The GBP/USD currency pair on Tuesday once again repeated the movements of the EUR/USD pair. We have already mentioned that while the euro had at least formal reasons for such a decline (weak business activity indices), the pound did not. Certainly, business activity indices in the United Kingdom also did not show a positive dynamic, but they did not worsen compared to September. Besides, there was also positive news. For instance, the unemployment rate decreased from 4.3% to 4.2%. However, positive news had no significance for traders; they were focused on selling right away.

As a result, the price once again fell below the moving average line, which seems to indicate a change from a short-term trend to a downward one. But we wouldn't rush to conclusions. The situation is not entirely clear, especially for the pound. The euro currency has at least formed two stages of an upward correction, so it can be considered sufficient. With the pound, we only saw one stage, and it was a very weak one. Of course, this does not mean that the pound cannot fall now. It can because it has no grounds for growth, especially not with the upcoming meetings of the Federal Reserve and the Bank of England, which will take place next week. If the Bank of England starts "dovish" rhetoric again and the Federal Reserve hints at a rate hike in December, the rise of the dollar is guaranteed.

In addition, we would like to point out that British statistics last week failed and exerted strong pressure on the pound. All the reports in the United Kingdom for this week have already been published, but they did not support the British currency either. Therefore, even technical corrections are currently in question for the pound.

In the 24-hour time frame, the pair could not overcome the Fibonacci level of 50.0% (1.2302), and yesterday it fell back below the critical line. Therefore, there is a much higher probability of the pound resuming its decline now.

Will Jerome Powell please the markets again?

We have said more than once that no instrument can constantly move in only one direction. However, in the last three months, the pound has only shown a downward movement. Of course, there have been minimal corrections and pullbacks, but they have been so weak that it becomes obvious—the bulls are on vacation. However, all year we have been saying that the British currency has no grounds for growth. Therefore, its decline is quite justified.

Today, Jerome Powell will speak again. None of his colleagues managed to provoke a market reaction, but their message was clear: the Federal Reserve rate can now only rise in extraordinary circumstances. If such circumstances do not arise, then at the very least, half of the monetary committee does not see the need for further tightening. However, Jerome Powell stated last week that the key rate could rise, but it would depend on incoming data. In principle, his rhetoric did not differ from his previous statements, but this time it sharply contrasted with the statements of other FOMC representatives. This is why the dollar "fluttered" from side to side last week.

We may see something similar today. If Powell once again allows a rate hike, if not in November, then in December, the dollar may go into a "storm" again. Moreover, it cannot be said that it strengthened or weakened last week. It just moved in different directions. And Powell has reasons to consider a new tightening. It should be remembered that inflation in the United States has been rising for three months in a row, and the economy is still very strong. For example, on Thursday, data on third-quarter GDP will be released, with growth expected to be 4.1%. With such a strong economy, the rate can be raised 2-3 more times easily. The more "hawkish" Powell's rhetoric, the higher the probability of a renewed decline for both pairs.

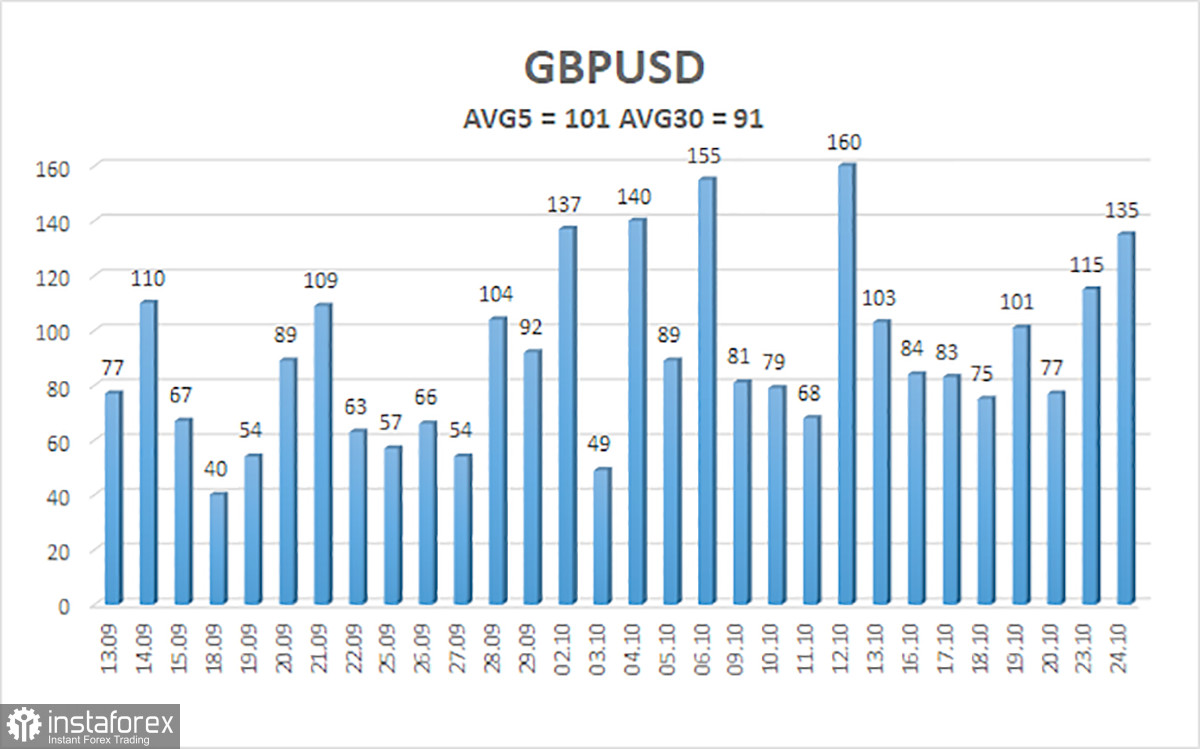

The average volatility of the GBP/USD pair for the last 5 trading days is 101 points. For the GBP/USD pair, this value is considered "average." As a result, on Wednesday, October 25, we anticipate movement that stays within the range defined by the levels of 1.2072 and 1.2274. A reversal of the Heiken Ashi indicator upwards will signal a new stage of the upward correction.

Nearest support levels:

S1 - 1.2146

S2 - 1.2085

Nearest resistance levels:

R1 - 1.2207

R2 - 1.2268

R3 - 1.2329

Trading recommendations:

In the 4-hour timeframe, the GBP/USD pair is still attempting to correct, but the results are not favorable. Therefore, new long positions can be considered with targets at 1.2268 and 1.2329 in case the price is fixed above the moving average. In cases where the price is below the moving average, short positions with targets at 1.2146 and 1.2072 will become relevant.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both are pointing in the same direction, it means the trend is currently strong.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price range in which the pair will trade over the next day based on current volatility indicators.

CCI indicator - its entry into the overbought zone (above +250) or oversold zone (below -250) indicates an approaching trend reversal in the opposite direction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română