Both instruments were relatively muted on Monday. The euro and the pound started a new upward movement, presumably as part of the third wave within wave 2 or b. I previously mentioned that wave 2 or b should be a three-wave structure because the first wave was extended for both instruments. Therefore, the price increase at the beginning of the week was expected. If it hadn't happened today, it would have occurred tomorrow. Moreover, there was no significant news. Therefore, I conclude that positive news is not necessary for building the corrective waves for the euro and the pound.

Over the weekend, European Central Bank President Christine Lagarde delivered a speech. As I previously mentioned, Lagarde did not say anything that was particularly important. The members of the ECB Governing Council have not been providing any interesting or critical information for the markets. This is easily explained by the fact that the ECB has generally completed the process of tightening monetary policy and does not intend to ease it in the near future. Consequently, the market does not expect any changes either, so what can de Guindos, Lagarde, and others report in such a case?

Lagarde mentioned wages and inflation with no significant consequences, so to speak. She noted that the pace of wage growth remains too high, and core inflation is far from the target. At the same time, the EU labor market shows no signs of weakening, but the European economy may slow down even further as the global economy could weaken due to new geopolitical conflicts. Economic growth could be stronger if consumer confidence rises due to a stronger labor market, income growth, and reduced uncertainty. Regarding monetary policy, the ECB plans to maintain a cautious approach.

Based on everything, it will be very difficult for the euro to find support until a downtrend is fully developed. I believe that the news background will not affect the framework of the corrective wave 2 or b. It won't impact the next, third wave either.

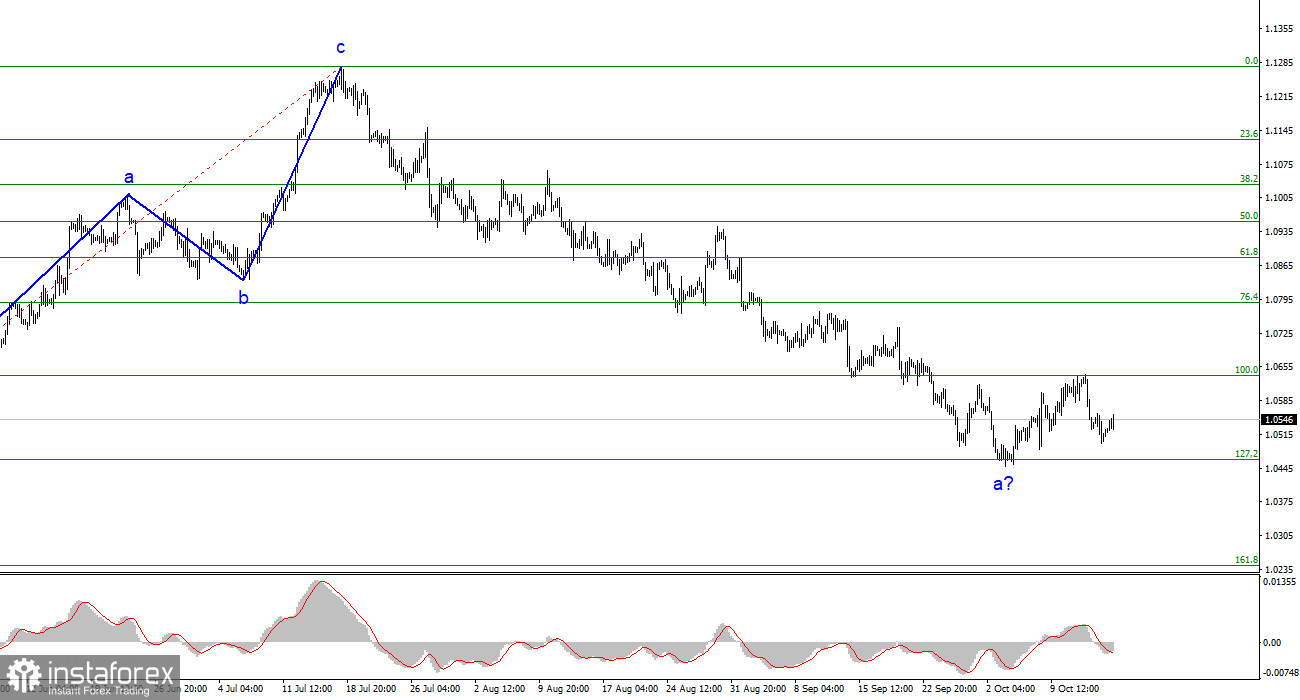

Based on the analysis conducted, I conclude that a bearish wave is currently being built. The targets around the 1.0463 level have been achieved, and the fact that the market has yet to breach this mark indicates that it is prepared to build a corrective wave. In my recent reviews, I warned you that it would be wise to consider closing short positions because there is currently a high probability of constructing an upward wave. The unsuccessful attempt to break the 1.0637 level, corresponding to the 100.0% Fibonacci, indicates the market's readiness to resume the decline, but I believe that wave 2 or b will be a three-wave structure.

The wave pattern of the GBP/USD instrument suggests a decline within a new downtrend segment. The most that the British pound can hope for in the near future is the construction of wave 2 or b. However, as we can see, even with the corrective wave, significant challenges are currently emerging. I wouldn't recommend opening new shorts at this time, but I also don't advise buying because the corrective wave may turn out to be relatively weak.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română