EUR/USD

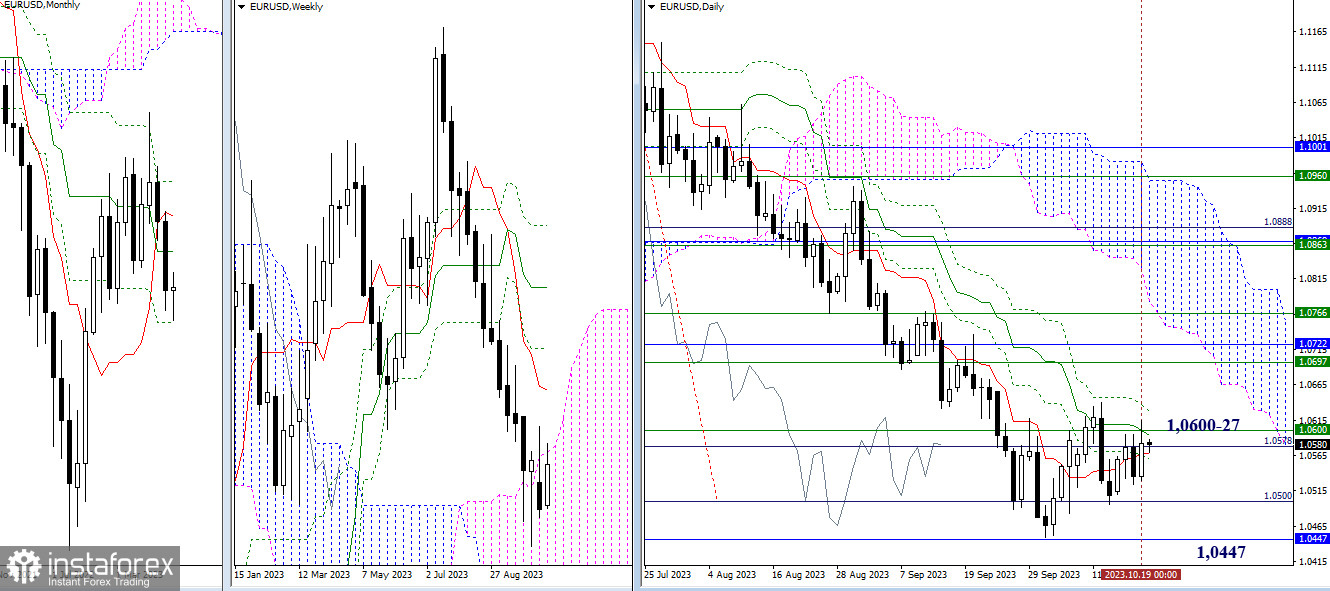

Higher Timeframes

The situation for the past day has not undergone significant changes again, but it should be noted that the levels of the daily Ichimoku cross are gradually readjusting, thereby preparing for a shift in sentiment. A breakout and the elimination of the death cross of the daily Ichimoku cloud (1.0627) and entry into the bullish zone relative to the weekly Ichimoku cloud (1.0600) will allow bulls to focus on new reference points, such as 1.0697 (weekly short-term trend) - 1.0722 (monthly medium-term trend).

Meanwhile, the task for bears has not changed today. For their future prospects, they still need to overcome the support of the daily target (1.0500) and the final level of the monthly Ichimoku cross (1.0447), thus restoring the downward trend (1.0449).

