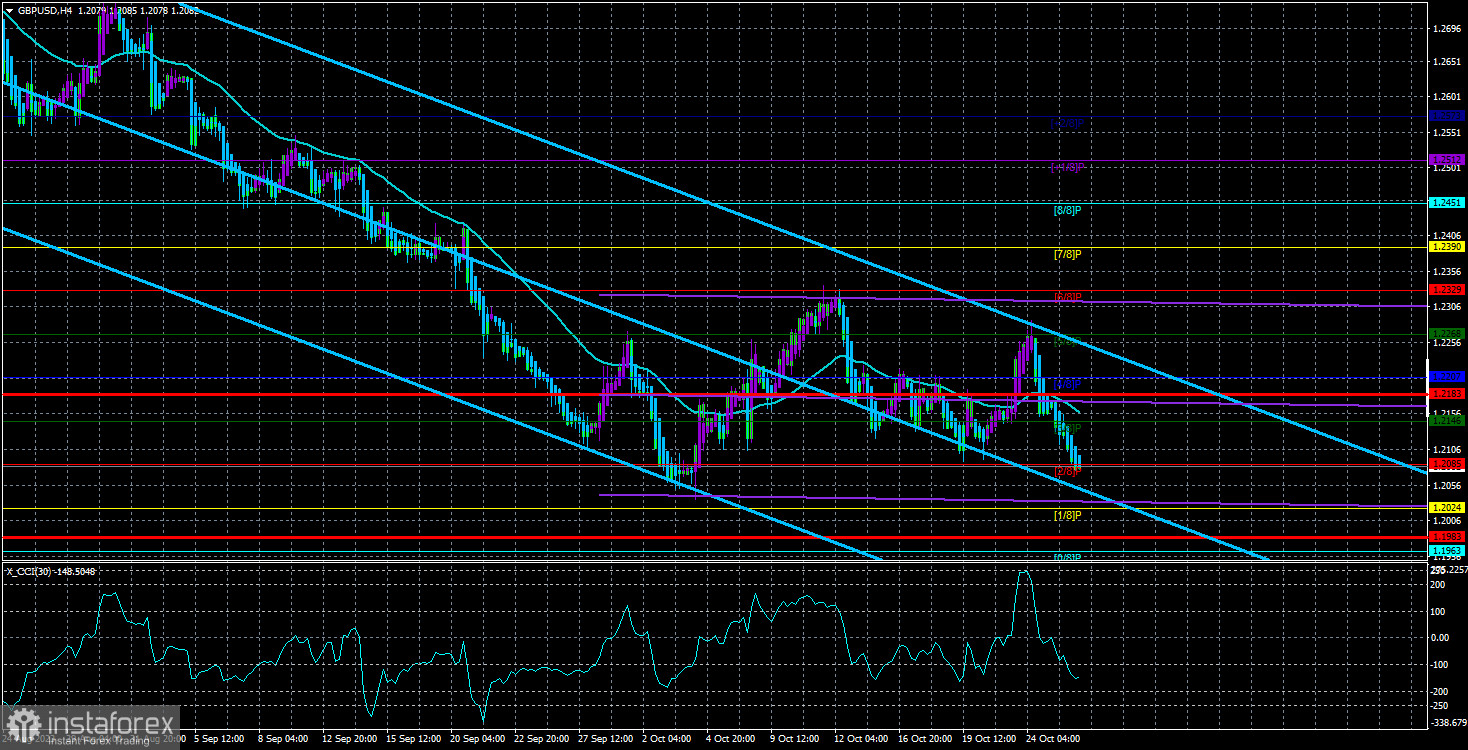

The GBP/USD currency pair continued its downward movement on Wednesday and has currently descended to the Murray level of "2/8"-1.2085. In principle, this level can also be considered the "last hope" for the pound. If it is breached, then the resumption of the downtrend will remain practically the only available option. In general, it already looks like the market has answered the question of whether the downtrend will continue. We don't oppose this scenario, and we have been discussing it in recent weeks. Therefore, we fully support the resumption of the British pound's decline, which has long lost any reason to rise. However, it doesn't have strong reasons to fall either, but we want to remind you that the pound has been rising for almost an entire year. Out of these 12 months, such a move has raised significant questions six times. So we continue to observe the "restoration of fair value" for this pair.

If, in the 24-hour timeframe for the euro, the price has temporarily crossed critical lines and important Fibonacci levels, then for the pound, it has bounced off similar barriers twice. Therefore, from a technical point of view, there are two strong sell signals on the daily chart, which are stronger than all lower timeframes. Thus, for both currency pairs, everything is moving towards a new phase of the medium-term downtrend. The macroeconomic environment or even the meetings of the FOMC and Bank of England next week are unlikely to stop this decline. The market does not expect any unexpected decisions or statements from the Fed right now. The Bank of England, on the other hand, may raise the rate, but the entire cycle of tightening monetary policy in the UK has already been worked out.

Sooner or later, the price will reach a certain "equilibrium point." We do not believe that the dollar will return to the 1.04 level, as it did last year. For such a strengthening, there must be reasons, so most likely, the balance will be found around the 1.1840 level. Then a strong fundamental foundation will be needed for a new trend, or a consolidation period will come when the price will be within a limited price range for a long time.

