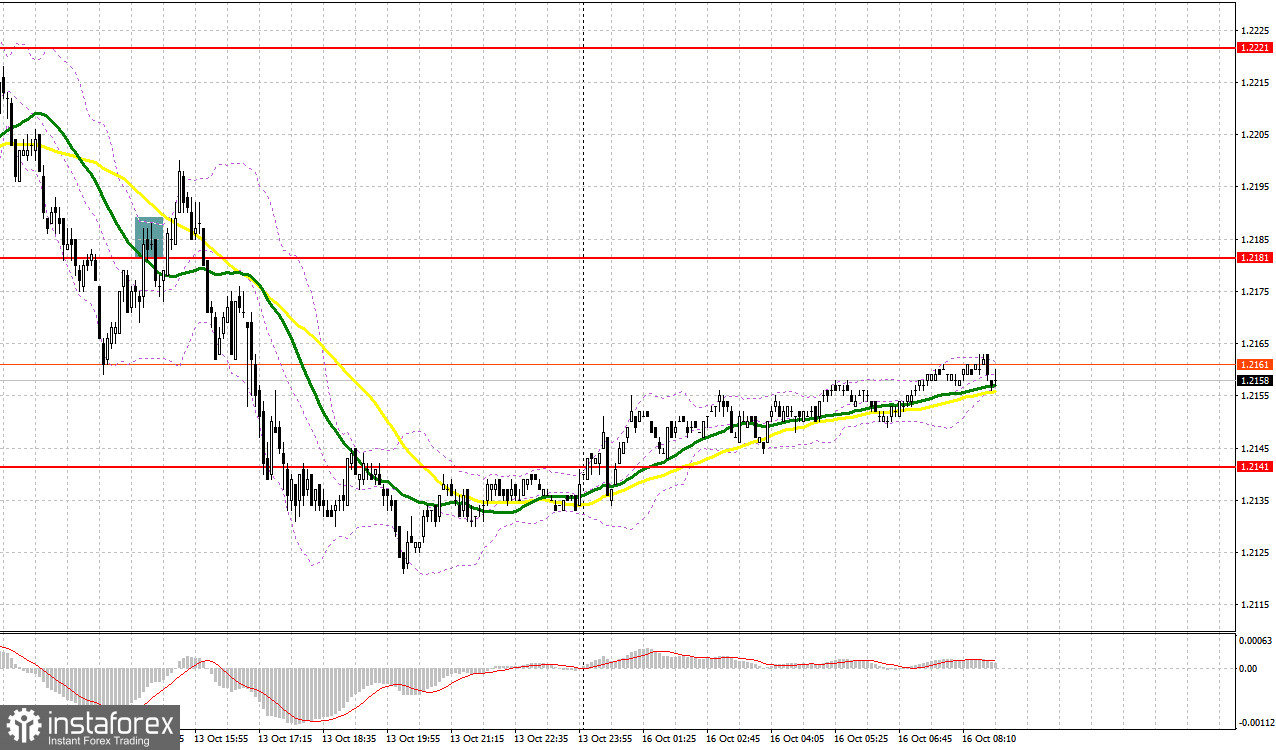

Last Friday, the pair formed several entry signals. Let's see what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.2224 as a possible entry point. A rise and a false breakout at this mark produced a sell signal, sending the pair down to the support level at 1.2172, making it possible to take 50 pips of profit. In the afternoon, defending the 1.2181 level and a false breakout at this mark produced another sell signal, and GBP/USD fell to the 1.2141 area.

For long positions on GBP/USD:

