Bitcoin ended the previous working week on a bearish note, breaking below the key support level of $27,000. This move weakened the local upward trend that had been forming since mid-September. The new trading week began with a strong upward surge, allowing BTC to reach $27,900 momentarily and eventually stabilize near $27,700.

Despite the confident rise, cryptocurrency prices remained below the $27,000 level for several days, thus weakening this support zone. However, there is a growing bullish sentiment in the crypto market, so a full attempt to establish a position above the $28,000 level can be expected. Such a sharp upward movement in BTC/USD may provide a platform for the cryptocurrency to firmly establish itself above $28,000. However, it is important to consider whether the cryptocurrency has enough incentives to break through the psychological resistance zone.

Fundamental Factors

An important factor that could have contributed to Bitcoin's recovery, even during the Asian session, was the de-escalation of the situation in the Middle East. Israel announced the postponement of a military operation due to weather conditions. Considering that investors were preparing for an escalation of the conflict with the potential involvement of the United States, this news served as a sharp positive reason to increase positions in high-risk assets.

In addition, oil and precious metals began to correct as significant selling began. It's worth noting the situation with oil, where a potential crisis due to an energy resource deficit is also being postponed. This, in turn, has a positive effect on the dollar's deflationary movement, thus contributing to the strengthening of high-risk assets such as Bitcoin.

Another reason for optimism was the financial report from JPMorgan Chase. Contrary to expectations of around $3.93 billion, the bank ended the third quarter with a profit of over $4.33 billion. Considering Bitcoin's positive correlation with the stock market, the successes of the first U.S. company reports could have a positive impact on the price movement of the leading cryptocurrency.

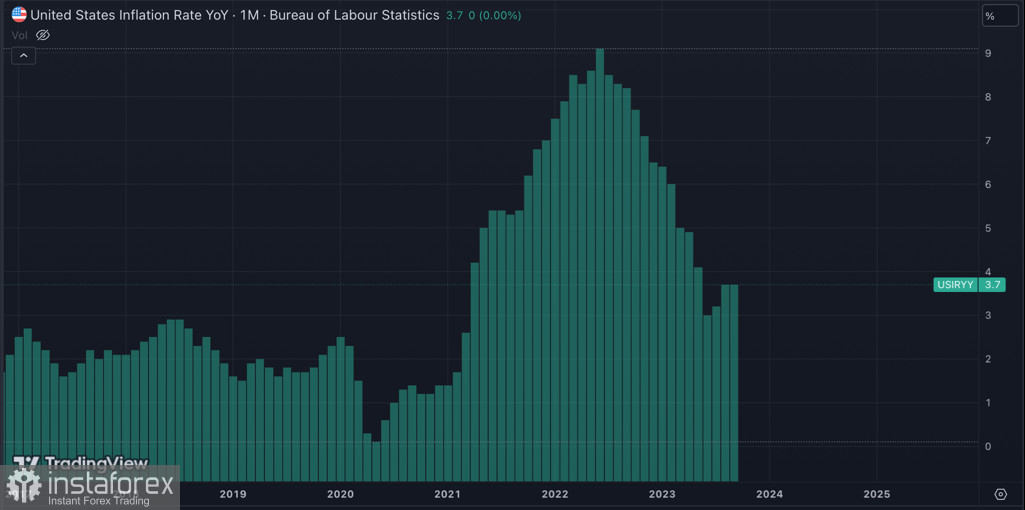

However, inflation remains a concern for investors, as does the Federal Reserve's policy, and Bitcoin's upward periods are directly related to the situation surrounding the U.S. dollar. This situation will persist until the Federal Reserve begins to ease monetary policy. In the meantime, the yield on U.S. 10-year bonds has jumped by 10 basis points to 4.66% after the release of U.S. inflation data. Therefore, the situation remains tense, and Bitcoin maintains a reverse correlation with the U.S. dollar index.

Will Bitcoin Conquer $28k?

As of the beginning of the new trading week on October 16, Bitcoin has resumed its upward movement, reaching the level of $27.9k and subsequently pulling back to $27.7k. Trading volumes have increased from $5 billion over the weekend to $13 billion. However, Bitcoin failed to retest $28k, and sellers are gradually taking the initiative.

On the 1D chart, we can see the stochastic oscillator exiting the oversold zone, followed by a strong and swift rise. The MACD is also reporting a gradual decline in bearish volumes and is preparing for a bullish crossover above the zero mark. It can be said with confidence that technical metrics indicate the likelihood of a resumption of the upward movement towards $28k.

At the same time, the new four-hour candle shows the activation of sellers, which is also evident from the growing shadow on the 1D chart. On the 4H chart, the stochastic oscillator has also moved out of the overbought zone, indicating the completion of the bullish impulse. However, there is still buyer activity on the same timeframe. In this case, the likely outcome will be price consolidation for BTC near the $27k level, followed by further upward movement.

Conclusion

Bitcoin is starting the trading week energetically, recovering above $27.5k amid positive news and expectations. After a brief consolidation, Bitcoin may continue its upward movement, but buyers need to maintain the $27.5k level. In the event of a deeper correction, Bitcoin needs to hold the $26.8k–$27.1k range to have a chance to resume the move towards $28k. The stabilization of the global situation and a positive start to the "earnings season" in the United States may allow Bitcoin to achieve its short-term target of $28k.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română