EUR/USD

Higher Timeframes

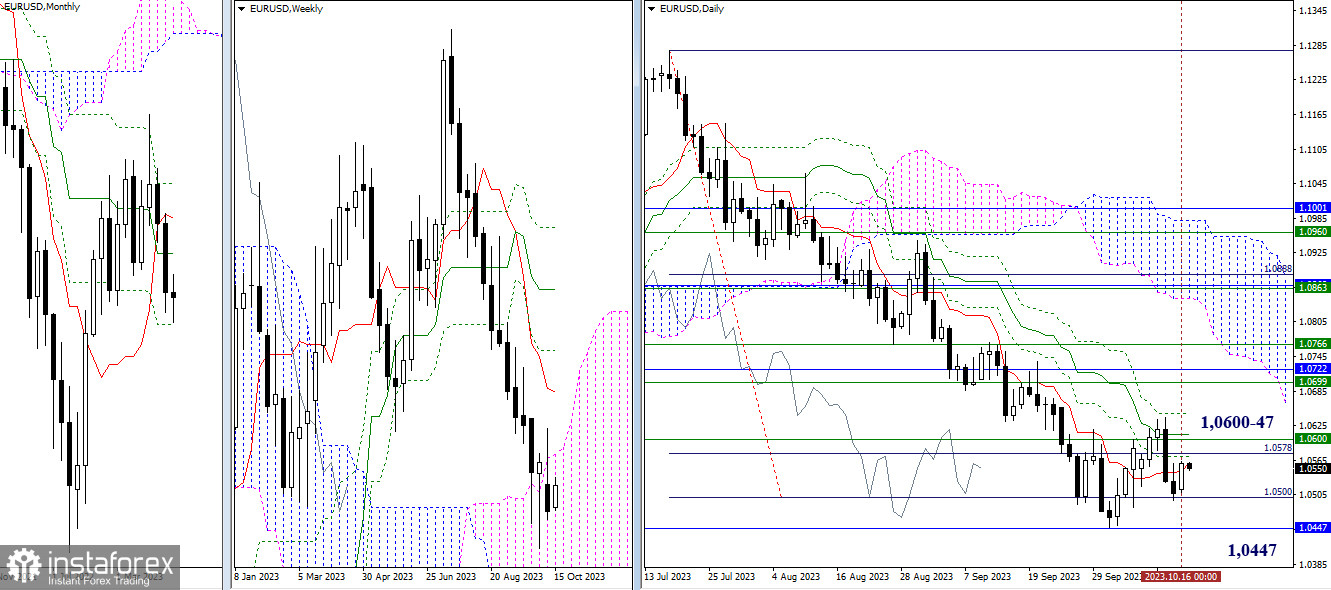

The support of the daily target (1.0500) continues to exert its attraction and influence, so daily sentiments changed direction once again yesterday. Overall, the situation remains unchanged. The conclusions and expectations voiced earlier still hold relevance. For the bullish players, it's important to eliminate the daily Ichimoku cross (1.0571 - 1.0609 - 1.0647) reinforced by the weekly short-term trend (1.0600). The bearish players' task involves re-establishing the downward trend (1.0449) and securely surpassing the monthly support (1.0447).

