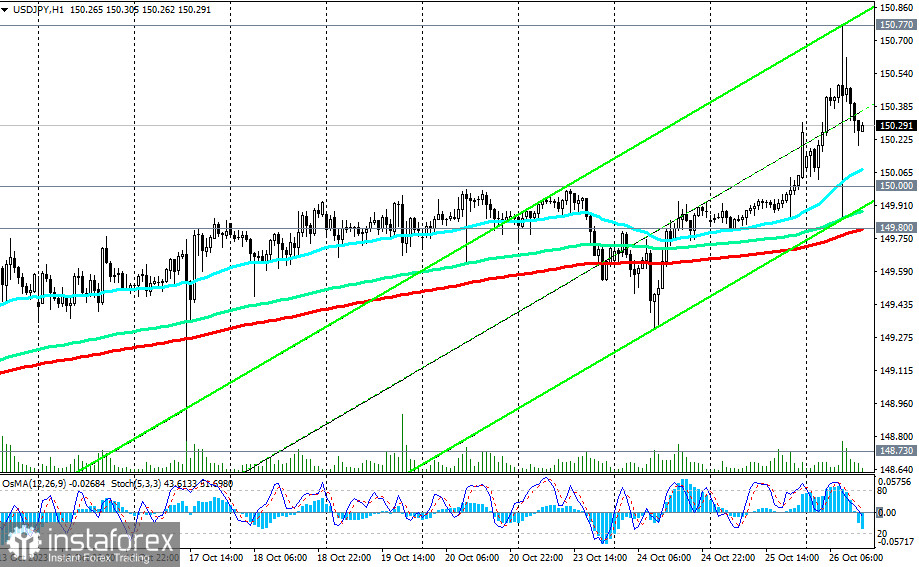

Despite investors' concerns about currency interventions by the Bank of Japan, yesterday, the USD/JPY pair finally broke through the psychologically significant level of 150.00, and at the beginning of today's European trading session, it briefly exceeded the 150.70 mark. However, it then sharply declined below the 149.90 level. The intraday volatility was 96 points. Economists believe that if the dollar continues its victorious march, the 150.00 level is unlikely to hold, and a rise in the pair to the 151.00 and 152.00 levels may not be far off.

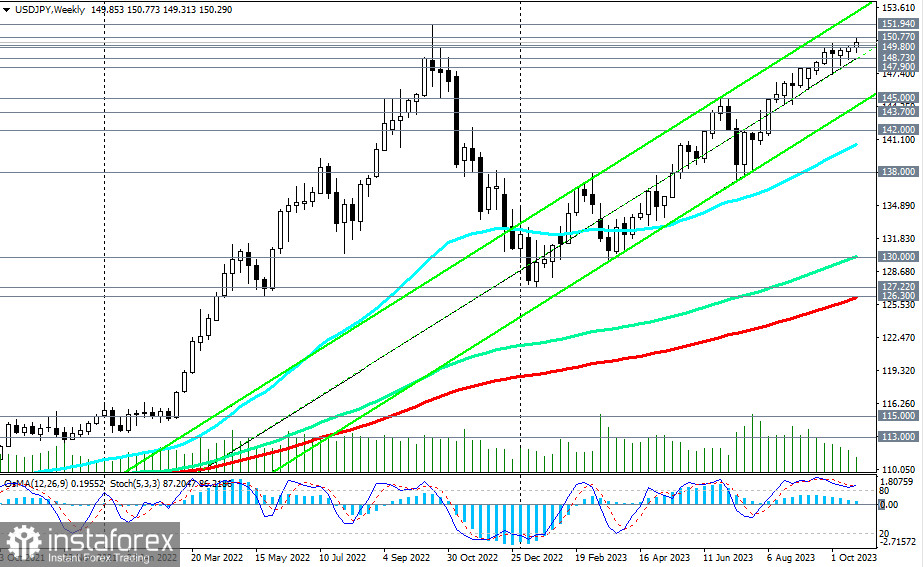

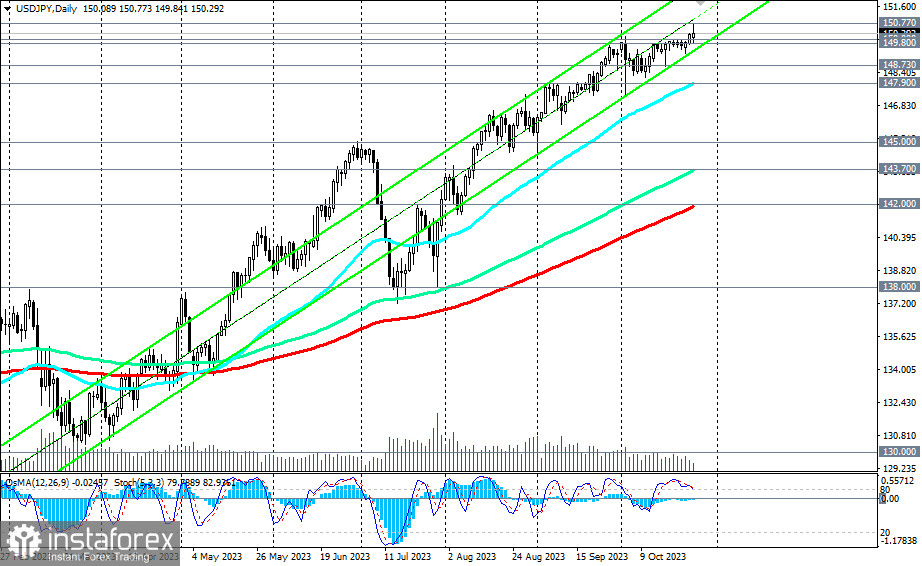

USD/JPY maintains its positive dynamics, staying in the zone of a solid bull market, short-term—above the support levels of 149.80 (200 EMA on the 1-hour chart), 148.73 (200 EMA on the 4-hour chart), medium-term—above the support levels of 143.70 (144 EMA on the daily chart), 142.00 (200 EMA on the daily chart), and long-term—above the support levels of 130.00 (144 EMA on the weekly chart), 126.30 (200 EMA on the weekly chart).

Previously, we assumed that a confident breakout of the 150.15 level could reassure buyers of the pair, allowing them to build up long positions.

In an alternative scenario, a signal to open short positions could be a breakdown of the support levels at 150.00, 149.80 (200 EMA on the 1-hour chart), and 149.33.

If the downward correction does not stop near the support levels of 148.00, 147.90 (50 EMA on the daily chart), the decline may continue to the local support level of 145.00 and the key support levels of 143.70 and 142.00.

Further decline will take the pair into the zone of the medium-term bear market (while maintaining the long-term and global bull markets).

Support levels: 150.00, 149.80, 149.33, 149.00, 148.73, 148.00, 147.90, 147.00, 145.00, 143.70, 143.00, 142.00

Resistance levels: 150.77, 151.00, 152.00

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română