EUR/USD

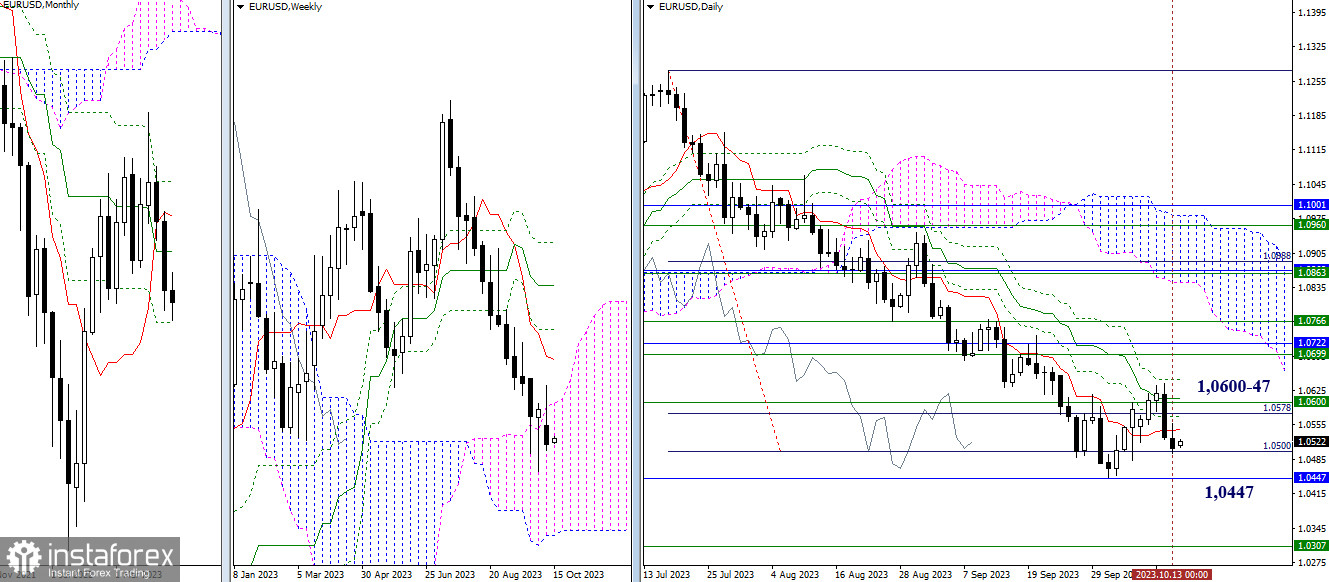

Higher Timeframes

Towards the end of last week, the initiative shifted towards the bearish players. As a result, instead of confirming a rebound from the weekly cloud formed earlier, the week closed within the cloud. Nevertheless, the pair remains in the zone of daily and weekly correction, which requires updating the low (1.0449) and overcoming the attraction of monthly support (1.0447) to exit. The next bearish reference point in this area will be the lower boundary of the weekly cloud (1.0307). If the bears lack the strength, and the opponent resumes building their positions, the immediate task will be to eliminate the death cross of the daily Ichimoku cloud (1.0546 - 1.0571 - 1.0609 - 1.0647), reinforced by the weekly short-term trend (1.0600).

