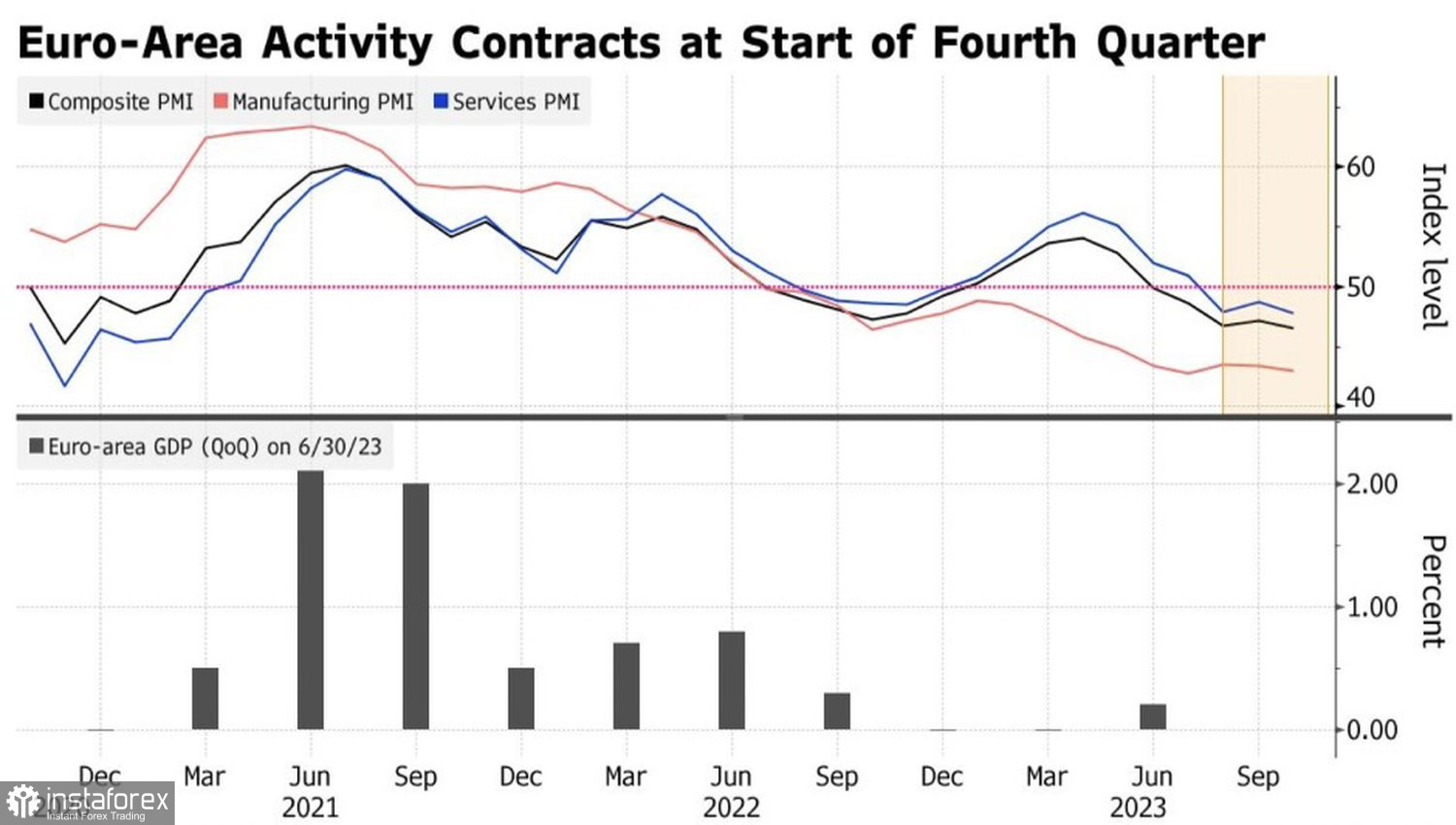

In a weak economy, there can't be a strong currency. Yes, the U.S. dollar has hit a rough patch; its previous advantages aren't working anymore. But this is not enough for a significant correction in EUR/USD. The Eurozone must show signs of life, and unfortunately, that is not happening. In October, the composite Purchasing Managers' Index (PMI) for the currency bloc fell to a three-year low of 46.5.

Such a decline in business activity implies that the risks of a technical recession, defined as two consecutive quarters of declining GDP, have significantly increased. This may occur in the second half of 2023. According to the consensus estimate of Bloomberg experts, the Eurozone economy shrank by 0.1% in July-September. And this is just the beginning!

