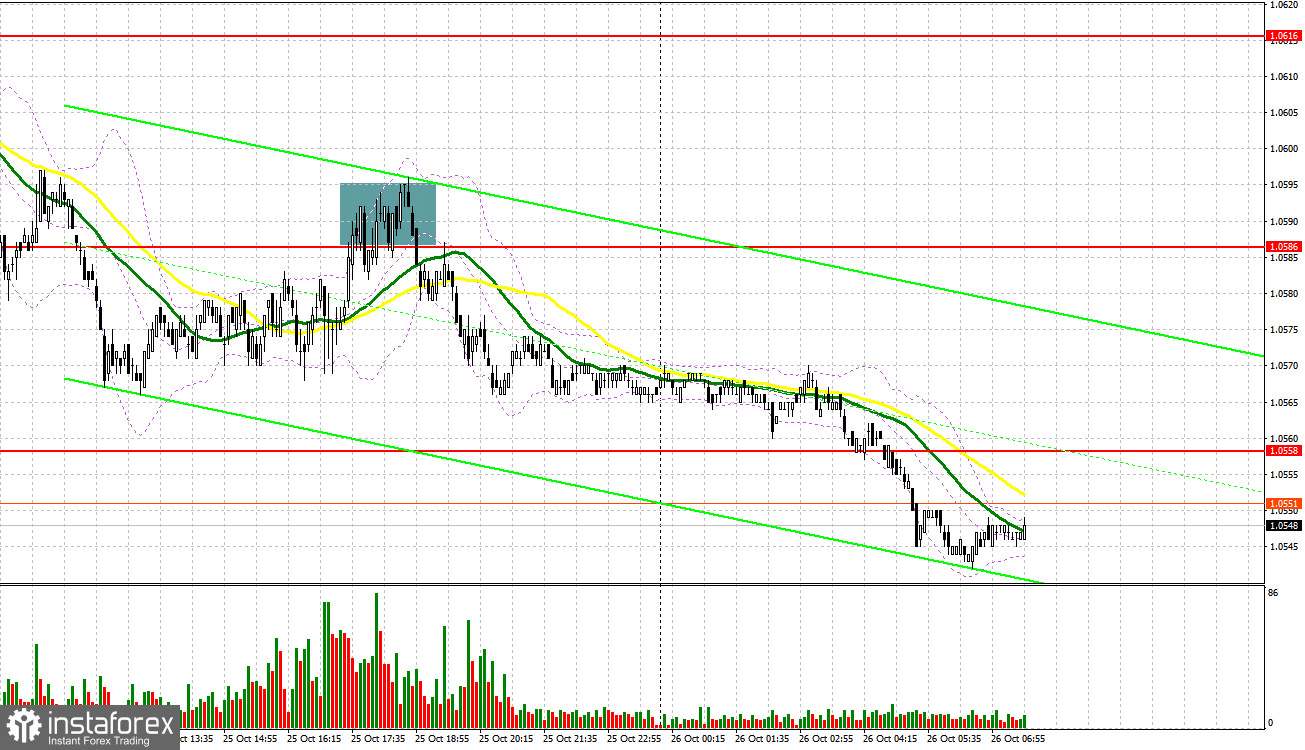

Yesterday, the pair formed several entry signals. Let's have a look at what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.0586 as a possible entry point. A decline and a false breakout near this mark generated a buy signal. However, even despite the good reports, the pair failed to move sharply higher, and the bulls missed 1.0586. In the afternoon, a false breakout at 1.0586 produced a sell signal. As a result, the pair fell by 20 pips.

For long positions on EUR/USD:

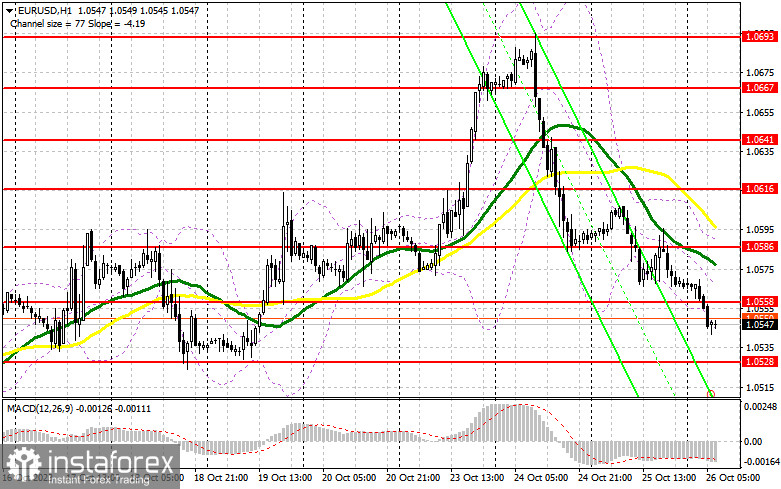

Strong data on US home sales and the fact that no change in interest rates is expected from the European Central Bank had exerted pressure on the euro, which is why it resumed its downside path. Today, attention now turns to the ECB's rate decision, followed by the monetary policy report. Traders will also keep an eye on ECB President Christine Lagarde's speech. It's clear that the significant cost of borrowing is raising questions about the sustainability of a tight policy course in 2024. If Lagarde makes a number of soft statements, the euro may fall even more. Hence, an optimal buying opportunity might arise on dips, particularly after a false breakout near the new support level at 1.0528, where the euro is now heading. This will serve as a confirmation of a correct entry point for long positions aiming for a recovery towards the new resistance at 1.0558. A breakout and a downward retest of this range can pave the way for a surge up to 1.0586, which is in line with the bearish moving averages. The ultimate target is found at 1.0616 where I plan to take profits. If EUR/USD declines and shows a lack of activity at 1.0528, the pressure on the euro will increase, which will push the pair down to the area of last week's lows. In such a scenario, only a false breakout near 1.0497 would provide an entry signal. I would immediately go long on a bounce from 1.0474, aiming for an intraday upward correction of 30-35 pips.

For short positions on EUR/USD:

Yesterday, the bears completed their tasks, which means that the pair has a good chance of falling further. A false breakout at 1.0558 will generate a good sell signal, with a prospect of a decline towards the 1.0528 support. A breakout and consolidation below this range, as well as its upward retest, on top of a softer stance from Lagarde, will give another sell signal with the target at 1.0497. The ultimate target will be the 1.0474 low where I will take profits. If EUR/USD rises during the European session and bears are absent at 1.0558, the bulls will surely try to return to the market. In this scenario, I will delay going short until the price hits the resistance at 1.0586. I may consider selling there but only after a failed consolidation. I will go short immediately on a rebound from the high of 1.0616, aiming for a downward correction of 30-35 pips.

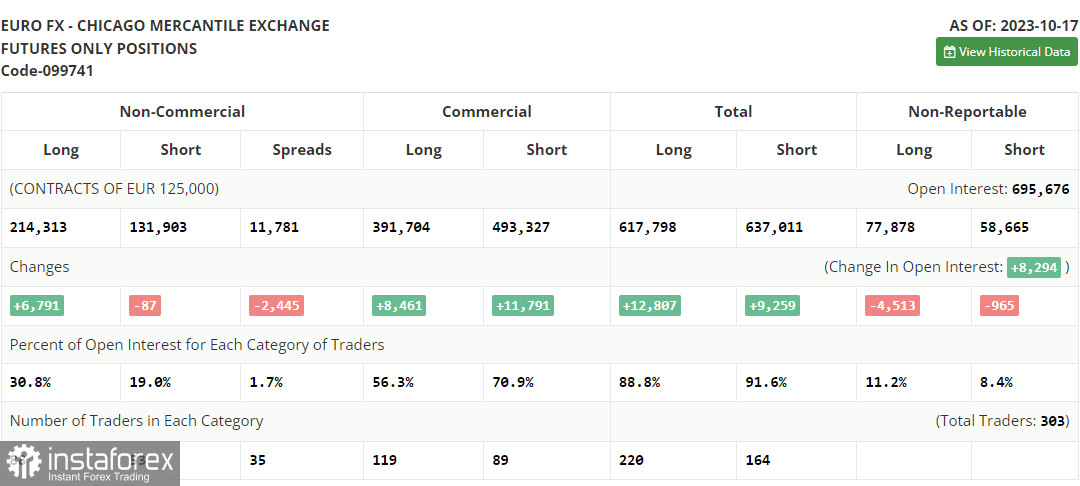

COT report:

The Commitments of Traders report for October 17 showed an increase in long positions and a decrease in short ones. The US continued to release fairly strong economic indicators, including retail sales and the labor market, indicating the need for additional interest rate hikes. However, before the Federal Reserve blackout period, which limits the extent to which FOMC participants and staff can speak publicly, a number of statements from Fed officials has convinced the market that the central bank will not raise rates in November. This weakened the demand for the dollar and boosted buyers' confidence. The COT report reveals that non-commercial long positions increased by 6,791 to 214,313, while non-commercial short positions declined by only 87 to 131,903. This resulted in the spread between long and short positions shrinking by 2,445. The closing price declined to 1.0596 compared to 1.0630, confirming the euro's upward correction.

Indicator signals:

Moving averages:

The instrument is trading below the 30 and 50-day moving averages. It indicates that EUR/USD is likely to decline lower.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If EUR/USD declines, the indicator's lower border near 1.0550 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română