EUR/USD

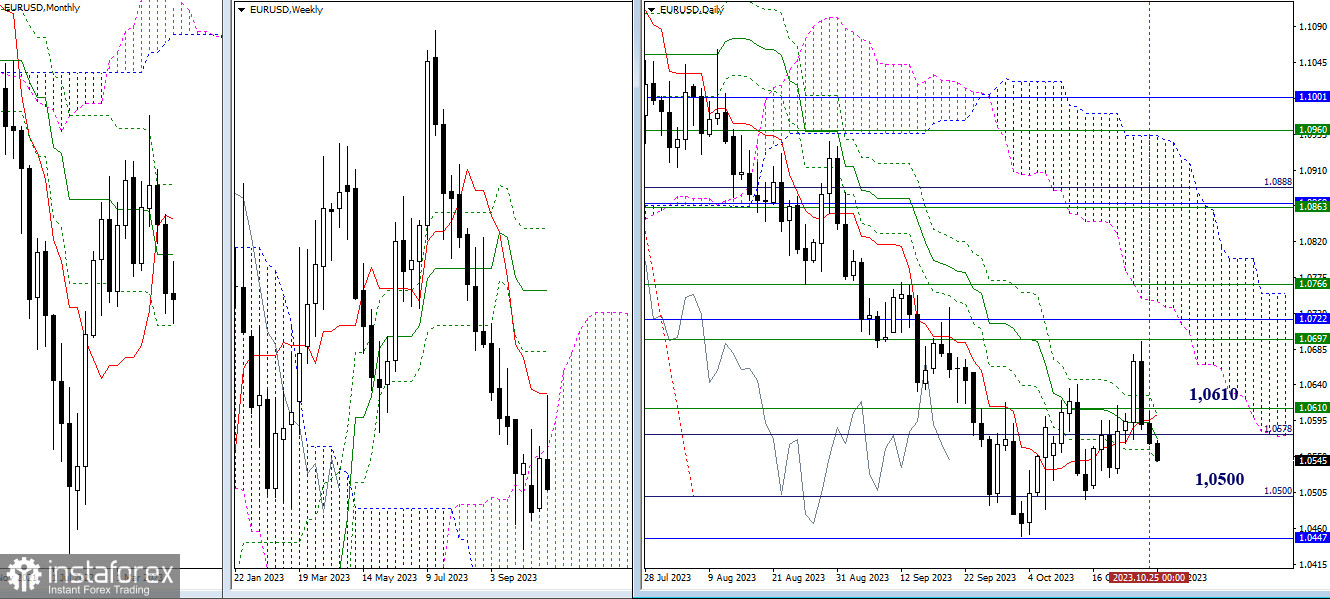

Higher Timeframes

Despite a loss of some productivity, bears continue their decline. Currently, the support is provided by the daily cross level (1.0543), with bearish targets being at 1.0500 (100% execution level of the daily target) and 1.0447 (the final level of the monthly Ichimoku cross).

At this stage, the attraction of accumulated levels around 1.0610 (the upper boundary of the weekly cloud + daily cross levels) still holds significance for the bulls. Then attention will again be directed to the broad resistance zone, where the market will first encounter the weekly short-term trend (1.0697).