H4 - H1

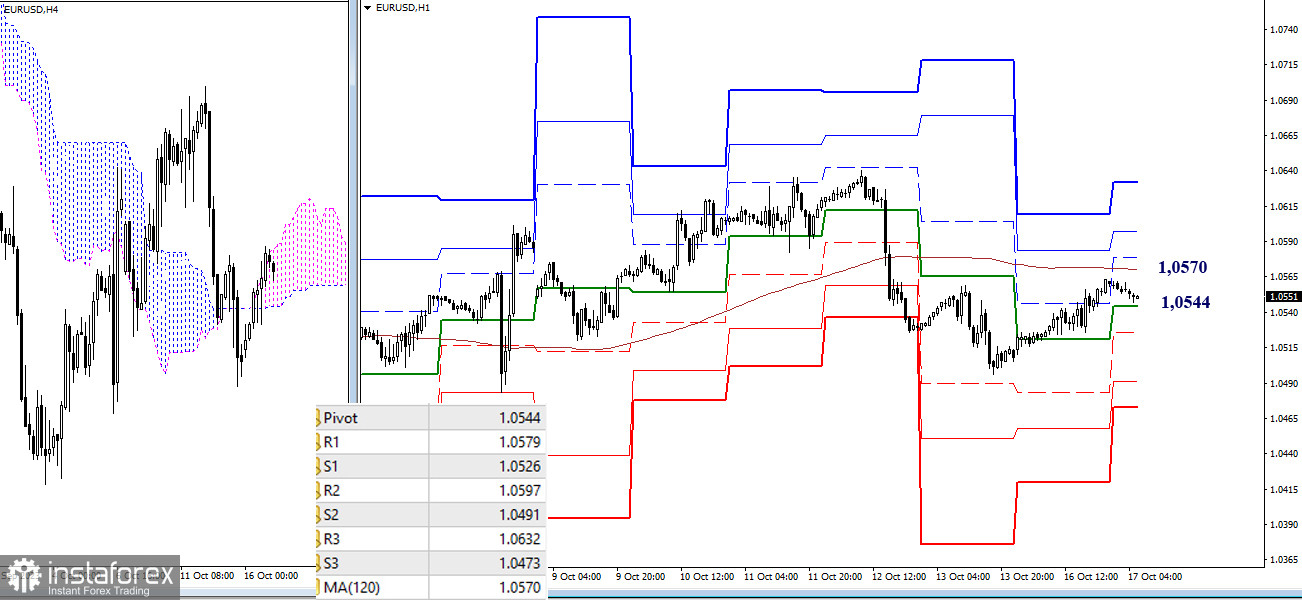

On the lower timeframes, bulls continue their ascent, having captured the central pivot point (currently at 1.0544). At the moment, they are close to commencing interaction with the main key levels of the lower timeframes—the weekly long-term trend (1.0570). A break and reversal of the moving average can change the current balance of power in favor of the bulls, with further targets within the day currently at 1.0579 - 1.0597 - 1.0632 (resistances of the classic pivot points). If the bearish players manage to maintain their current advantage, the most important target for them is to update the low (1.0496). Afterward, classic pivot points S2 (1.0491) and S3 (1.0473) can provide support.

