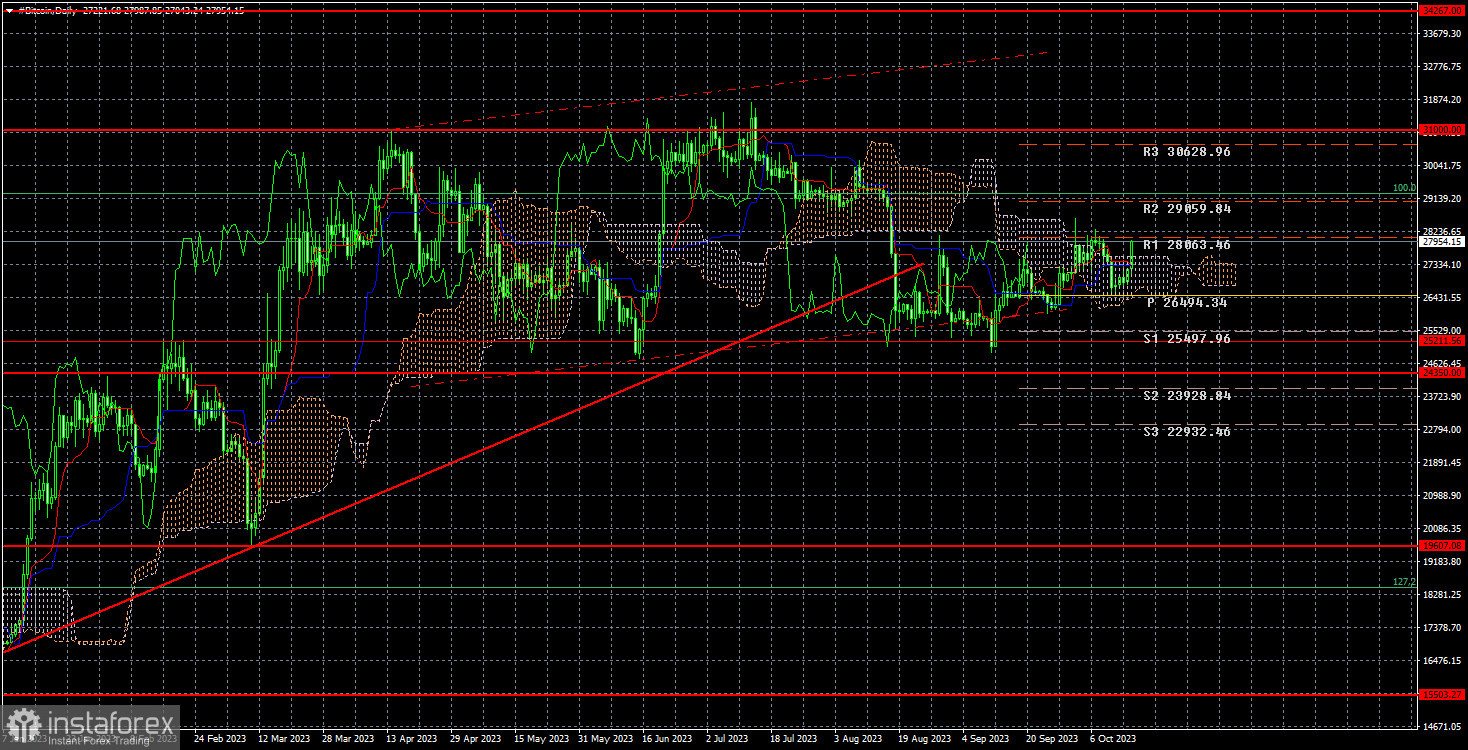

Flagship cryptocurrency Bitcoin began a new bearish sequence, aiming to hit $24,350 – $25,211. We assumed that the cryptocurrency could rise to the Senkou Span B line on a 24-hour timeframe and this actually happened. The first rebound from the indicated area encouraged a rally by $5,000 within just a few days. A second bounce from this area resulted in a $2,500 gain within 19 days. We believe that such a dynamic allows us to suppose that the correctional scenario will continue. Moreover, the digital asset failed to overcome the Ichimoku cloud. Today, Bitcoin rose in price by $800 within a couple of hours. But what is $800 for the number one cryptocurrency in the world? This move mean a minor growth. Market noise, nothing more.

While the whole world awaits a new rally and predicts Bitcoin's further recognition as a global currency, analytics company Glassnode said that about 10.5 million Bitcoin tokens have not moved anywhere for 5 years. It means that more than half of the Bitcoin coins simply lie in the wallets of hodlers or are irretrievably lost. Imagine, for example, that half the supply of the US dollar lies under the cushions of a few millionaires and billionaires and does not take any part in the economy. Also imagine this: billionaires continue to accumulate dollars under their pillows, and there is less and less currency in circulation. What will happen? It starts to rise in price. Other currencies can grow in the same way. It turns out that the supply is so small, and the amount of money withdrawn is so large that there is simply not enough for daily payments.

Naturally, in such a situation, the central bank will step in and print more money. Many Bitcoin fans consider this accommodative monetary policy to display a huge disadvantage of fiat money. However, in this case, the central bank ensures the stability of the currency and makes sure that it is enough for all participants in the economy. What's wrong with that? And what will perform similar functions in the case of Bitcoin? Nothing. Hodlers and institutional investors can continue to buy and withdraw coins from circulation, pursuing one single goal: to provoke an even greater growth of Bitcoin. There is no question of being a substitute for money.

On the 24-hour timeframe, Bitcoin rebounded from the level of $25,211 and tested the Senkou Span B line. Since a dip followed from this line, it was possible to sell the cryptocurrency with a target of $24,350-25,211. Further selling will be possible if the price passes this area, hitting a target of $19,607. It will be possible to think about buying when there is a dip from the area of $24,350-25,211, but this will be the third drip, which may be even weaker than the second. We believe that the correction scenario remains, and Bitcoin will fall even lower until the end of 2023.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română