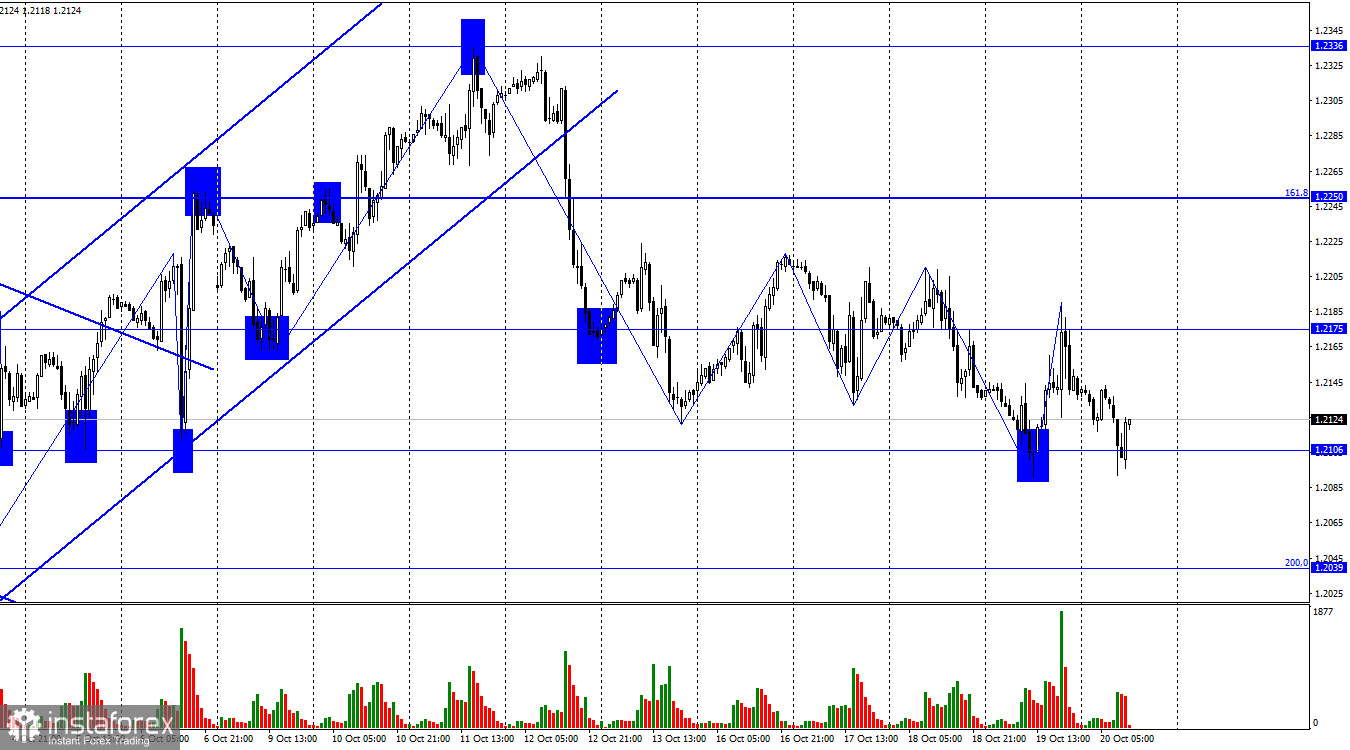

On the hourly chart, the GBP/USD pair rose to the level of 1.2175 on Thursday, bounced off it, and turned in favor of the American currency, dropping to the level of 1.2106, from which four rebounds have already occurred. Thus, the new rebound will work in favor of the British pound and a resumption of growth towards the levels of 1.2175 and 1.2210. Closing the pair's rate below the level of 1.2106 will increase the likelihood of further decline towards the next corrective level of 200.0%–1.2039.

The British pound's fall at the end of last week by 200 points led to a breakthrough of the low on October 9. Thus, we got the first sign of a shift to a "bearish" trend.

Subsequently, a series of waves followed, and many of them did not break the previous lows and peaks. However, yesterday's downward wave broke the last two lows, so now we can talk about a "bearish" trend. For me, the movement of the last few days is horizontal, and the level of 1.2106 is capable of ending the "bearish" trend.

The information background for the British pound remains rather weak. Yesterday, Jerome Powell slightly reinforced the overall rhetoric of the Federal Reserve regarding the interest rate, and this morning, a report on retail trade was released in Britain, which (it is not difficult to guess) did not support the pound. Retail trade volumes in September fell by 0.9% m/m and by 1.0% y/y. Traders were prepared for a decline, but not for a significant one. Therefore, when this report was released, the bears became active again. Despite the weak background for the pound, I believe that there will be no closures below the level of 1.2106. If I am wrong, then you should be prepared for sales, but a return to the level of 1.2175 or slightly higher is more likely. As I have already mentioned, the movement is currently more horizontal.

