When the US dollar sharply fell on Monday, without any apparent reason, there were suspicions that it was due to some speculation. Unfortunately, yesterday's events seem to confirm this. The dollar sharply grew on Tuesday. And even though there was a formal reason for this in the form of good PMIs, in reality, all of this occurred even before their release. After all, the forecasts for the US PMIs were entirely negative. Perhaps the most telling aspect is that despite the incredible volatility in the currency market, gold remains virtually unchanged. Although it has an inverse correlation with the dollar, this correlation is particularly evident during sharp currency market movements. One could try to attribute these movements to the UK data, but the problem is that these indices turned out mixed. This can't possibly explain such massive movements.

Moreover, the movement started even before their release. In other words, it makes no sense to take economic reports into account. At the moment, it is quite difficult to make forecasts because the economic calendar is basically empty, and these unusual movements may persist. Nonetheless, the market appears to have returned to its initial position. That is, to the levels it was at before the dollar sharply fell at the beginning of the trading week. Ideally, the market should stall and tread water for a day. This is especially true since the empty economic calendar should favor this scenario. The market needs to calm down and take a breather ahead of tomorrow's European Central Bank meeting.

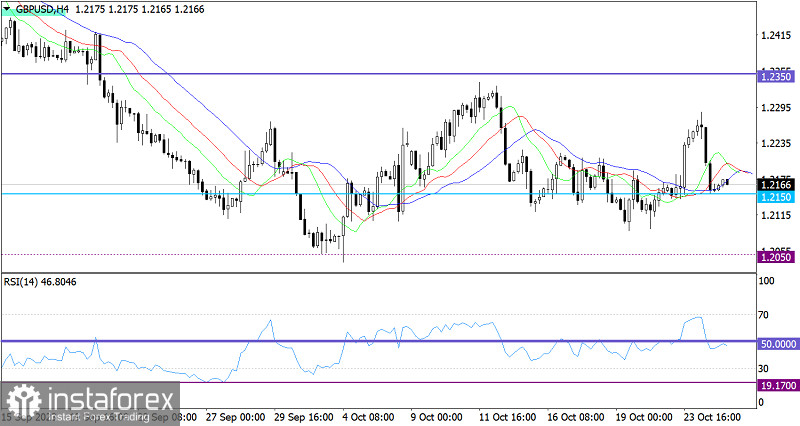

The bullish speculation has been replaced by a bearish one, causing the quote to return to the support level of 1.2150.

On the four-hour chart, the RSI downwardly crossed the 50 middle line, thus reflecting bearish sentiment among traders.

The Alligator's MAs are intertwined in the 4-hour time frame, signaling a slowing bull cycle, followed by a period of stagnation.

Outlook

If the price consolidates below the support level of 1.2150, further growth in selling volumes could lead to movement toward the upper psychological level in the 1.2000/1.2050 area. Until then, market participants consider 1.2150 as a support level, which allows for the possibility of a rebound.

The complex indicator analysis points to a downward cycle in the short-term and intraday periods.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română