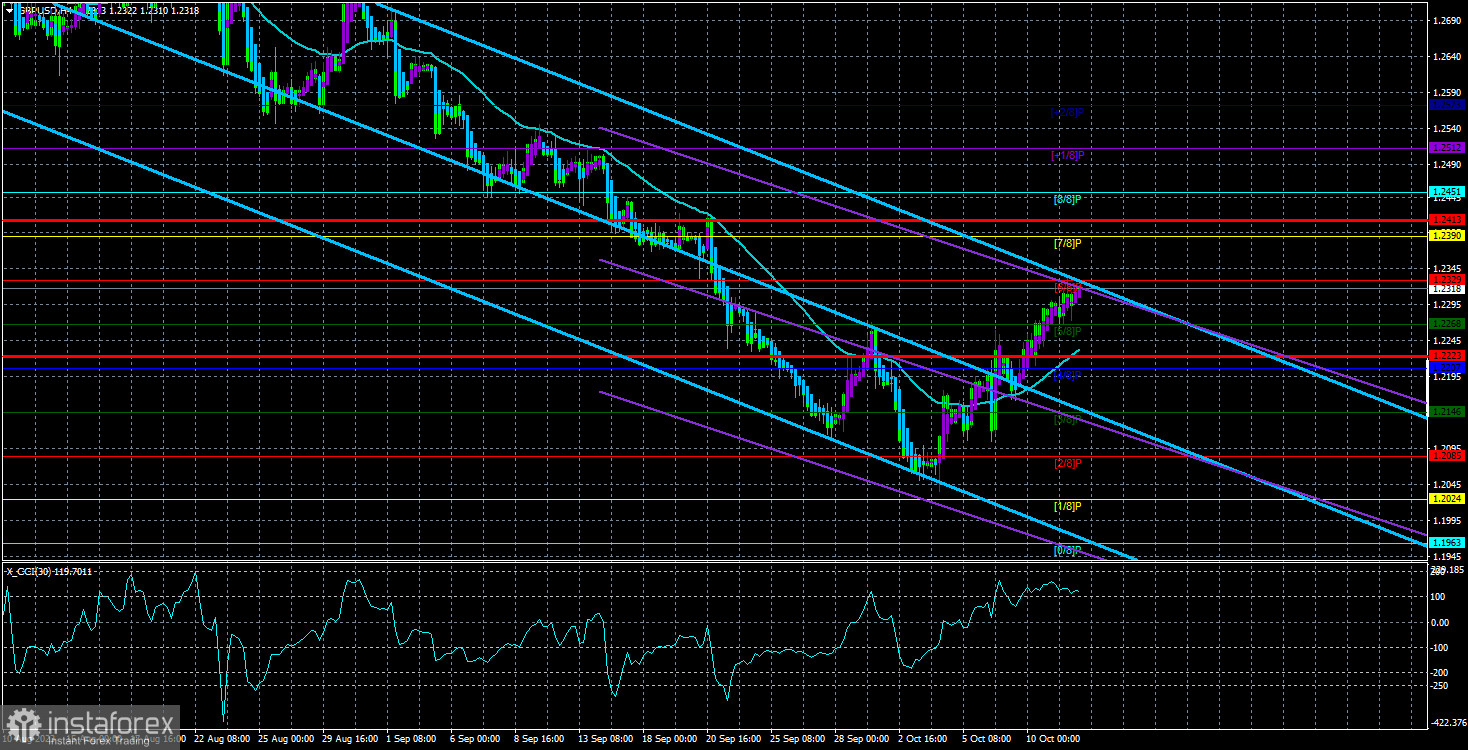

On Wednesday, the GBP/USD currency pair continued its upward correction movement, which was once more unaffected by macroeconomic or fundamental factors. Two linear regression channels show that the pair is still in a downward trend. However, the more critical signal was the triple entry of the CCI indicator into oversold territory, after which the upward correction simply had to begin. Thus, what we observe now is the purely technical growth of the British currency. The overall decline of the pound over the past two months has been around 1100 points, so the correction could be around 500–550 points. At the moment, the pair has moved up 280 points, so it can rise freely to the 25th or 26th level without strong news support.

However, in the 24-hour timeframe, a technical picture has formed, which suggests the resumption of the pound's decline as early as today. The price has hit an important Fibonacci level of 50.0% at 1.2300, as well as the Kijun-sen line of the Ichimoku indicator. A bounce off these obstacles may trigger a new leg down with a target of 1.1844, as we have mentioned many times before. In general, it is clear to everyone that the current strengthening of the pound is not due to negative information from the US but rather positive news from the UK. We have not received any information from the UK for a long time. So, once again, the correction is purely technical and may end for technical reasons and signals. There may be little impact from macroeconomic factors, although even some individual reports should not have a significant influence on the pair's movement.

We believe that the correction should be stronger than it is now, but it is the market that will make the final decision, not us. There are no signals for a resumption of the decline at the moment, so we continue to view the correction scenario as the main one.

Lorie Logan considers a rate hike unwise. Just yesterday, we talked about Raphael Bostic, the President of the Federal Reserve Bank of Atlanta, who was the first to make the statement that further tightening of monetary policy is not required. The head of the Federal Reserve Bank of Dallas, Lorie Logan, echoed his rhetoric yesterday. Ms. Logan stated that the sharp rise in US Treasury yields can be seen as a restraining factor for economic activity, so additional tightening is not needed in the current circumstances. In fact, Logan's statements were somewhat vague, as she admitted that the economic situation could change, and in that case, a rate hike would be possible. However, we have heard about the possible end of the tightening cycle from two Federal Reserve representatives.