Business activity dynamics in the Eurozone

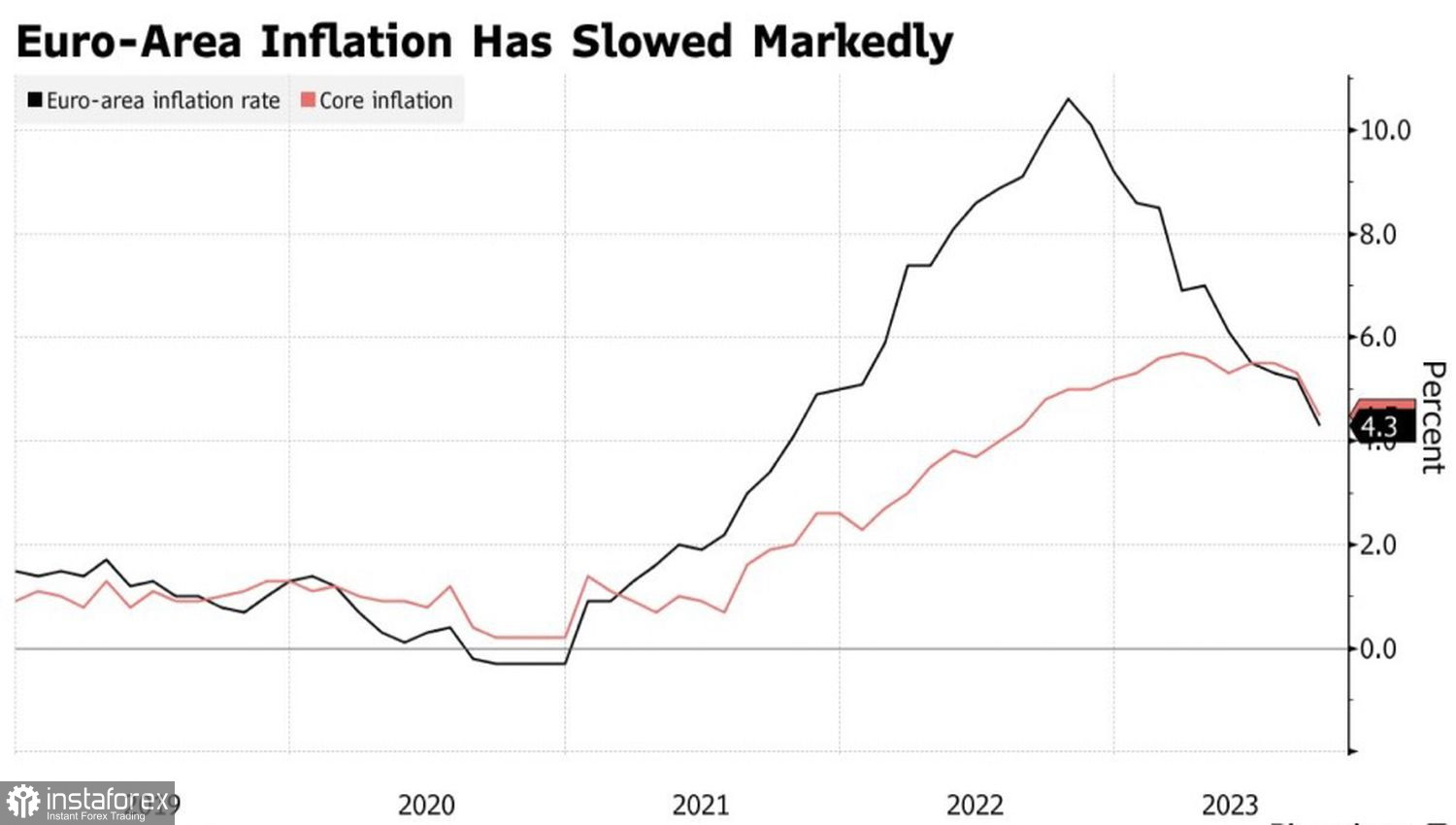

The "bulls" on EUR/USD are not pleased, and neither are ECB President Christine Lagarde's comments. According to Bloomberg's insider information, Lagarde discussed balancing the currency bloc between recession and stagflation at closed events. She notes progress in the fight against inflation, which contrasts with her official statements that the rise in the core CPI remains elevated.

Interestingly, inflation data in the Eurozone for October could show a further slowdown in figures, possibly down to 3%. This will not only put a damper on the ECB's monetary policy tightening but also increase the likelihood of a dovish pivot in 2024. Currently, derivatives suggest that the deposit rate will fall by 50 basis points to 3.5% next year.

European inflation dynamics

Under normal circumstances, the weakness of the currency bloc's economy and the ECB's intention to complete the monetary tightening cycle would have buried the "bulls" on EUR/USD. However, the market is currently in a phase of universal dislike for the U.S. dollar. What helped it for the past few months is now perceived as a tool that increases the risks of financial instability in October. This is a negative for the U.S. dollar.

