Gold rose in price amid the ongoing conflict in the Middle East.

The latest weekly gold review indicated the very optimistic view of retail investors, contrary to that of market analysts who expect a pullback after a sharp two-week surge.

Ole Hansen, Head of Commodity Strategy at Saxo Bank, said prices will likely consolidate this week, albeit influenced by geopolitics.

RJO Futures commodity broker Daniel Pavilonis, on the other hand, noted a potential price decline to 1945.

Senior Market Analyst at Barchart.com, Darin Newsom, predicts an increase in gold prices this week, as investors see gold as a safe haven amid Middle East geopolitics.

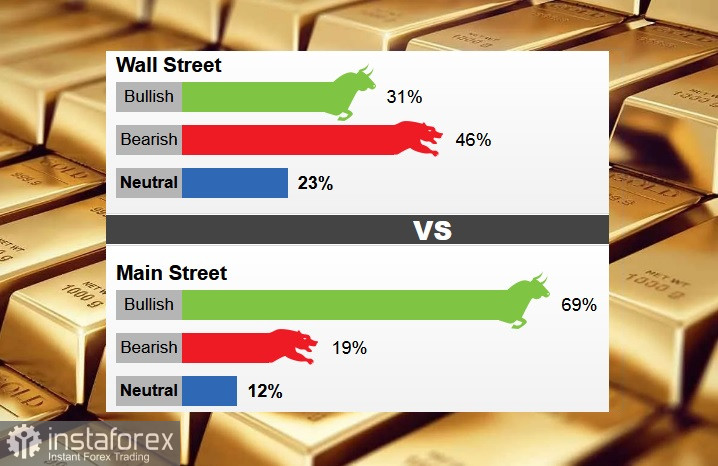

In a survey from Wall Street, 31% anticipate price increases this week, 46% foresee a decrease, and 23% remain neutral. Meanwhile, in an online poll, 69% expect prices to rise, 19% anticipate a decrease, and 12% remain neutral.

Adam Button, Chief Currency Strategist at Forexlive.com, said gold and oil remain predictable in tense situations and they will continue to be sensitive to new developments. Therefore, in the face of uncertainty in the Middle East, demand for them rises. However, high bond yields hold back gold prices, especially amid the stubborn optimism of the US consumer and stock markets.

Nevertheless, Adrian Day, President of Adrian Day Asset Management, believes that as long as tension persists in the Middle East, gold prices will stabilize at a higher level. Mark Leibovit, Publisher of VR Metals/Resource Letter, also remains very optimistic, believing that prices will break above $2,000 this week. Meanwhile, Forex.com Senior Market Strategist James Stanley sees a price decline during the week.

This week, attention should be paid to economic data to be published, including US GDP for the 3rd quarter, the report on durable goods for September, S&P service and manufacturing PMI indices for October, the PCE report for September, as well as research from the Chicago and Richmond Fed. Additionally, central bank leaders will be speaking this week, including ECB President Christine Lagarde and Fed Chairman Jerome Powell.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română