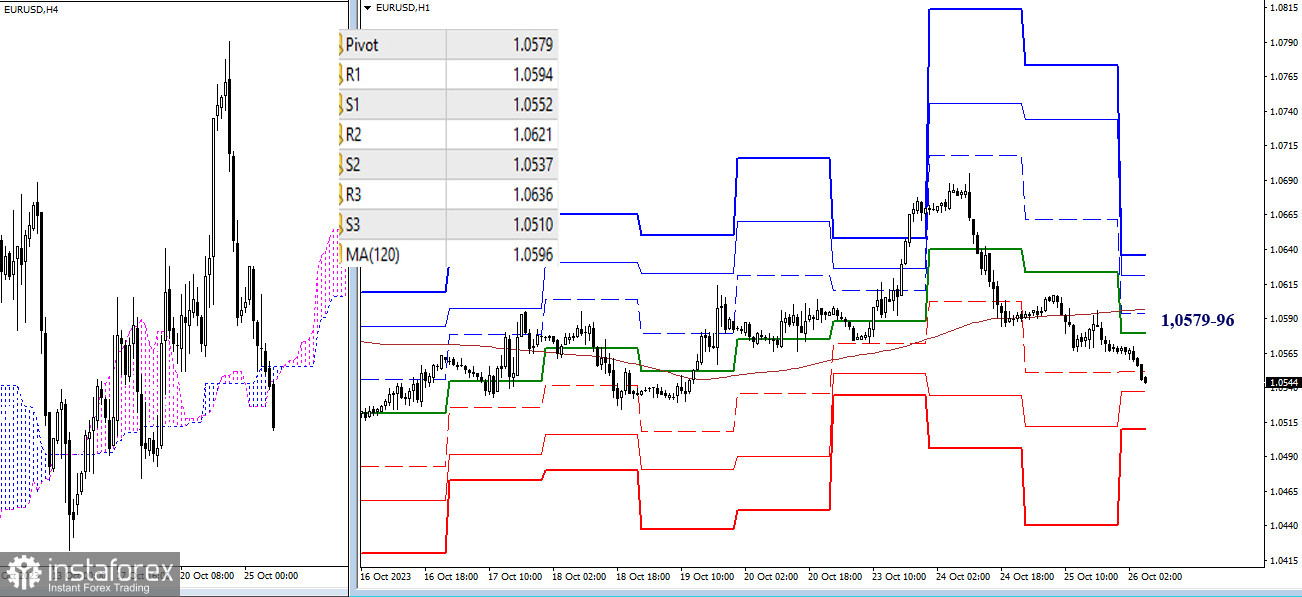

H4 - H1

On the lower timeframes, key levels today are located in the range of 1.0579 - 1.0596 (central pivot point + weekly long-term trend). The market has settled below, so the main advantage is currently on the side of strengthening bearish sentiment. If the bears have the strength to continue the decline and gain an advantage on higher timeframes, a more global downward trend may be restored. If the bears limit their advantage only on lower timeframes, their opponents will aim to regain their positions and return to key levels (1.0579 - 1.0596). Additional intraday targets are the supports (1.0537 - 1.0510) and the resistances (1.0621 - 1.0636) of the classic pivot points.