Indeed, the U.S. budget deficit increased by $1.02 trillion in 2022-2023, reaching $2.02 trillion after adjustments related to the removal of the impact of Joe Biden's student loan forgiveness program. This is a colossal sum that, on the one hand, requires significant bond issuances by the Treasury. On the other hand, it increases the risks of a political crisis, a government shutdown, and threatens a credit rating downgrade for the United States.

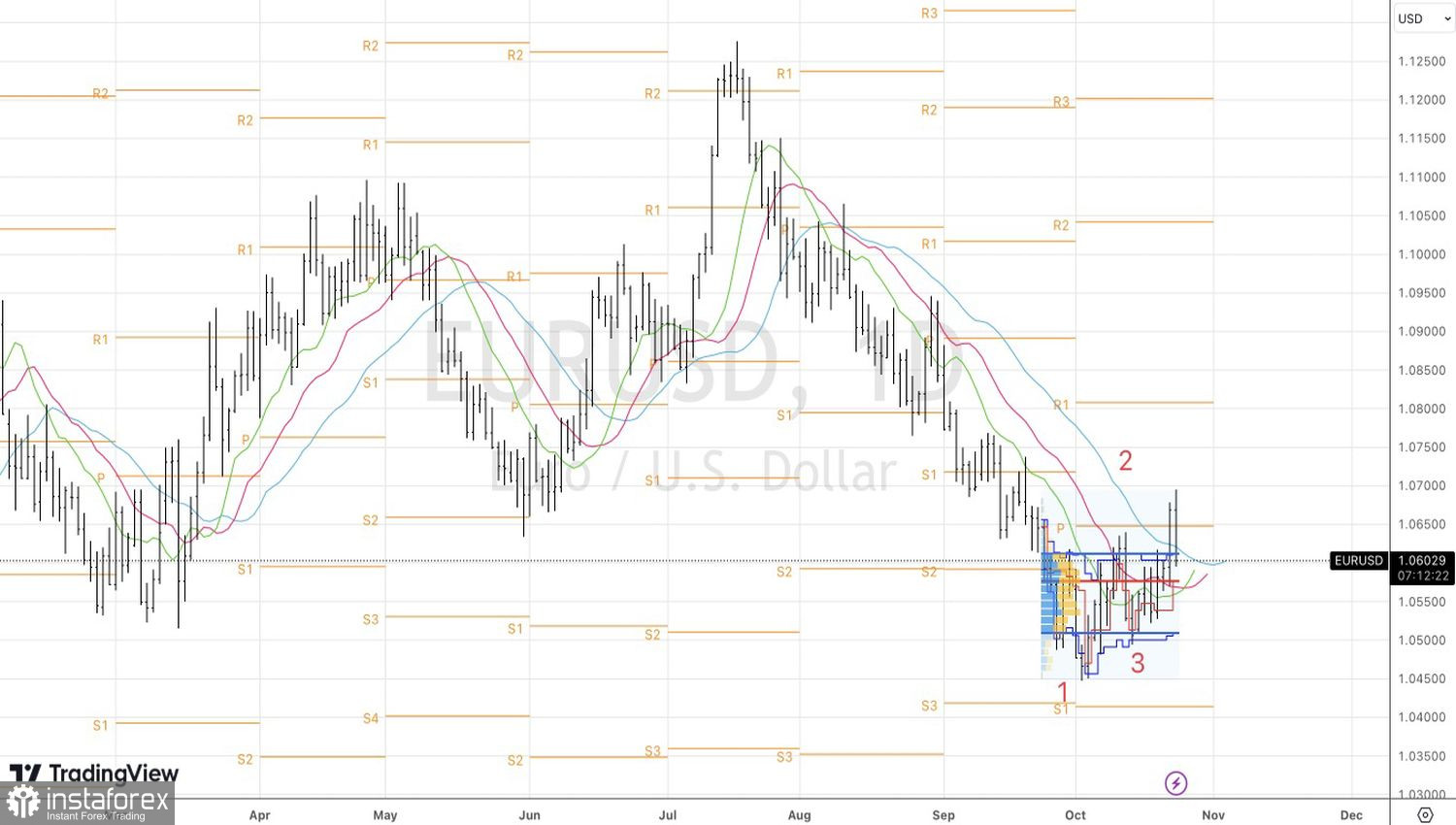

As a result, both the U.S. dollar and the euro have plenty of vulnerable spots. This prevents the main currency pair from deciding on the direction of its further movement. It can't break out of the consolidation range between 1.05 and 1.07.

Technically, unsuccessful attempts to breach the upper boundary of the range between 1.05 and 1.07, which is part of the "Splash and Shelf" pattern, indicate the weakness of the "bulls" on EUR/USD. A drop below support at 1.061 and a return to the fair value range will open the door for selling. Conversely, a rebound will be a reason to buy.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română