Yesterday, the dollar continued to lose ground for almost the entire day. It lost as much as it did on Friday. And what's interesting is that the pound gained more than the euro. All of this happened when the economic calendar was basically empty. So we can confirm that what we are seeing now is a form of a corrective phase, and this move will likely continue today. It's not about the British fundamentals as the unemployment rate is expected to remain unchanged. The focus will be on US retail sales, which is expected to slow from 2.5% to 1.5%. In addition, industrial output, which is currently at 0.2%, is expected to turn negative at -0.8%. If recently, despite the dollar's overbought condition, US reports have been working in its favor, now things might take a different turn. In general, today's data could be the first in weeks to demonstrate a significant deterioration in the US economy.

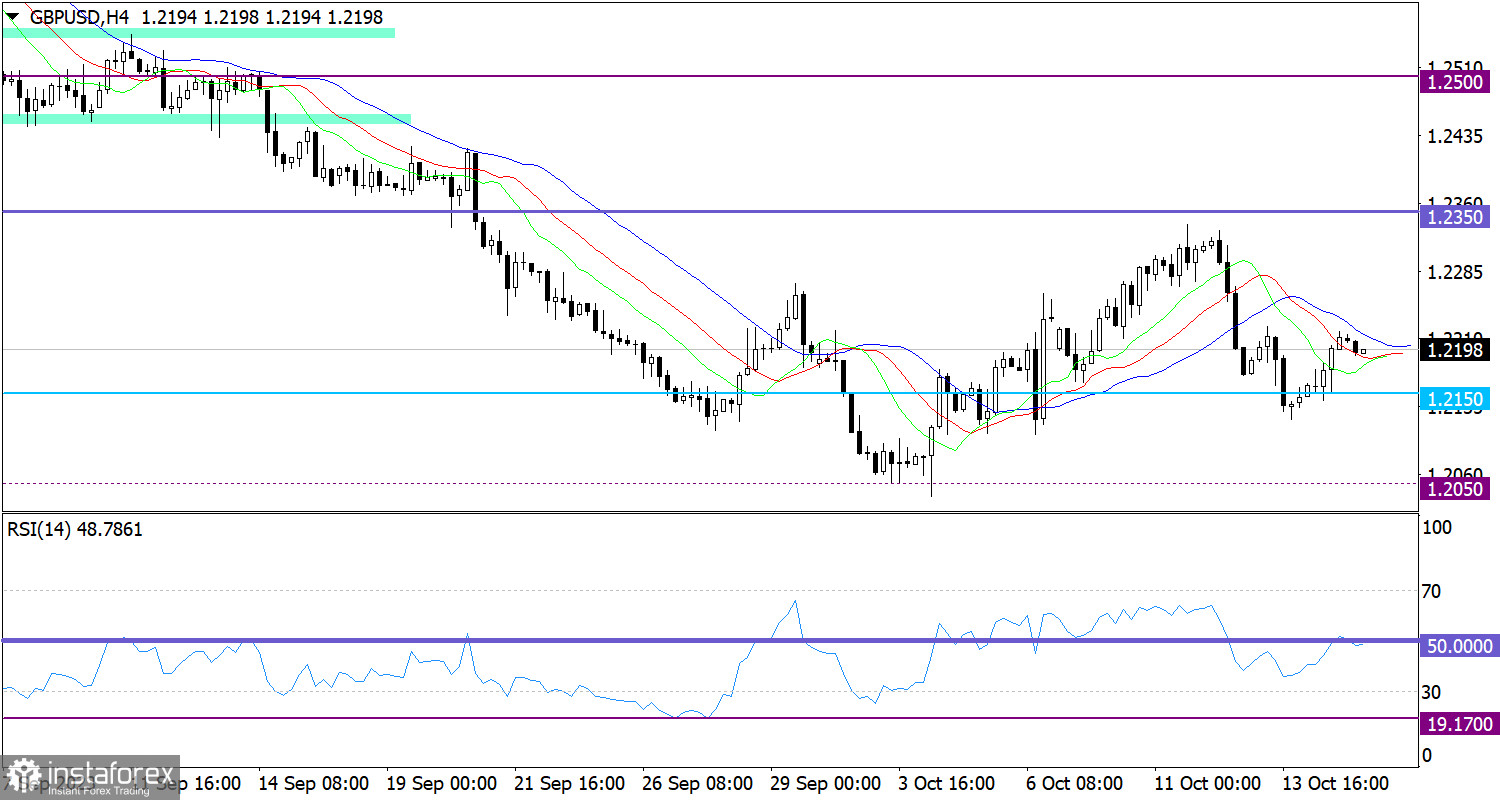

The GBP/USD pair retreated from the support level of 1.2150. As a result, the volume of long positions increased, providing bulls with the opportunity to push the price above 1.2200.

On the 4-hour chart, the RSI technical indicator shows that it has temporarily crossed the 50 mid line, indicating a corrective phase.

On the same chart, the Alligator's MAs are headed downwards, ignoring the corrective move.

Outlook

In order to rise further, the price should stay above 1.2230. In this case, the pound could rise towards 1.2300.

The bearish scenario will come into play if the current retracement slows down, leading the price back to the support level of 1.2150. In this case, this would extend the downward cycle.

Complex indicator analysis indicates a corrective phase in the short-term and intraday periods.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română