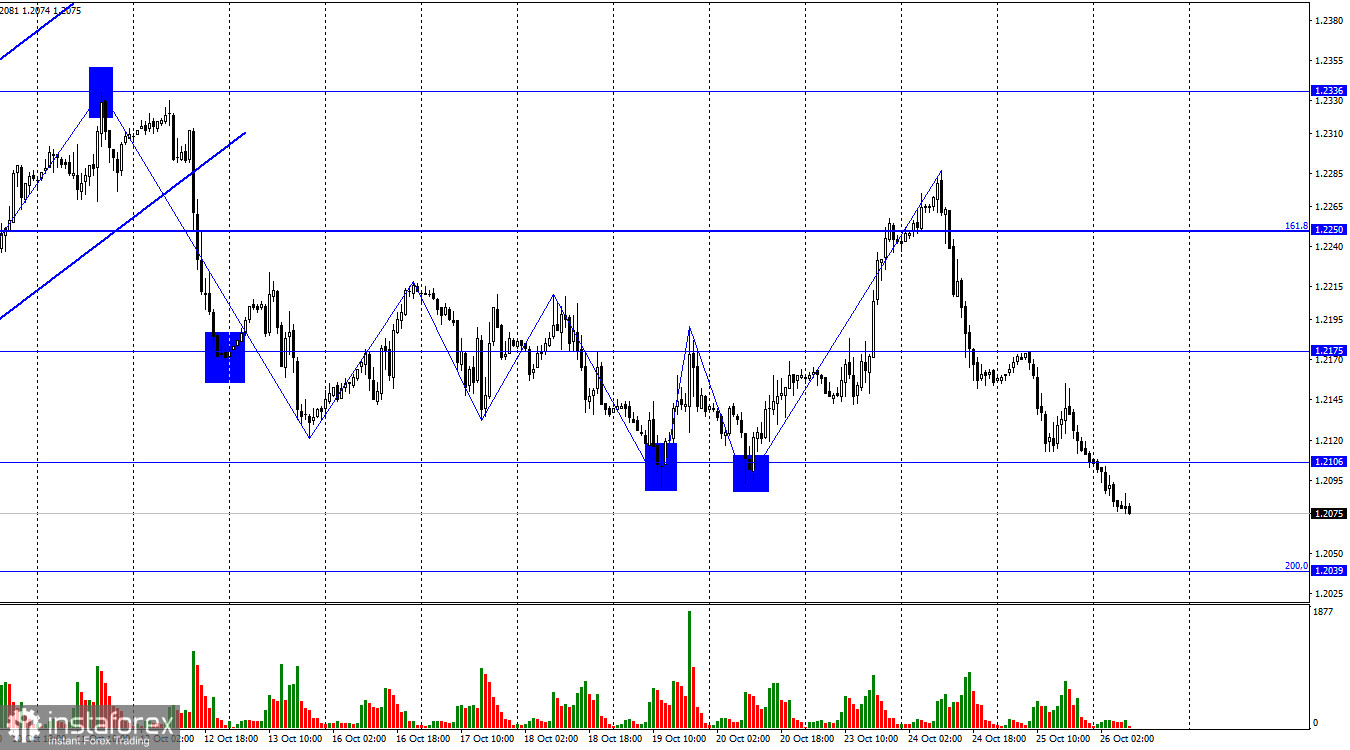

On the hourly chart, the GBP/USD pair rebounded on Wednesday from the 1.2175 level, reversing in favor of the US dollar and resuming its decline. By the end of the day, it had closed below the 1.2106 level. Thus, the process of falling prices may continue towards the next corrective level at 200.0%–1.2039. A rebound from this level will allow the bears to take a break.

The wave situation has become somewhat clearer after Monday's rise and the changes following the decline on Tuesday and Wednesday. The recent downward wave broke through the last four lows, and now only one conclusion can be drawn: the "bullish" trend has not really begun. After a 220-point decline in the British pound (which is not yet complete), I would expect an upward wave. However, there is currently no sign of the descending wave ending.

Today, in the United States, at least two important reports will be released. GDP for the third quarter, despite all the recession concerns, may not only fail to slow down but also increase. And not just increase, but grow twice as fast compared to the previous quarter. Traders are expecting 4.3% growth in the American economy. Slightly less optimistic forecasts predict growth of 4.0%. Such data could very well trigger another rise in the dollar. And perhaps we are already witnessing it. Equally important is the report on orders for durable goods, which traders also anticipate having very high values. If these expectations are met, the dollar will have a new opportunity to strengthen its position. This is exactly what it has been doing in recent months.

The ECB meeting has a greater impact on the euro, but the euro tends to drag the British pound along with it. If the pound today also works through this incident, I wouldn't be surprised.

On the 4-hour chart, the pair rose to the corrective level of 50.0% (1.2289), rebounded from it, and reversed in favor of the US dollar. A new decline has begun towards the 1.2008 level. Quotes closed above the descending trend corridor, but it remains very difficult to expect further growth for the pound. There are no new emerging divergences with any indicators today.

