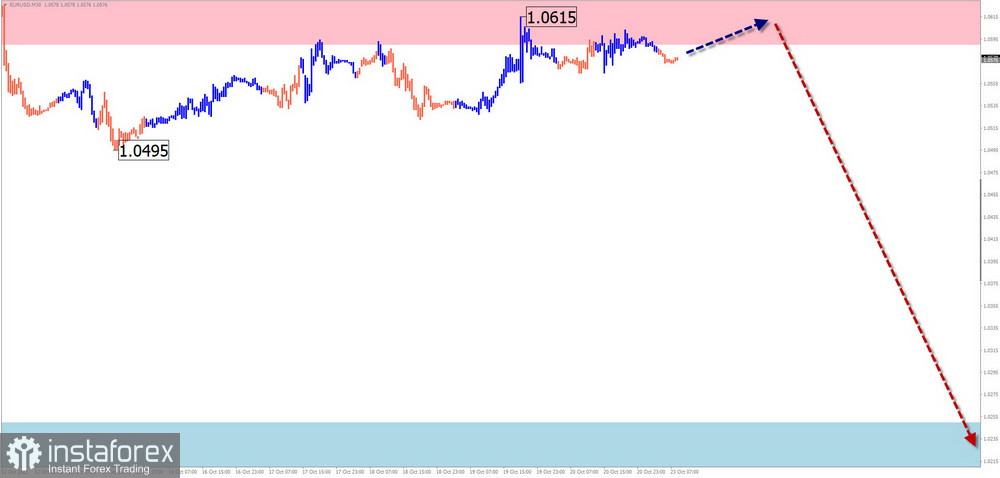

EUR/USD

Analysis:

In the short-term perspective, the price movement of the euro in the main pair is defined by the descending wave algorithm from September 26. The wave's potential does not go beyond the correction of the previous bullish trend. Over the past month, the quotes of the pair have formed a complex corrective structure, shifting horizontally along the resistance zone. The movement has entered its final phase.

Forecast:

At the beginning of the upcoming week, a continuation of the overall flat movement of the European currency is expected. Reversal formation can be expected around the resistance zone. A price decrease is more likely in the second half of the week. The timing reference is the date of important news releases.

Potential reversal zones

Resistance:

- 1.0590/1.0640

Support:

- 1.0250/1.0200

Recommendations:

Sales: They will become preferable after the appearance of corresponding reversal signals in the resistance area.

Purchases: There are no conditions for such transactions.

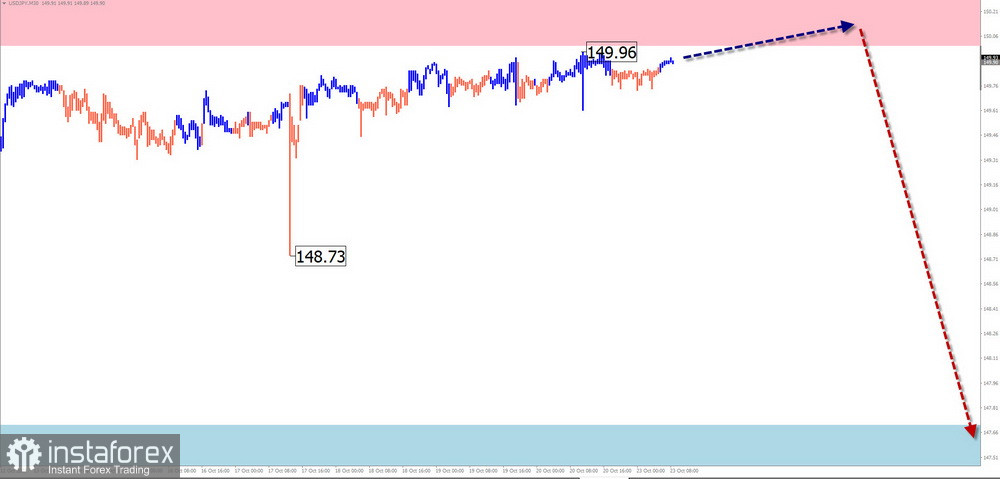

USD/JPY

Analysis:

The dominant trend on the chart of the major pair of the Japanese yen is the upward trend, which led the quotes to the upper boundary of a strong daily TF resistance zone. In the short-term perspective, the upward wave from October 3 is relevant. In its structure, the intermediate part (B) is still incomplete.