***

GBP/USD

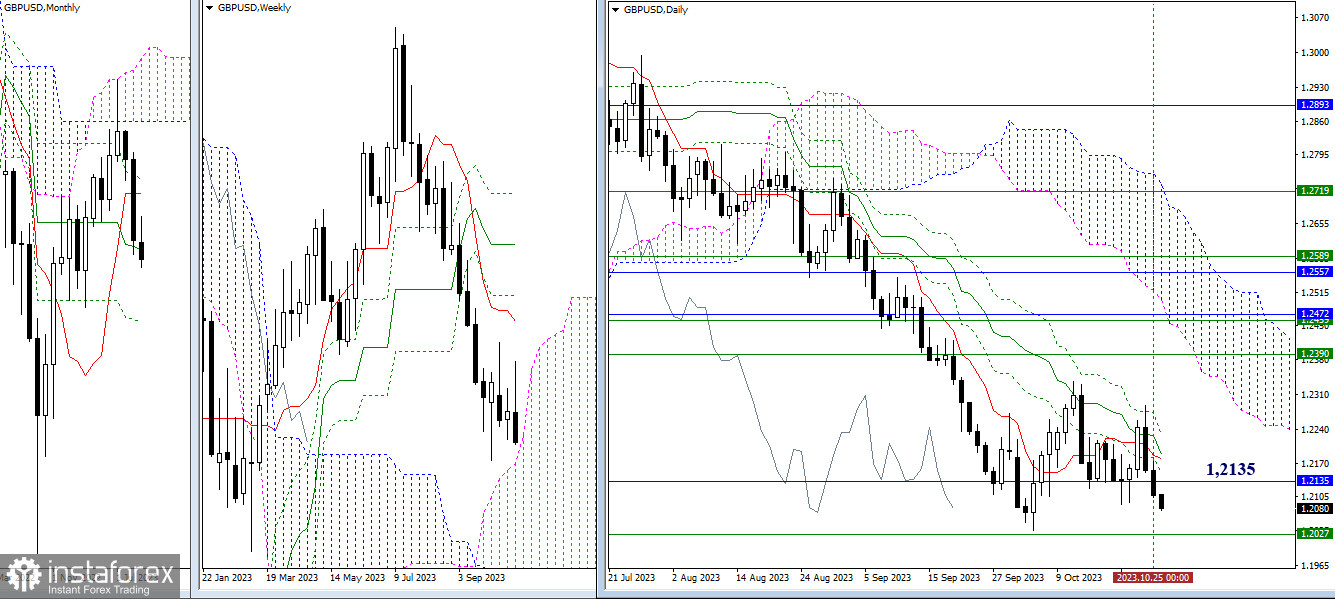

Higher Timeframes

After a rebound from the final resistances of the daily Ichimoku cross, bears continue the decline. As a result of the current situation, the most important task in this market area for bears is to exit the weekly and daily correction zone (1.2036) and enter the weekly cloud (1.2027). If the bulls want to change the situation, they now need to not only eliminate the daily Ichimoku cross (1.2190 - 1.2226) but also update the highs of the current correction (1.2287 - 1.2336).

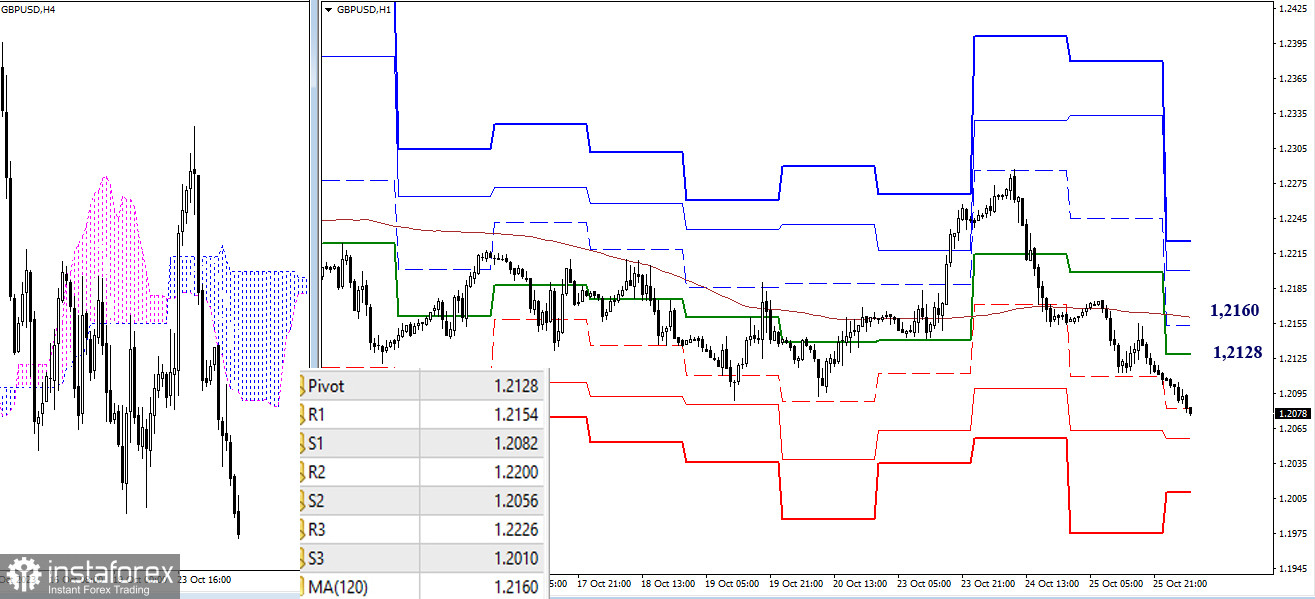

H4 - H1

On the lower timeframes, the main advantage is on the bears. The market continues to decline, and the classic pivot points (1.2056 - 1.2010) currently serve as bearish targets. Today, key levels play the role of resistances, and in the event of a correction, they are ready to meet the market at the levels of 1.2128 (central pivot point of the day) - 1.2160 (weekly long-term trend). Overcoming these resistances and firm consolidation above can change the current balance of power. The next upside targets will be the resistances of the classic pivot points R2 (1.2200) and R3 (1.2226).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română