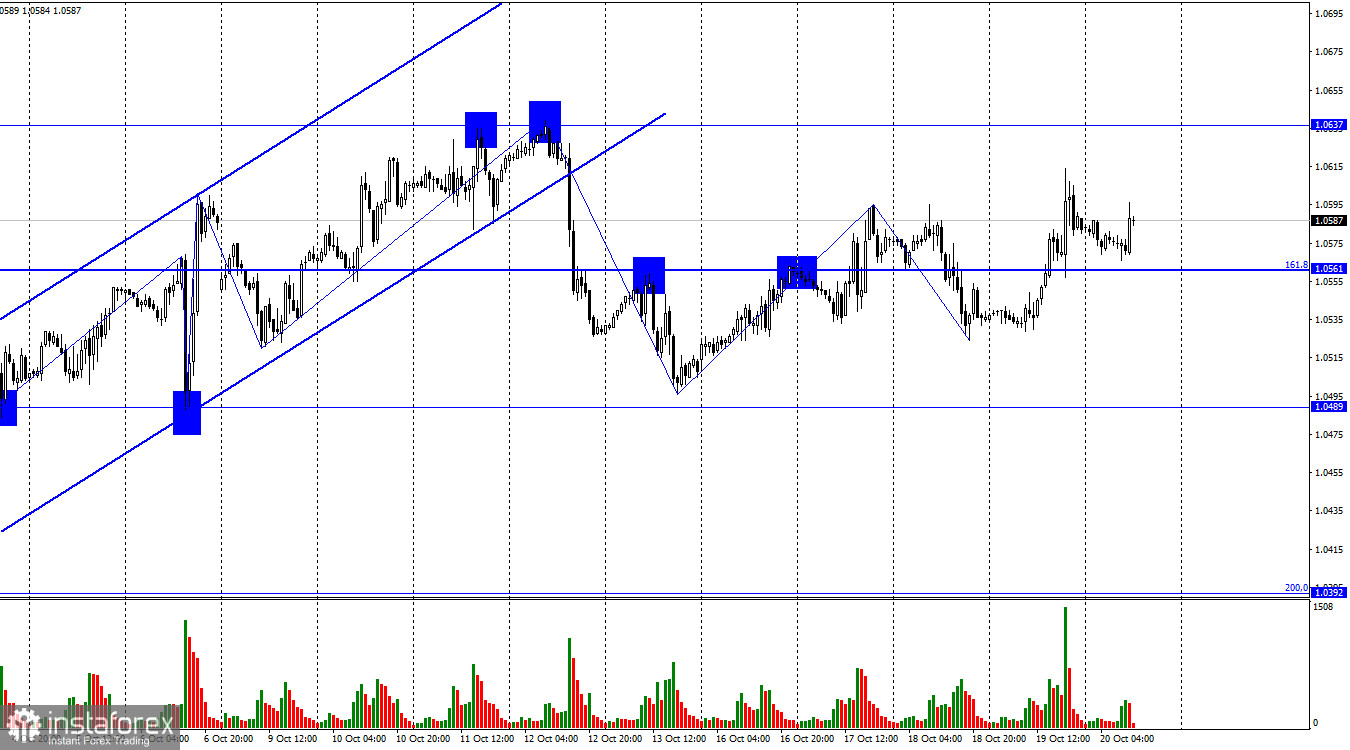

The EUR/USD pair performed a new reversal in favor of the European currency on Thursday, securing itself above the seemingly insignificant corrective level of 161.8% (1.0561). This development allows for the anticipation of further growth towards the next level at 1.0637, but using it as a signal was rather questionable. The same goes for the potential closing of the pair below 1.0561. While it would imply the possibility of a drop towards the level at 1.0489, I would not recommend using it as a selling signal.

The situation with the waves has become a bit clearer. Yesterday, a new upward wave was formed, breaking the peak of the previous wave. Thus, we are once again talking about the formation of a "bullish" trend. To establish a "bearish" trend, the pair needs to break the last low at 1.0524.