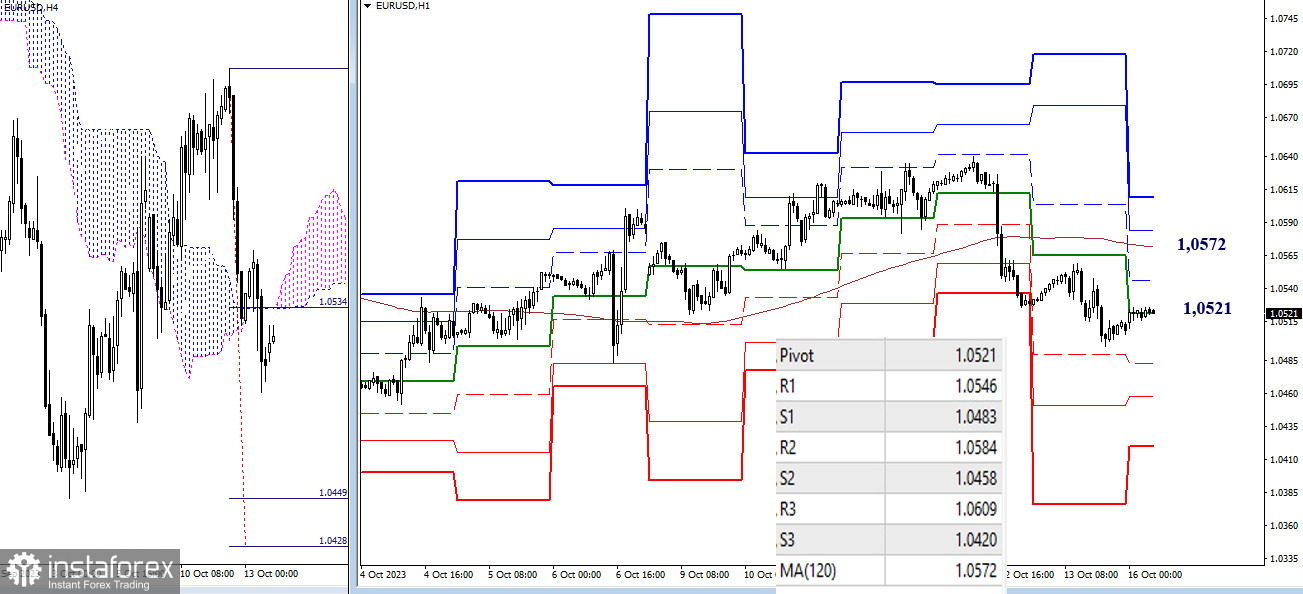

H4 – H1

On the lower timeframes, bears still have the main advantage. As of writing, the market is trading within the attraction zone of the central pivot point of the day (1.0521). To influence the current balance of power in favor of the bullish players, they need to surpass the resistance of the weekly long-term trend (1.0572) and, by reversing the moving average, securely consolidate above it. Additional bullish reference points within the day also include the resistance levels of the classic pivot points (1.0546 - 1.0584 - 1.0609).

Meanwhile, bearish targets today are at 1.0483 - 1.0458 - 1.0420 (support of the classic pivot points) and 1.0449-28 (target for breaking the H4 cloud). The achievement of the target will depend solely on the bearish players' ability to deal with the supports on the higher timeframes (1.0447-49).

