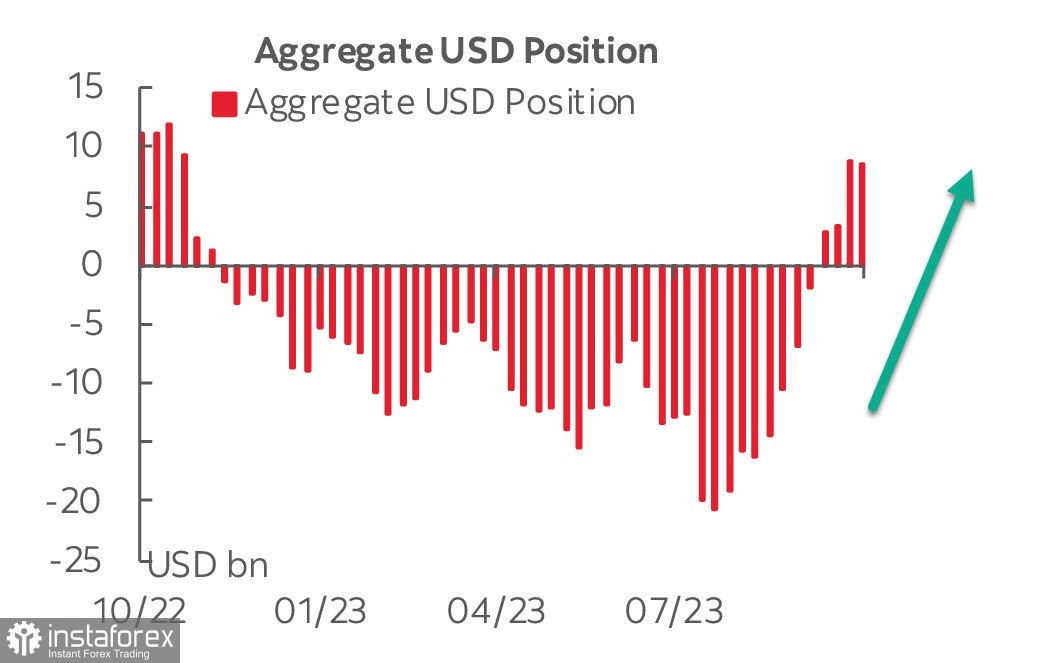

According to the latest CFTC report, the past week was relatively calm in the futures market. One notable change was the value of the net short yen by position, which corrected by 1.2 billion, while changes in other currencies were minimal. The US dollar's net positioning, after sharply rising the previous week, saw a 0.3 billion correction, bringing it to 8.5 billion, indicating a firm speculative positioning for the dollar.

Other factors that supported the greenback are the drop in the number of long positions in oil and especially gold, with a weekly change of -4.8 billion, implying further declines. This often signifies growing bullish sentiment for the US dollar.

The University of Michigan's Consumer Sentiment Index fell to 63.0 in October, the reading was below the forecast of 67.2, reaching the lowest level since May. This marks the third consecutive decline and can be largely attributed to rising gas prices and a decline in the stock market. However, consumer spending remains at a good level despite weaker sentiment in recent months.

China's consumer price index remained flat from a year earlier in September, while the Producer Price Index fell by 2.5% as concerns linger about weak demand. Both figures were slightly below consensus estimates. This week's data on industrial production, retail sales, and third-quarter GDP will provide a clearer picture of the impact of the government's additional stimulus measures.

The conflict between Israel and Hamas has quickly escalated into the bloodiest clash in the past 50 years from both sides. As both Israel and Iran are minor natural gas exporters, European natural gas prices rose by about 40% last week. Oil markets remain calmer due to reduced demand and excess production capacity.

US consumer price inflation for September shows headline prices rose 0.4% month-on-month (consensus 0.3%), and the core index slowed down from 4.3% year-on-year to 4.1% year-on-year, which is a positive sign for the Federal Reserve. There is growing confidence that the Fed's rate hike cycle is coming to an end.