The key event of the previous day was undoubtedly the speech by FOMC President Jerome Powell. Initially, few paid attention to this speech because he and presumably the entire FOMC committee had been speaking consecutively, and the regulator's stance had been clear as day. However, Powell managed to introduce doubt into the market. While his colleagues had been speaking more about the unwarranted need for another interest rate hike, Powell stated that the Federal Reserve was not ruling out further tightening, but it would depend on economic data. He noted that the U.S. economy was still in excellent condition, preventing inflation from continuing to decrease. He referred to the summer progress in slowing inflation but deemed it unstable, saying, "The situation can change at any moment, and we must be prepared." Thus, if in recent weeks the probability of another rate hike had been confidently approaching zero, it has now begun to rise again. The dollar didn't benefit from this development, but its growth potential remains intact.

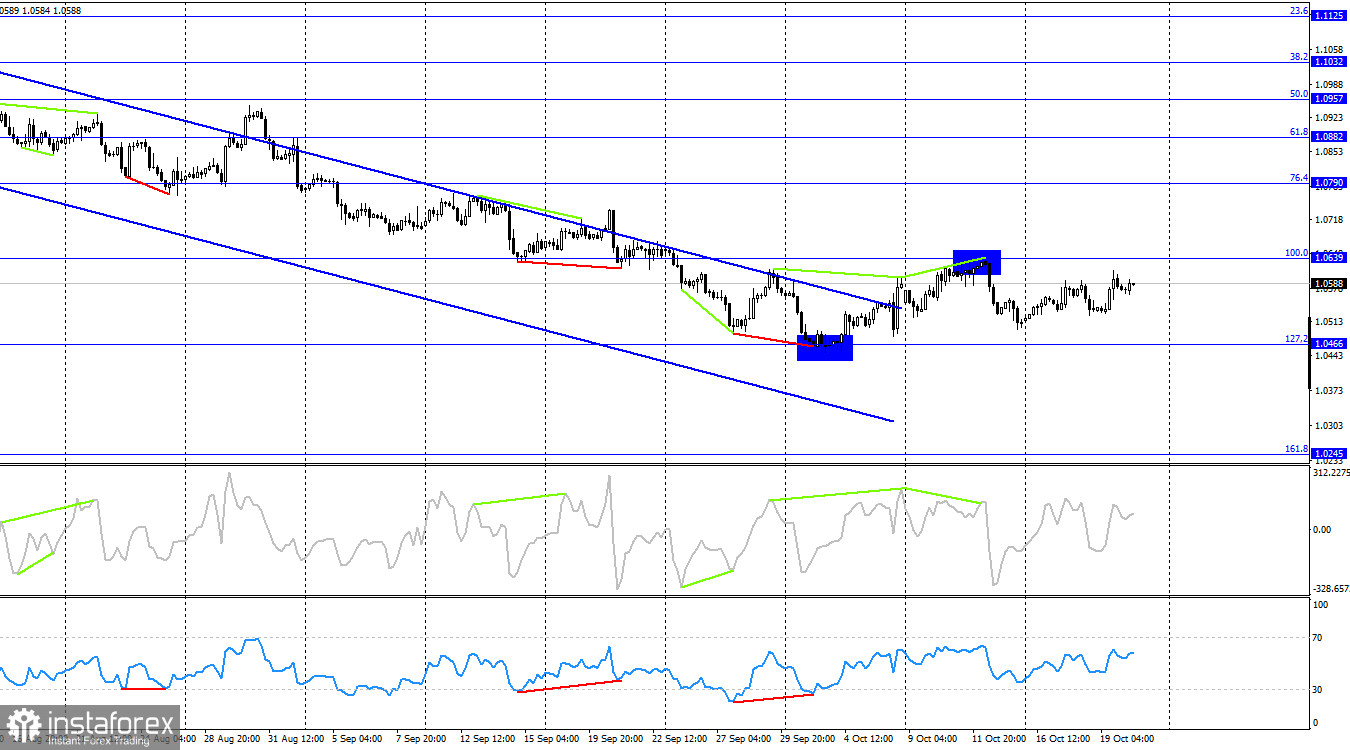

On the 4-hour chart, the pair bounced back from the 100.0% correction level at 1.0639, reversed in favor of the U.S. currency, and began a descent towards the 127.2% Fibonacci level at 1.0466 after the formation of a "bearish" divergence in the CCI indicator. The emerging "bullish" divergence was cancelled. On the hourly chart, the formation of a new "bullish" trend has begun, so the pair may return to the 1.0639 level, around which we should expect new signals.