***

GBP/USD

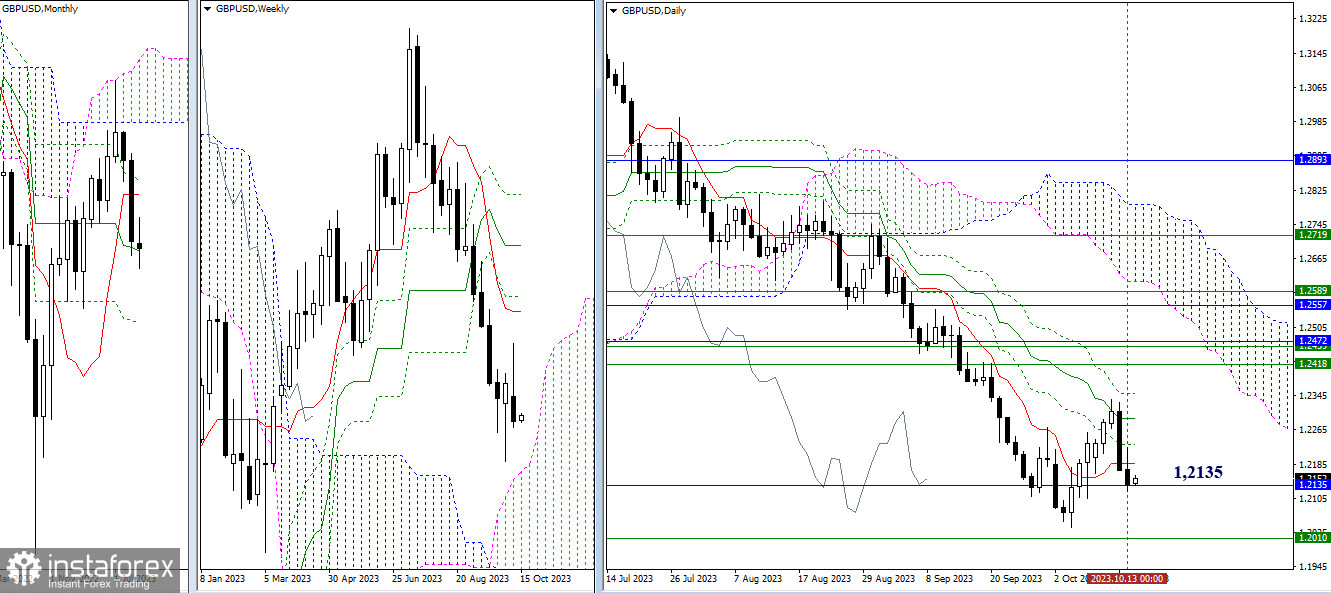

Higher Timeframes

Towards the end of the previous trading week, bears almost completely absorbed bulls' optimistic expectations. However, the pair remains within the zone of the upward correction of the daily and weekly timeframes, relying on the attraction and influence of the monthly medium-term trend (1.2135). To change the situation and gain new perspectives, the bullish players must eliminate the death cross of the daily Ichimoku cloud (1.2186 - 1.2231 - 1.2291 - 1.2351). In turn, for the bearish players in this section of the chart, it is important to restore the downward trend (1.2036) and enter the weekly cloud (1.2010).

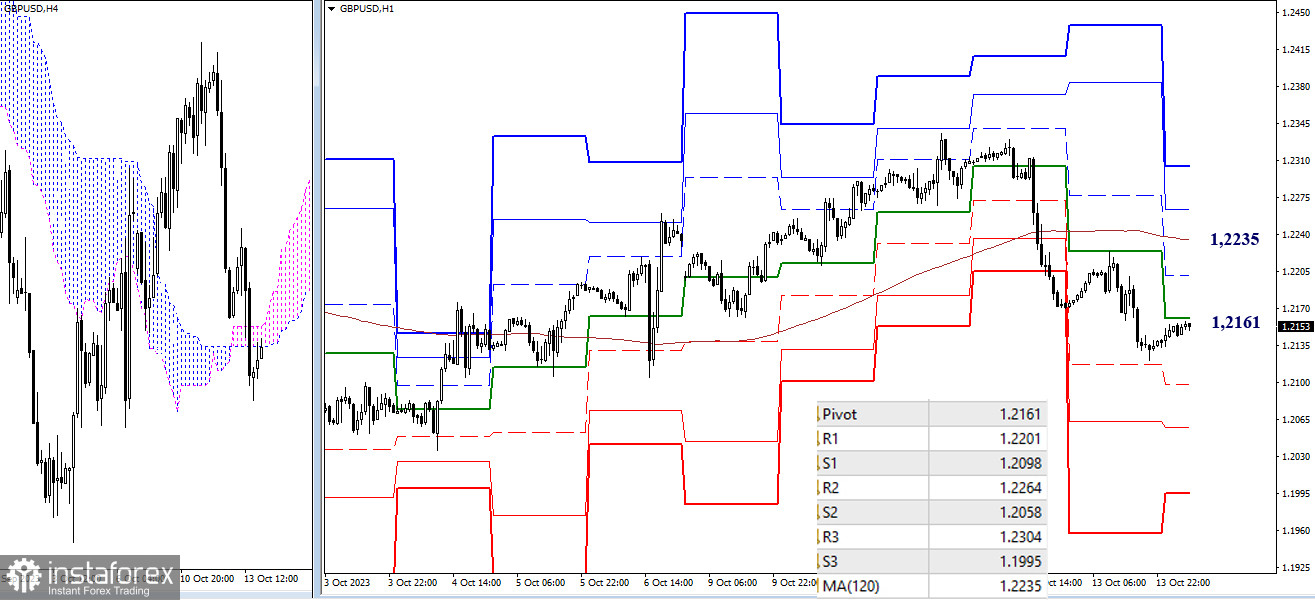

H4 – H1

The main advantage on the lower timeframes belongs to the bearish players because the pair is currently trading below key levels, which now act as resistance, located at 1.2161 (central pivot point) and 1.2235 (weekly long-term trend). Consolidation above and a reversal of the weekly trend will affect the current balance of power. The next reference points for an upward move, in this case, will be the resistance levels of the classic pivot points R2 (1.2264) and R3 (1.2304). If the bearish sentiment continues and intensifies, the reference points within the day will be the supports of the classic pivot points (1.2098 - 1.2058 - 1.1995).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română