To be more precise, Philip Jefferson, who holds the position of Vice Chairman of the Federal Reserve, also stated that a sharp increase in Treasury yields could deter further monetary policy tightening. He delivered these words in a more veiled manner, but the essence is roughly the same. Mr. Jefferson also mentioned that the rise in bond yields indicates a worsening market condition, which should be taken into account at the regulator's upcoming meetings. Thus, it may seem that the "bullish" support for the dollar is beginning to wane, but from our perspective, this is not the case.

The issue here is that the US currency has been rising for the past two months, not based on the "hawkish" policies of the Federal Reserve. The "hawkish" policy of the Federal Reserve has been in place for a year and a half, during which the dollar has been actively declining. The current decline in the euro and pound is also a technical correction against a stronger preceding movement. Given that the euro and pound have unfairly appreciated over the last 12 months, what we are witnessing now is merely a return of both pairs to balance. Therefore, the weakening of the "hawkish" sentiment among Federal Reserve officials should not affect the favorable outlook for the dollar in the next 2–3 months.

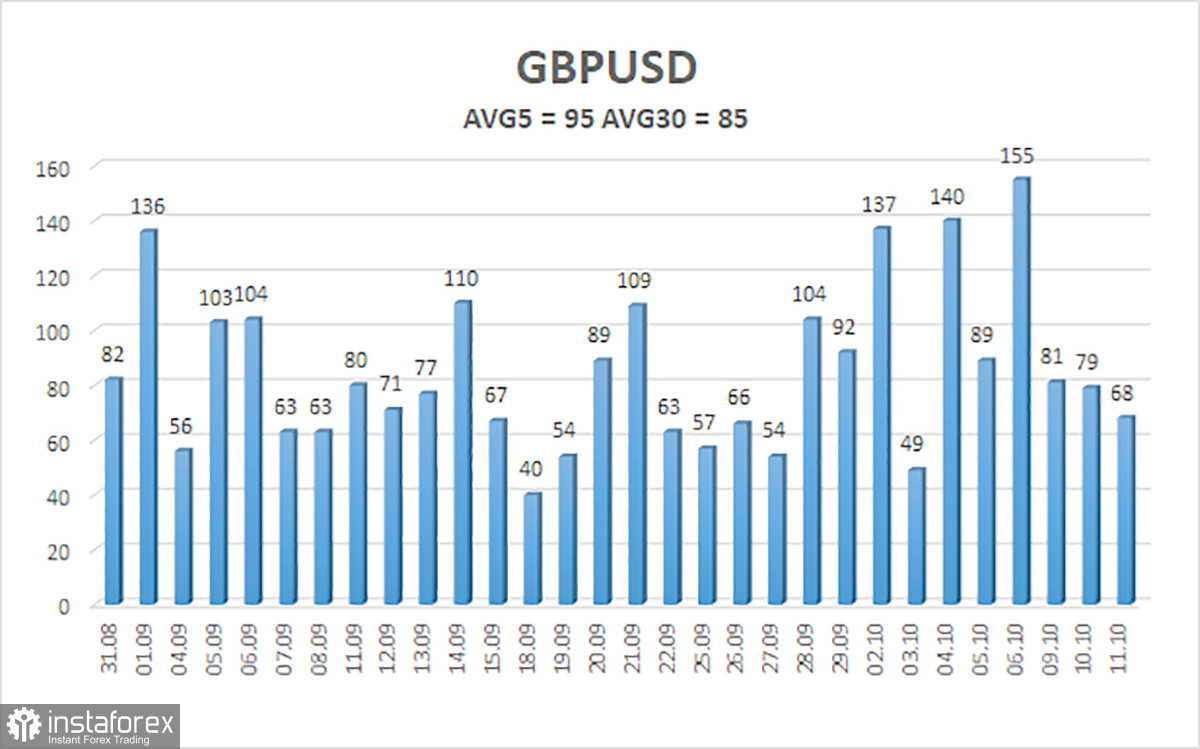

The average volatility of the GBP/USD pair over the last 5 trading days is 95 points. For the pound/dollar pair, this value is considered "average." As a result, on Wednesday, October 12th, we anticipate movement between levels 1.2223 and 1.2413. A reversal of the Heiken Ashi indicator to the downside will signal the possible resumption of the downward movement.

Nearest support levels:

S1 - 1.2268

S2 - 1.2207

S3 - 1.2146

Nearest resistance level:

R1 - 1.2329

Trading recommendations:

In the 4-hour timeframe, the GBP/USD pair has begun a new phase of correction. Therefore, short positions can be considered with targets at 1.2146 and 1.2085 in case the price settles back below the moving average. At the moment, you can stay in long positions with targets at 1.2390 and 1.2413 until the Heiken Ashi indicator reverses to the downside.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both are pointing in the same direction, it means the trend is currently strong.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will trade in the next 24 hours, based on current volatility indicators.

CCI indicator - its entry into the oversold territory (below -250) or overbought territory (above +250) indicates an impending trend reversal in the opposite direction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română