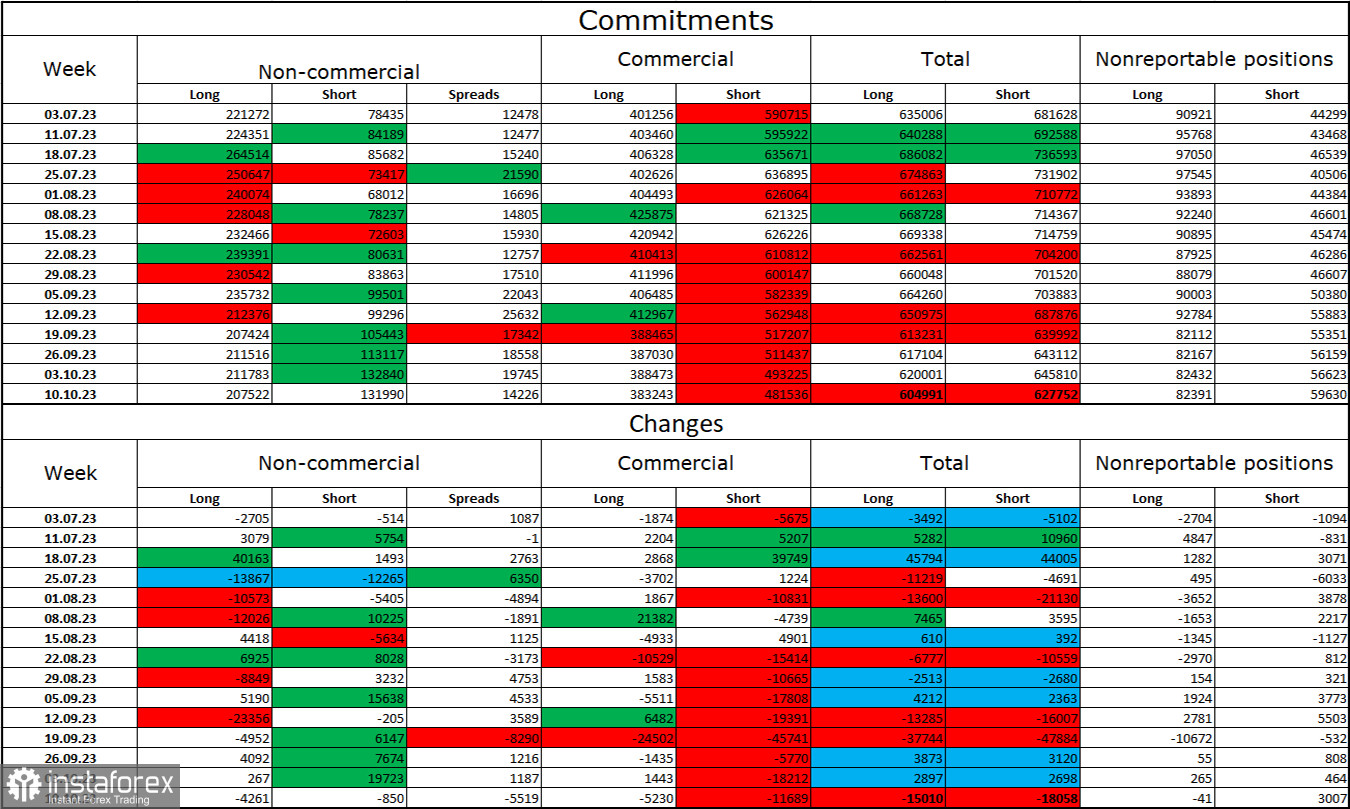

Commitments of Traders (COT) Report:

Last week, speculators closed 4,261 long contracts and 850 short contracts. The sentiment of large traders remains bullish but has noticeably weakened in recent weeks and months. The total number of long contracts held by speculators now stands at 207,000, while short contracts amount to 132,000. The difference is now less than twofold, whereas a few months ago, the gap was threefold. I believe the situation will continue to shift in favor of the bears. Bulls have dominated the market for too long, and they now need a strong information background to initiate a new bullish trend. Such a backdrop is currently absent. Professional traders may continue to close their long positions in the near future. I think the current figures suggest a further decline in the euro currency in the coming months.

Economic Calendar for the US and the European Union:

On October 20th, the economic calendar does not contain any interesting entries. The impact of the information background on traders' sentiment for the rest of the day will be absent.

Forecast for EUR/USD and Trader Recommendations:

I do not recommend either buying or selling the pair at the moment since there are no strong signals, and I do not expect them to form in the near future. Only rebounds or a close above the level of 1.0637 can be considered signals.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română