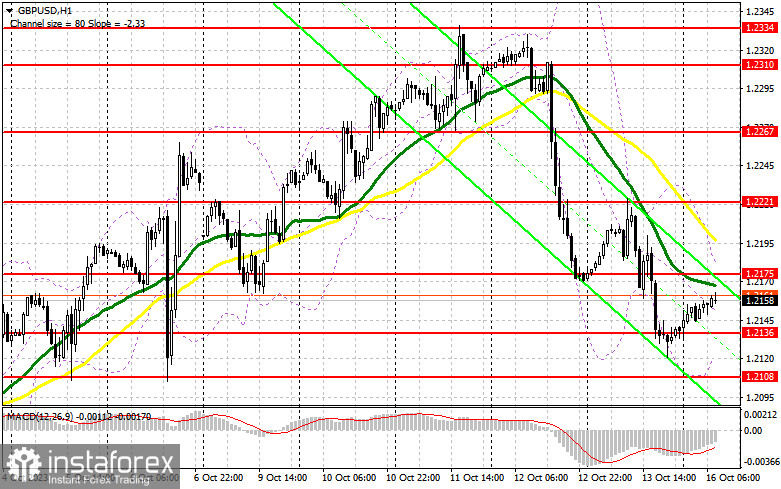

The speech of Bank of England Governor Andrew Bailey and strong US data became another reason to sell the British pound further along the trend, which we have formed as a result of last week's strong US inflation data. Today, except for the speech of BoE MPC member Huwe Pill, there are no scheduled economic reports, so sellers can easily continue to press the pound with the purpose of updating last week's lows. But I don't plan on buying until the price reaches the support level at 1.2136. A false breakout at this mark will serve as an entry point for long positions allowing the price to reach a major resistance at 1.2175, which is in line with the bearish moving averages. A breakout and consolidation above this range will make it possible to return the pair to the sideways channel, allowing the pair to reach 1.2221. The further target will be 1.2267 where I will take profits. If the pair rises and we see weak trading at 1.2136, the bears might take advantage of this opportunity, which will put even more pressure on the pair. In this case, I will postpone selling until a false breakout at 1.2108. One can sell the British pound on a bounce from the 1.2071 low, bearing in mind a 30-35-pips intraday correction.

For short positions on GBP/USD:

Today, the bears have a good chance of regaining control over the market and restoring the downtrend. Therefore, it is important not to miss the nearest resistance at 1.2175, where the pair is heading now. A false breakout at this level will give a sell signal to continue last week's downtrend and could push the pair towards the support level at 1.2136. Breaching this level and subsequently retesting it from below will deal a more serious blow to the bulls' positions, providing a window to aim for the 1.2108 low. The more distant target will be 1.2071, where I'd be taking profits. If GBP/USD grows and there are no bears at 1.2175, which is most likely to be the case, the demand for the pair will return and bulls will have a chance to push the pound in the sideways channel. In this case, I will postpone selling until a false breakout at 1.2221. If downward movement stalls there, one can sell the British pound on a bounce from 1.2267, bearing in mind a 30-35-pips downward intraday correction.

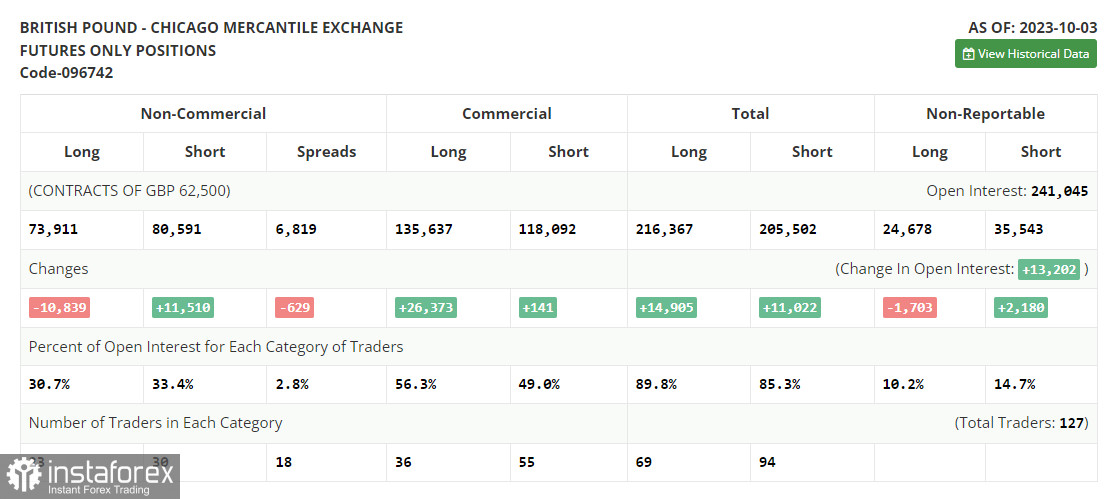

COT report:

In the COT (Commitment of Traders) report for October 3, we see a decrease in long positions and, in parallel, a very large increase in short positions. This suggests that buyers of the pound sterling are becoming less numerous, especially after a series of disappointing UK economic growth statistics and strong US data indicating the need for further interest rate hikes, making the US dollar more attractive in the medium term. The situation that is currently brewing up in the Middle East, although it does not greatly affect the British pound, still scares investors away from the risky assets to which it belongs, maintaining the luster of the US dollar as a safe-haven asset. The latest COT report said that long non-commercial positions fell by 10,839 to 73,911, while short non-commercial positions increased by 11,510 to 80,591. As a result, the spread between long and short positions narrowed by 629. GBP/USD closed last Friday lower at 1.2091 versus 1.2162 in the previous week.

Indicator signals:

Moving Averages

Trading below the 30- and 50-day moving averages indicates a possible decline in the pair.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If the pair declines, the lower band of the indicator around 1.2125 will act as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română