The dollar is rising, realizing that the Fed will extend the pause. The next week will feature the meetings of the Federal Reserve and the Bank of England, so the week can be very volatile and interesting. We have already said that the market's reaction can be anything to any central bank decision. Locally, the pound may rise, even if everything points to its decline. The overall trend is what matters. The trend right now is that the Fed has taken a second pause and may decide to extend it in November. Despite the fact that such a decision is considered "neutral," it has a "dovish" nature for many. Nevertheless, the dollar has been rising for three months, and the pound can't even get a proper correction.

Also, next week will see a meeting of the Bank of England, where a key rate increase is not planned either. Nevertheless, there may be a "surprise" with the British regulator. According to official forecasts, the number of members of the monetary committee who will vote to keep the rate unchanged is five out of a total of nine. Thus, literally one vote is enough to shift the balance towards a 0.25% rate hike. This means that the pound may receive support next Thursday, but it will be local support again. So, essentially, neither the FOMC meeting nor the Bank of England meeting should have a fundamental impact on the market's "bearish" sentiment.

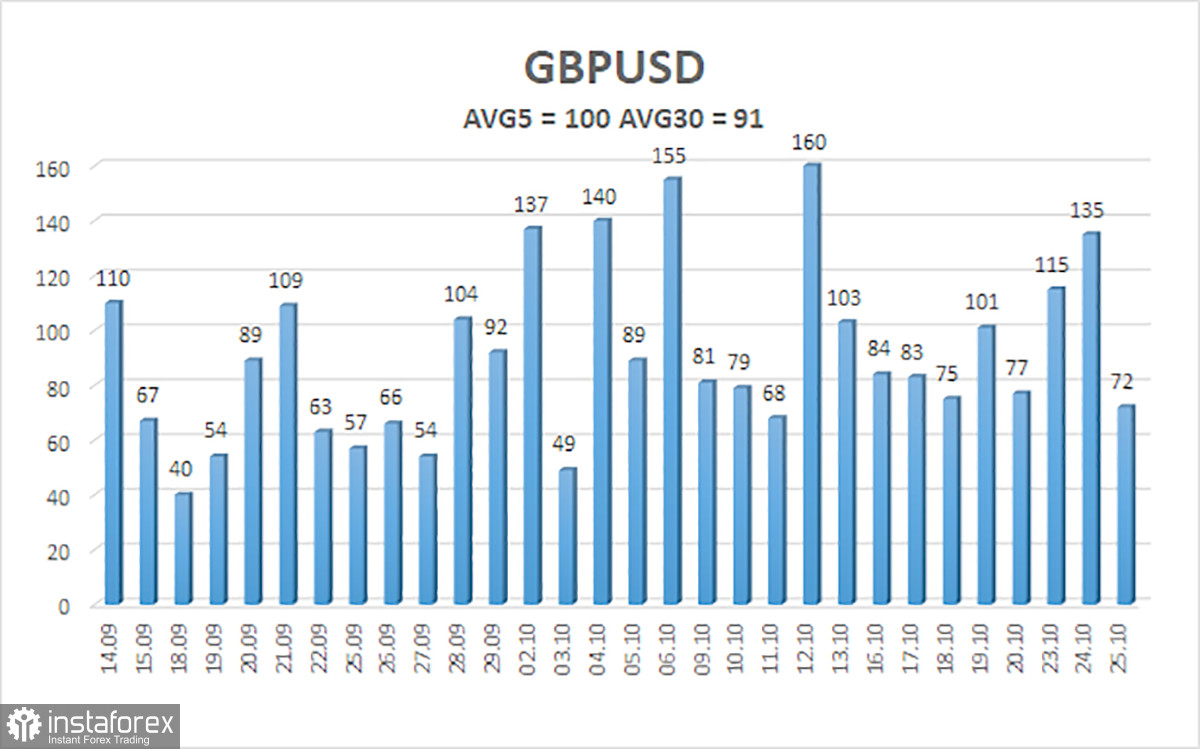

The average volatility of the GBP/USD pair over the past 5 trading days is 100 points. For the pound/dollar pair, this value is considered "average." Therefore, on Thursday, October 26, we expect movement within the range of 1.1983 and 1.2183. A reversal of the Heiken Ashi indicator upwards will signal a possible new upward correction phase.

Nearest support levels:

S1 – 1.2085

S2 – 1.2024

S3 – 1.1963

Nearest resistance levels:

R1 – 1.2146

R2 – 1.2207

R3 – 1.2268

Trading recommendations:

In the 4-hour timeframe, the GBP/USD pair may have completed its sluggish correction attempts. Therefore, it is currently advisable to maintain short positions with targets at 1.2024 and 1.1983 until the Heiken Ashi indicator reverses upwards. In the event of the price consolidating above the moving average, long positions with targets at 1.2207 and 1.2268 will become relevant.

Explanations for the illustrations:

Linear regression channels help determine the current trend. If both channels are pointing in the same direction, it indicates a strong trend.

The moving average line (settings 20.0, smoothed) determines the short-term trend and the direction in which trading should be conducted.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) represent the likely price range within which the pair will trade over the next few days, based on current volatility indicators.

The CCI indicator entering the oversold region (below -250) or overbought region (above +250) indicates an approaching trend reversal in the opposite direction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română