Forecast:

In the coming week, one can expect a continuation of the price movement within the sideways corridor. In the first few days, a "side" movement along the lower boundary of the resistance zone is possible. Then the likelihood of a change in direction and a decrease in the pair's rate increases. The calculated support area indicates the likely lower boundary of the pair's weekly movement.

Potential reversal zones

Resistance:

- 150.00/150.50

Support:

- 147.70/147.20

Recommendations:

Sales: They will be possible after the appearance of confirmed signals from your trading systems in the support area.

Purchases: They are risky and can lead to losses.

GBP/JPY

Analysis:

On the chart of the pound/yen cross, an upward trend dominates. Its unfinished section counts as of July 28. The wave is forming within the potential reversal zone of the weekly TF. The corrective part of the wave takes the form of a sideways flat.

Forecast:

A sideways movement with a downward vector is expected in the first half of the upcoming week. The decline can be expected no later than the support boundaries. Further, activation and resumption of the rate increase are likely, up to the calculated resistance levels. The start of activity may coincide with the release of important economic data.

Potential Reversal Zones

Resistance:

- 183.60/184.10

Support:

- 180.60/180.10

Recommendations:

Sales: have low potential and could be risky. It is suggested to reduce the lot size.

Purchases: will become relevant after the appearance of reversal signals in your trading systems in the support area.

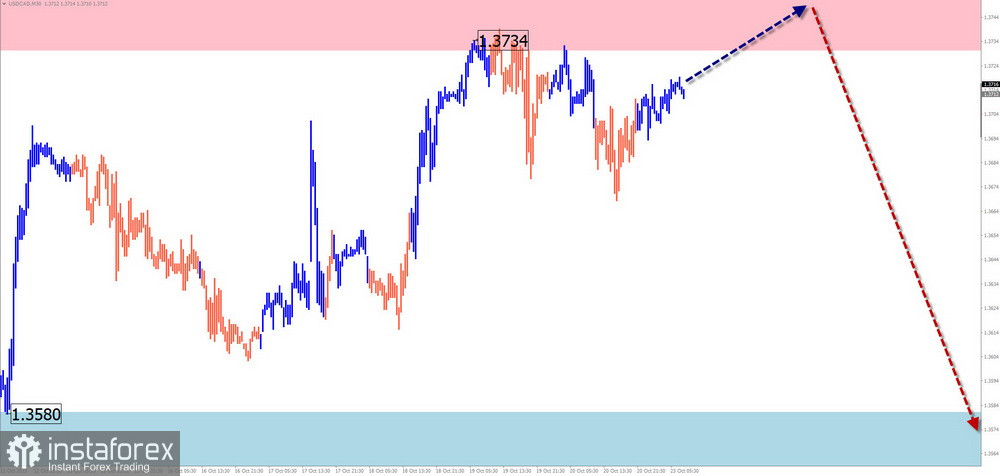

USD/CAD

Analysis:

The formation of a descending wave model in the Canadian dollar market has been ongoing since October 5. Within this wave, the price forms a correction within a sideways range. Its structure appears to be complete. However, there are no signs of an imminent reversal on the chart.

Forecast:

In the upcoming week, the current flat movement around the resistance zone is expected to come to an end. Subsequently, a reversal and resumption of price decreases can be expected. Going beyond the range marked by the opposing zones is unlikely.

Potential Reversal Zones

Resistance:

- 1.3730/1.3780

Support:

- 1.3580/1.3530

Recommendations:

Sales: May be used after the appearance of relevant signals from your trading systems in the support area.

Purchases: Due to their low potential, they are risky and could lead to deposit losses.