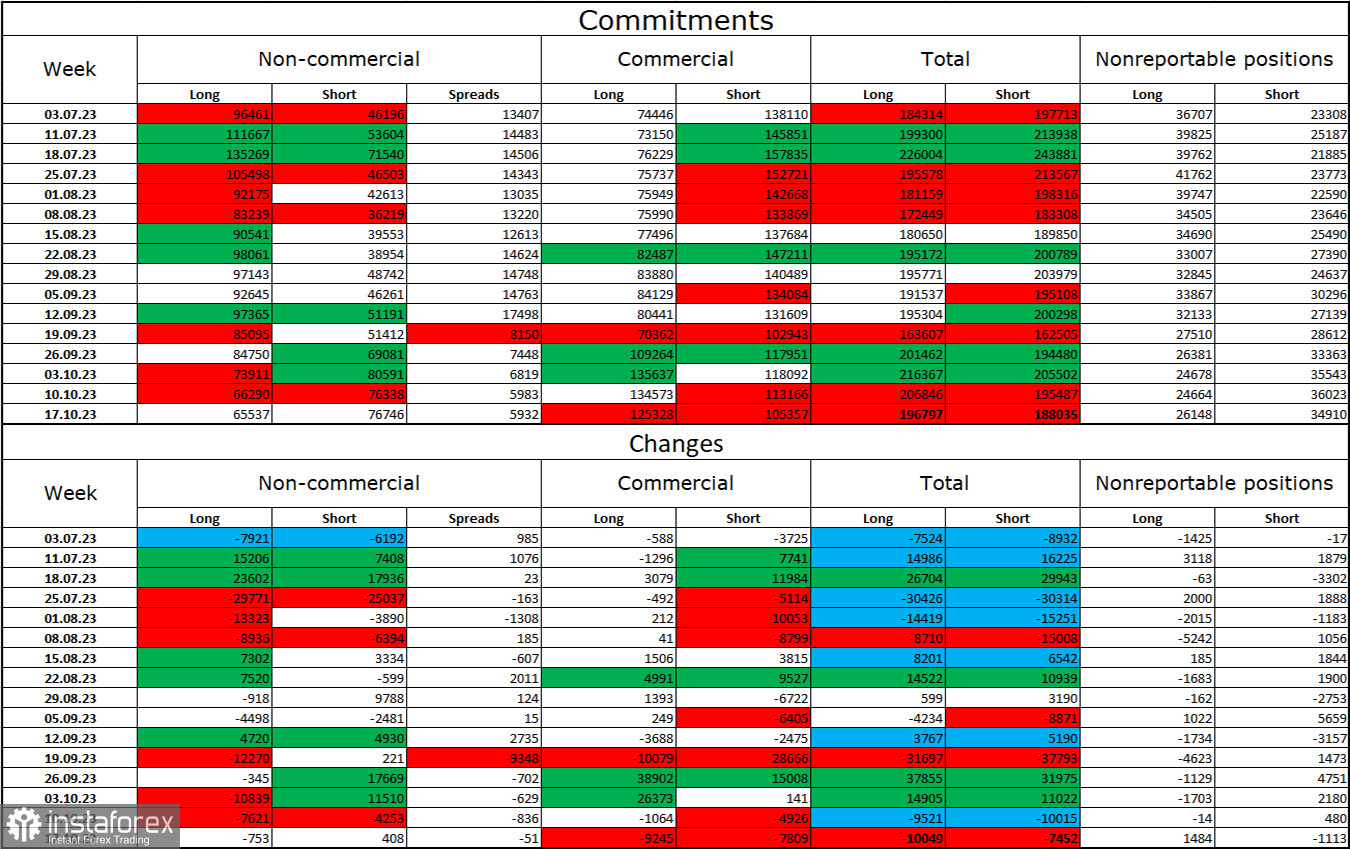

Commitments of Traders (COT) Report:

The sentiment of the "non-commercial" traders category has not changed in the latest report. The number of long contracts held by speculators decreased by 753 units, while the number of short contracts increased by 408 units. The overall sentiment of major players has shifted towards "bearish," but the gap between the number of long and short contracts is increasing in the other direction: 65 thousand against 76 thousand. In my opinion, the British pound still has excellent prospects for further declines. I do not expect a strong rise in the pound in the near future. I believe that over time, bulls will continue to get rid of buy positions, just as they did with the European currency.

News Calendar for the USA and the UK:

USA - Durable Goods Orders (12:30 UTC).

USA - GDP in the third quarter (12:30 UTC).

USA - Initial Jobless Claims (12:30 UTC).

On Thursday, the economic events calendar includes three entries, two of which are highly important. The impact of the information background on market sentiment in the remaining part of the day could be significant.

Forecast for GBP/USD and trader recommendations:

Selling the British pound was possible on the rebound from the 1.2289 level on the 4-hour chart, with targets at 1.2250, 1.2175, and 1.2106. All targets have been reached. You can keep the sales open with targets at 1.2039 and 1.2008 until the price closes above 1.2106. Purchases today are possible on a rebound from 1.2008 or 1.2039, with targets at 1.2106 and 1.2175.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română