In the latest weekly gold market overview regarding its prospects for the week, market analysts and retail investors have arrived at an almost identical bullish consensus.

John Weyer, Director of the Commercial Hedge Division at Walsh Trading, believes that all events in Israel is "a little bit of a risk-off safe-haven play," so prices will likely fluctuate this week and then continue to rise.

Colin Cieszynski, chief market strategist at SIA Wealth Management, shares a positive view as well. He notes that, at the moment, U.S. Treasury bond yields and the U.S. dollar have paused, so attention will be on corporate earnings, which could further fuel the rise of the precious metal.

James Stanley, senior market strategist at Forex.com, believes that the precious metal will strengthen this week.

According to Everett Millman, Chief Market Analyst at Gainesville Coins, several factors contributed to outstanding results for gold last week. He'll be monitoring the range from $1900 to $1950 per ounce.

And Adrian Day, President of Adrian Day Asset Management, said gold prices will remain unchanged this week after a significant rise last week. From his perspective, the geopolitical rally in the precious metal won't last long, although it will depend on the tension in the Middle East. However, the long-term perspective is more dependent on monetary policy.

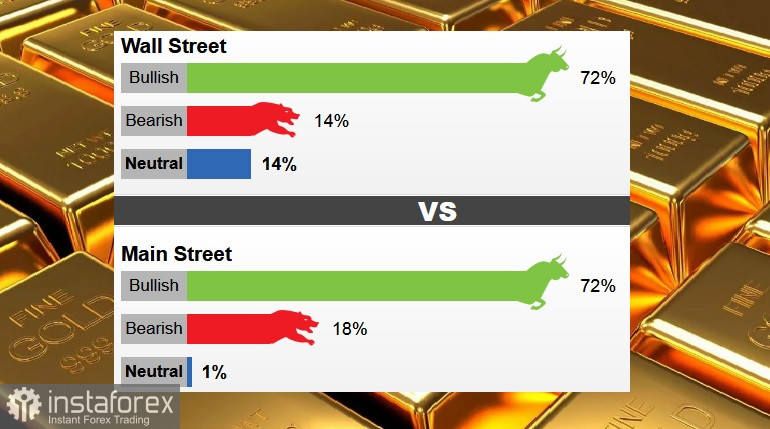

14 Wall Street analysts participated in the survey. Ten of them, or 72%, expect gold prices to rise. Two analysts, or 14%, anticipate a price decline, while the remaining two were neutral.

In an online poll, 595 votes were cast. Of these, 431 retail investors, or 72%, expect prices to rise. Another 106, or 18%, believe that prices will fall, and only 58 respondents, or less than 1%, were neutral.

According to the latest survey of retail investors, the price for the week will trade around $1902 per ounce, which is $60 higher than last week's forecast but also $28 lower than the current spot price.

The current week will be relatively calm in terms of data. The most significant report will be published on Tuesday, which will be the U.S. retail sales data for September. Economists have also warned that due to weak consumption, it will be more challenging for the central bank to raise interest rates in November.

Other notable events include surveys from the Federal Reserve Bank of New York (Empire State) and Philadelphia, as well as Federal Reserve Chairman Jerome Powell's speech on Thursday.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română