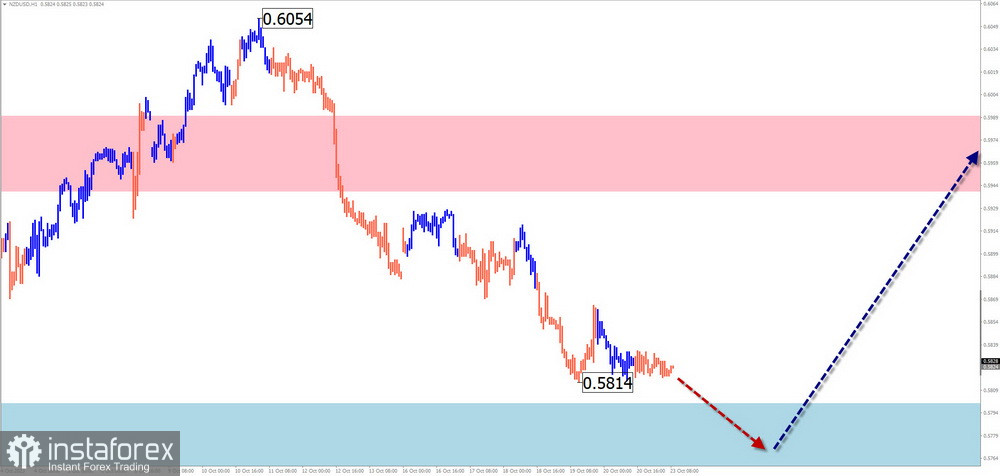

NZD/USD

Brief Analysis:

The ongoing descending trend segment of the New Zealand dollar's main pair has been underway since July 14. In its structure, from mid-August to October 10, there has been a counter correction in the form of an extended horizontal flat. The final part of wave (C) has reached strong support.

Weekly Forecast:

At the beginning of the upcoming week, pressure on the support area is expected. Subsequently, price fluctuations can be expected to transition into a sideways flat with an upward vector. Closer to the weekend, an increase in volatility and a resumption of price decreases are not excluded.

Potential Reversal Zones

Resistance:

- 0.5940/0.5990

Support:

- 0.5800/0.5750

Recommendations:

Purchases: May be used with a small lot size after the appearance of relevant signals in the resistance area.

Sales: Due to their limited potential, they are risky and could lead to deposit losses.

Gold

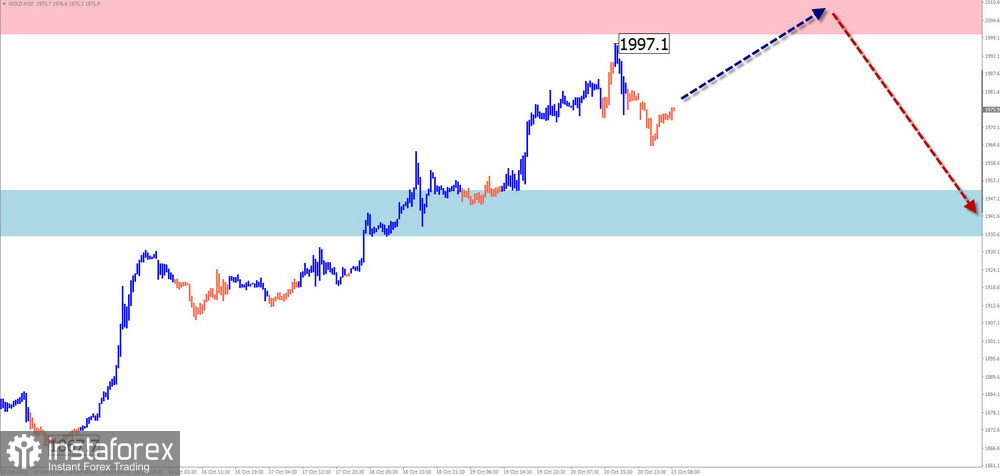

Analysis:

The six-month-long descending correction on the gold chart has concluded. The upward wave that began on October 6 has significant reversal potential. In terms of wave level, this movement already belongs to the daily time frame. Quotes have reached the lower boundary of a strong potential reversal zone.

Forecast:

At the beginning of the upcoming week, a complete price increase is expected. The most likely ending point of the rise is the calculated resistance. Subsequently, a reversal formation and transition of price fluctuations into a sideways flat with a downward vector can be expected.

Potential Reversal Zones

Resistance:

- 2000.0/2020.0

Support:

- 1950.0/1930.0

Recommendations:

Sales: Pointless until the current rise is completed and reversal signals appear.

Purchases: Have limited potential, not beyond resistance. It is advisable to minimize the trading volume in such trades.

Note: In simplified wave analysis (SWA), all waves consist of three parts (A, B, and C). On each time frame (TF), the most recent, unfinished wave is analyzed. Dotted lines represent expected movements.

Attention: The wave algorithm does not account for the duration of instrument movements over time!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română