On the 4-hour chart, the pair bounced off the upper line of the descending trend corridor. The "bearish" divergence of the CCI indicator greatly helped it in this. A new "bullish" divergence of the CCI indicator allows us to count on a reversal and new growth towards the Fibonacci level of 50.0%–1.2289. The British pound has a rather confusing graphical picture at the moment.

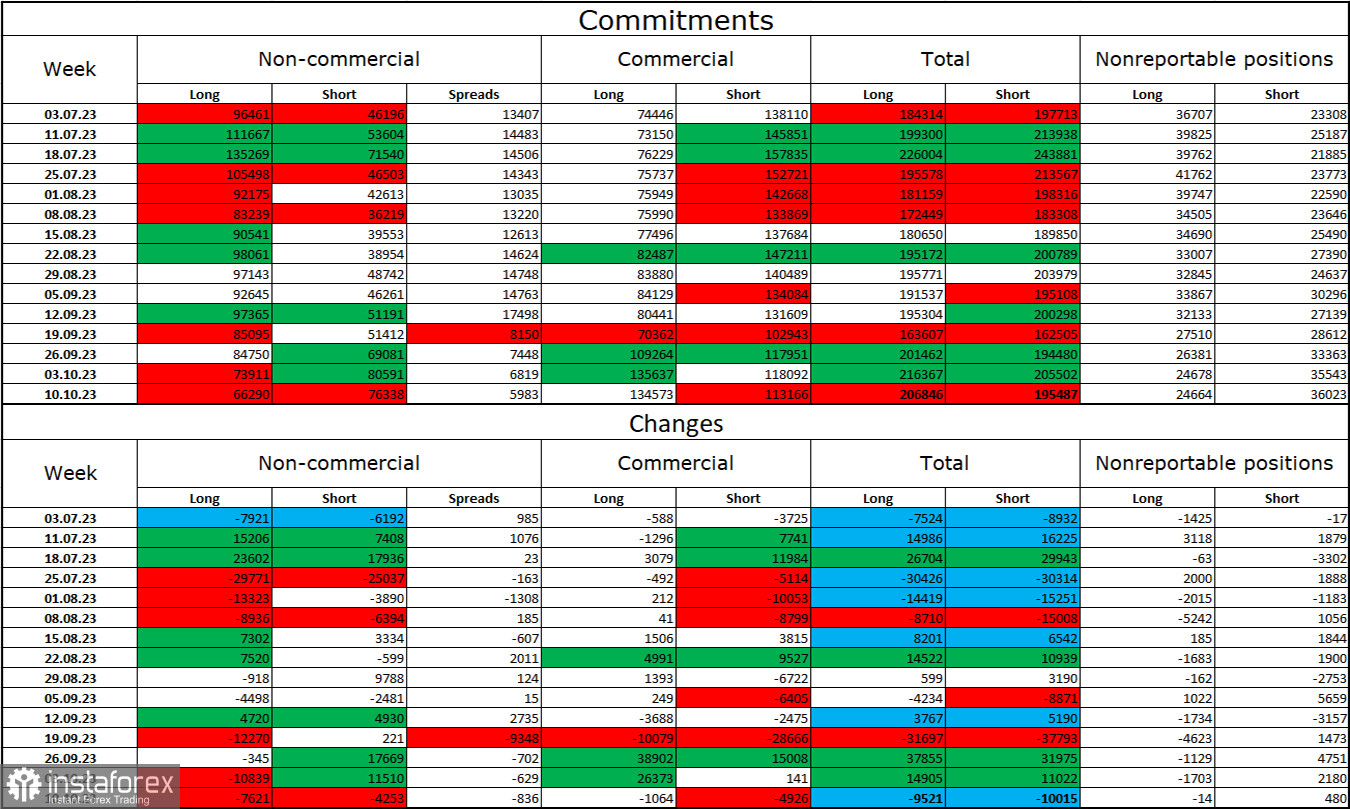

Commitments of Traders (COT) report:

The sentiment among "non-commercial" traders for the last reporting week has become more "bearish." The number of long contracts held by speculators decreased by 7,621 units, and the number of short contracts decreased by 4,253 units. The overall sentiment of major players has shifted to "bearish," and the gap between the number of long and short contracts is increasing, but now in the other direction: 66,000 versus 76,000. In my view, there are excellent prospects for the British pound to continue its decline. I do not anticipate a strong pound rally in the near future. I believe that over time, the bulls will continue to reduce their buy positions, as with the European currency. Only a close above the descending corridor on the 4-hour chart would make me consider a new "bullish" trend. I do not expect a decline in the British pound this week, but I consider it a possibility.

Economic calendar for the US and UK:

On Friday, the economic events calendar for the UK and the US was empty. The influence of the information background on market sentiment will be absent for the remaining part.

GBP/USD Forecast and Trader Recommendations:

Both selling and buying the British pound are possible when signals form around the levels of 1.2106, 1.2039, or 1.2250. The level of 1.2106 with a rebound from it appears to be the most promising. In this case, I recommend buying with a target of 1.2175. However, a close below 1.2106 can be used for selling with a target of 1.2039.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română