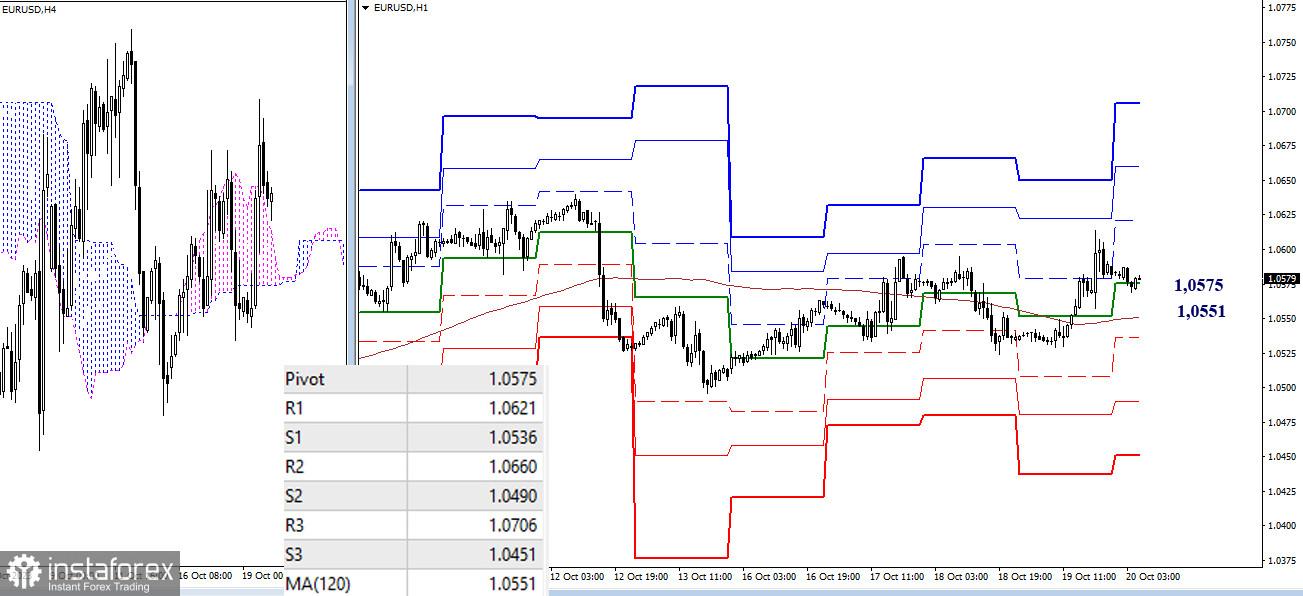

H4 - H1

The uncertainty has led bulls on the lower timeframes to regain control of key levels, which are currently located within the range of 1.0551 - 1.0575 (central pivot point of the day + weekly long-term trend). If the upward movement continues, resistance of the classic pivot points (1.0621 - 1.0660 - 1.0706) is anticipated. In case of breaking through the key levels (1.0551-75) and a strengthening of bearish sentiments, support levels of the classic pivot points (1.0536 - 1.0490 - 1.0451) will come into play.