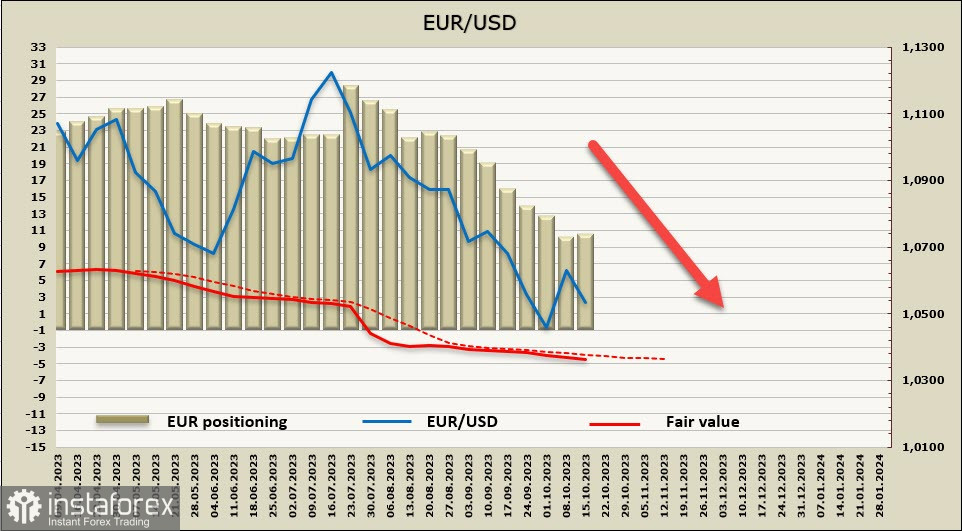

EUR/USD

Industrial production in the 20 countries sharing the euro rose by 0.6% month-on-month in August, after a -1.1% decline in July, for a 5.1% year-on-year decline, well below the forecast of -3.5%.

On Tuesday, the ZEW Economic Sentiment Index for Germany and the eurozone will be published. On Wednesday, European Central Bank President Christine Lagarde will comment on the state of the eurozone economy and the central bank's outlook for the future, which will draw attention ahead of a quiet week and may fuel volatility.

The net long EUR position has remained almost unchanged over the reporting week, with a bullish bias of 10 billion. However, the dynamics are clearly not in favor of the euro. The price is below the long-term average and continues to decline.

Nothing has changed for the euro, and the long-term trend is bearish. Any potential bullish retracements should only be considered as corrective movements. EUR/USD corrected towards the upper band of the bearish channel but failed to surpass it, which is not surprising. Afterward, bearish pressure resumed. The pair is expected to fall, with the nearest support level at the October 3rd low of 1.0445, followed by 1.0405. There are no significant resistance levels below this support, and in case of a break below, the euro could even fall to 1.0200.

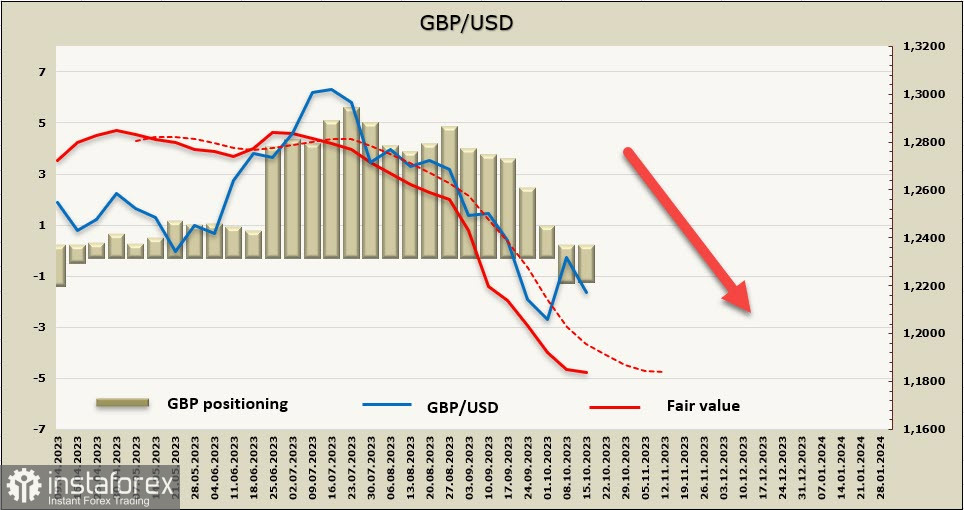

GBP/USD

The UK's GDP growth is slowing down, and NIESR expects a 0.1% decrease in the third quarter, but the UK economy is expected to avoid a recession this year.

The UK will update its labor market data on Tuesday. Employment levels have decreased over the past two months, so it is expected that the September data will continue this trend. On the same day, the employment level for August will be updated along with the wage data, which has grown by over 8% in annual terms.

On Wednesday, the UK will release inflation data for September, with the consumer price index. The core index is expected to decrease but remain at a very high level of 6% on an annual basis.

The net short GBP position increased by 0.3 billion to -0.8 billion over the reporting week. The GBP positioning is bearish, and the price is well below the long-term average, indicating a downward direction, which implies that the currency will fall further.

The British pound corrected slightly above the resistance level at 1.2305 and then resumed its decline. It is assumed that the local peak has been formed, and the sell-off will continue, with the nearest target being 1.2033 (the low from October 4). In case it breaks below this level, selling pressure may intensify, with the long-term target being 1.1740/90.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română