***

GBP/USD

Higher Timeframes

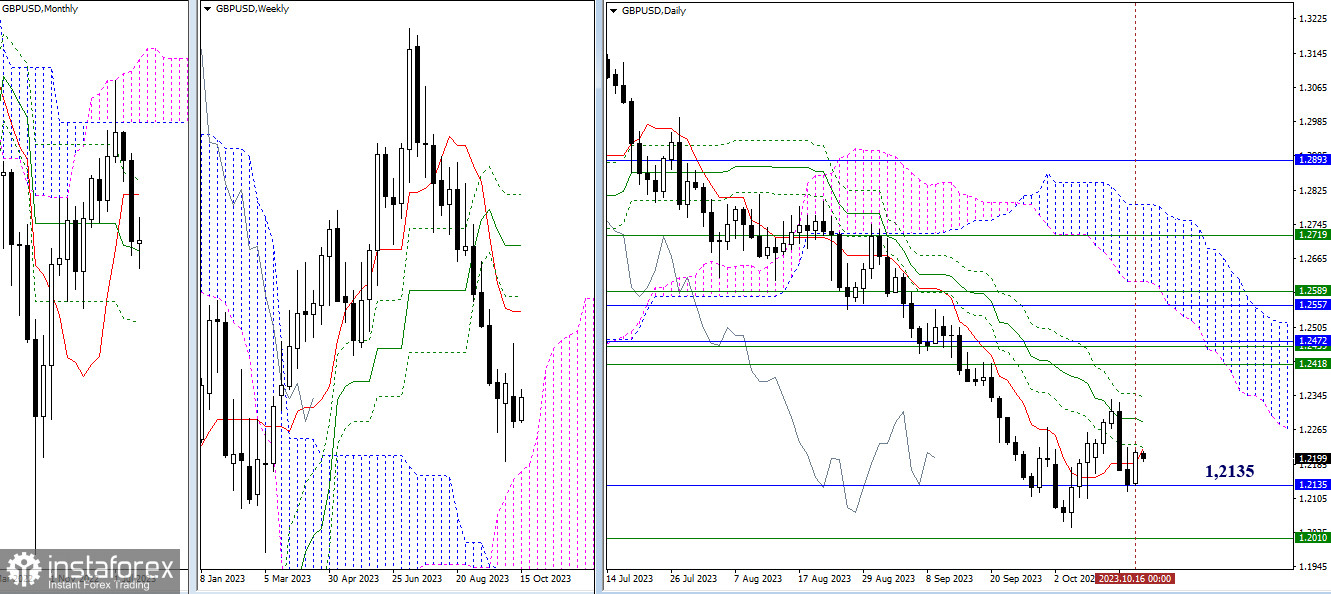

The support of the monthly medium-term trend (1.2135) has once again proven its effectiveness, but this hasn't changed the global situation. Other benchmarks have retained their significance and positions. For bulls, the top priority is to eliminate the death cross of the daily Ichimoku cloud (1.2283 - 1.2341). Only after this can they focus on the resistance zone at 1.2418 - 1.2472, which combines the weekly levels and the monthly short-term trend. For the bears, it's important to move out of the influence zone of the monthly medium-term trend (1.2135), reestablish the downward trend (1.2036), and solidify their position in the weekly cloud (1.2010).

H4 - H1

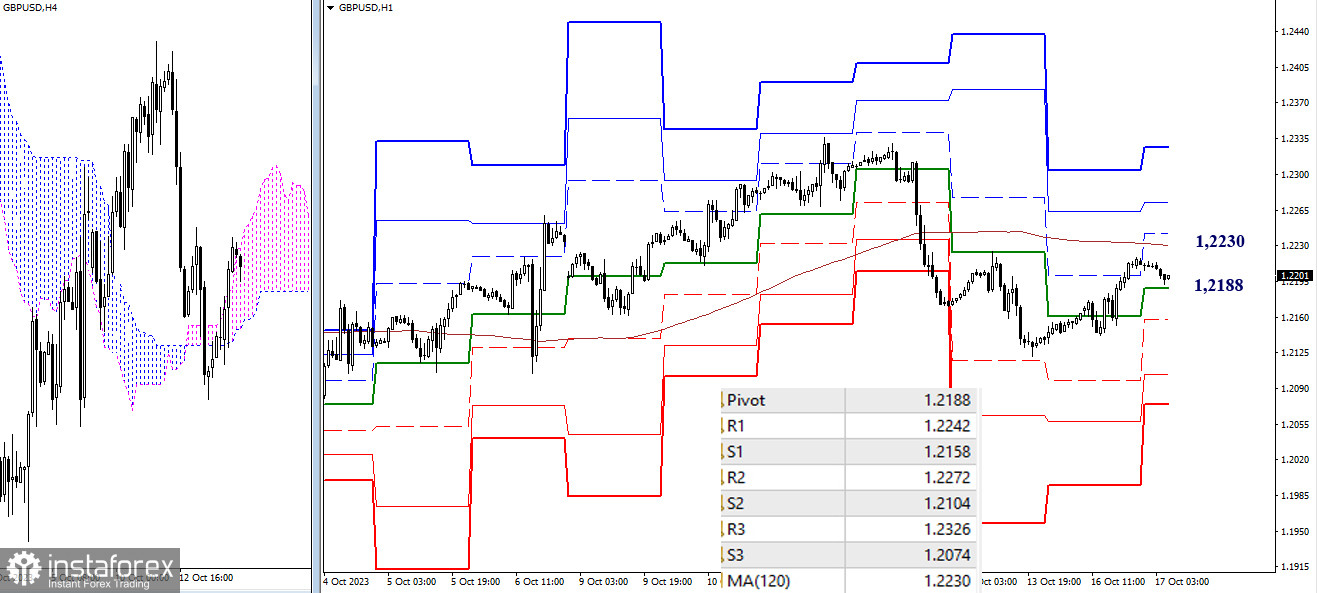

On the lower timeframes, the market continues to operate below the weekly long-term trend (1.2230). A breakout and secure consolidation above it can affect the current balance of power. In this case, for the bullish players, the resistance levels of classic pivot points (1.2242 - 1.2272 - 1.2326) will become reference points within the day. If the bullish players' failure brings competitors back into the market, the bearish focus on the lower timeframes will be on passing the existing supports 1.2188 - 1.2158 - 1.2104 - 1.2074 (classic pivot points).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română