***

GBP/USD

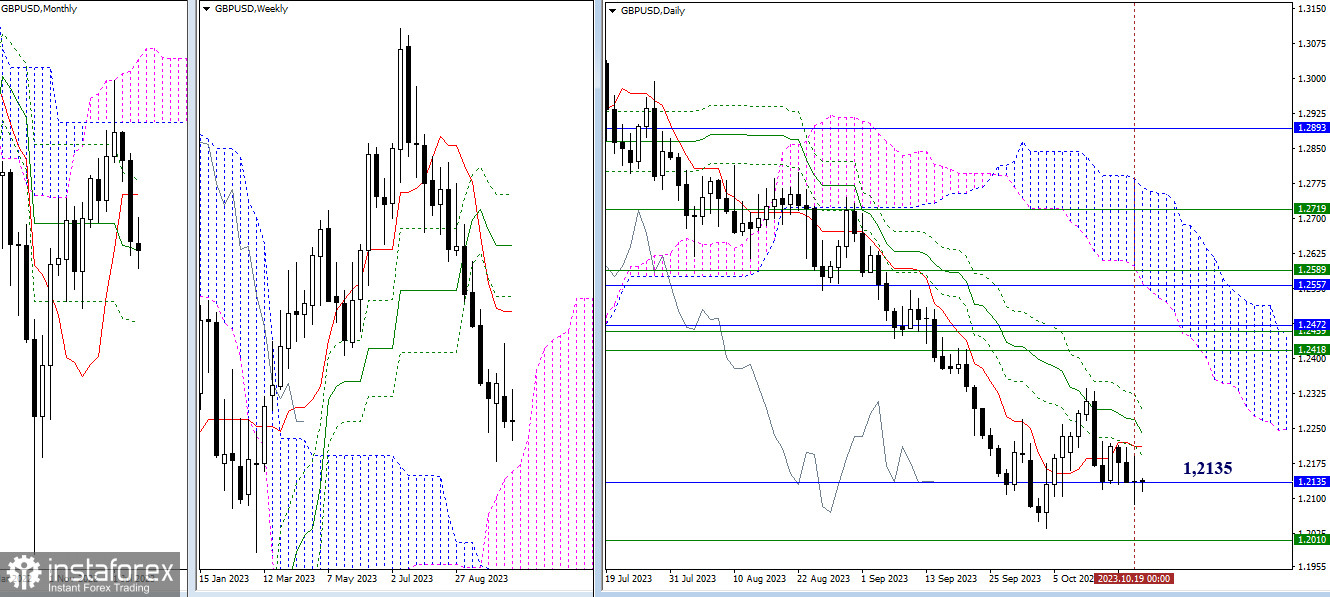

Higher Timeframes

The strength and attraction of the monthly medium-term trend (1.2135) continue to restrain the situation from developing further, maintaining uncertainty. The immediate tasks of the market have not changed. For bulls, it is important to eliminate the death cross of the daily Ichimoku cloud (1.2212 - 1.2241 - 1.2289). For bears, it is necessary to enter and establish themselves in the weekly cloud (1.2010).

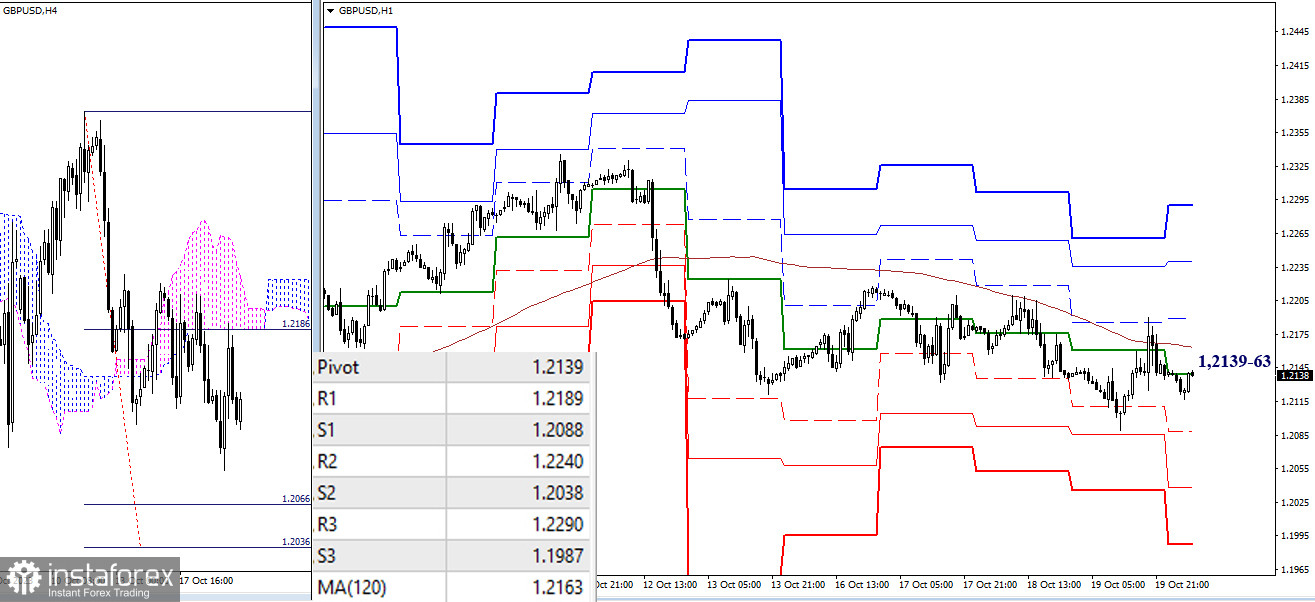

H4 - H1

Bulls' attempt to break the weekly long-term trend failed yesterday. Bears retained the upper hand on the lower timeframes. Trading below the key levels of 1.2139 - 1.2163 (central pivot point of the day + weekly long-term trend) supports the bearish advantage and may contribute to further strengthening of bearish sentiments. Within the day, it will be important for the bears to overcome the support levels of the classic pivot points (1.2288 - 1.2038 - 1.1987). A breakout and consolidation above the key levels (1.2139-63) will affect the current balance of power, laying the groundwork for subsequent strengthening of bullish sentiments and the conquest of resistance at the classic pivot points (1.2189 - 1.2240 - 1.2290).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română