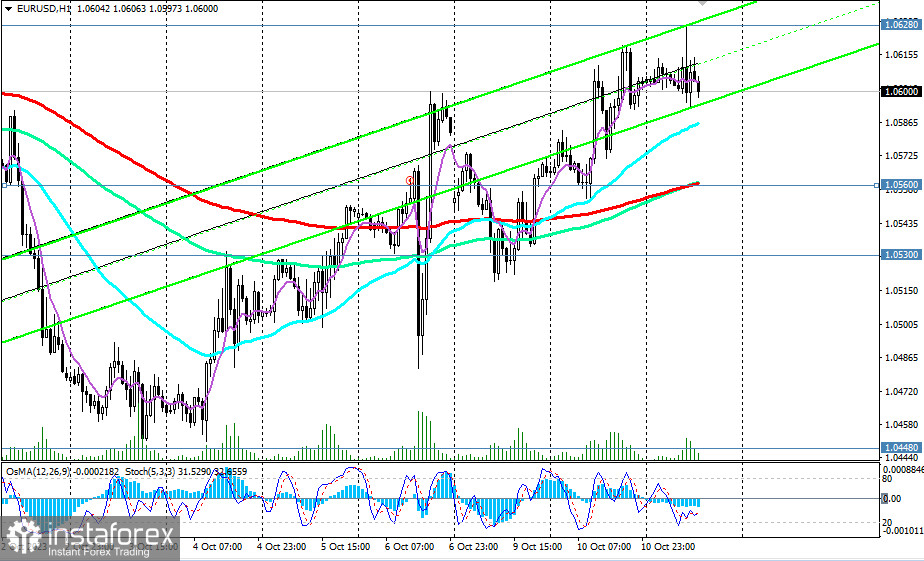

Last Wednesday, after declining for 11 weeks in a row, the pair's direction reversed.

By Friday, following the release of the American NFP report, the EUR/USD growth accelerated. The price broke through a crucial short-term resistance level (200 EMA on the 1-hour chart), which was then around the 1.0543 mark, and entered the short-term bullish market zone.

However, after a 5-day advance the day before, the EUR/USD pair has now paused its ascent. As of writing, it was trading near the 1.0600 mark.

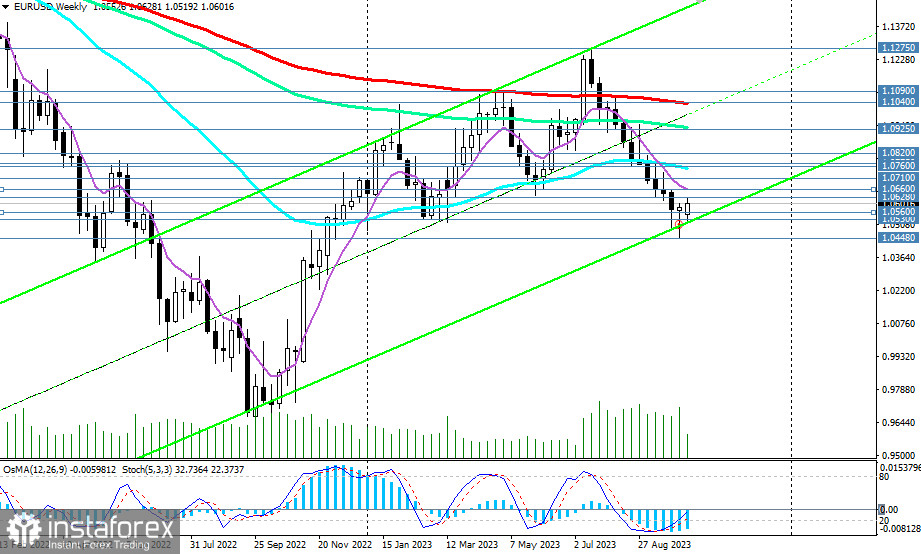

In the event of breaking today's high at 1.0628 and subsequently overcoming the significant resistance level at 1.0660 (200 EMA on the 4-hour chart), the corrective rise of the pair may continue towards the key resistance levels at 1.0760 (200 EMA on the daily chart) and 1.0775 (144 EMA on the daily chart). Breaking through them will place EUR/USD into the medium-term bullish market zone. Furthermore, breaching the key resistance levels at 1.1040 (200 EMA on the weekly chart and 50 EMA on the monthly chart) will return the pair to the long-term bullish market zone.

In an alternative scenario, the first signal to reinitiate short positions could be breaking today's low at 1.0593, and breaking the important short-term support level at 1.0560 (200 EMA on the 1-hour chart) would serve as a confirming signal. The nearest downside target is the local low at 1.0448.

Support Levels:1.0600, 1.0593, 1.0560, 1.0530, 1.0500, 1.0448, 1.0400

Resistance levels: 1.0628, 1.0660, 1.0700, 1.0710, 1.0760, 1.0775, 1.0800, 1.0820, 1.0900, 1.0925, 1.1000, 1.1040, 1.1090, 1.1200, 1.12 75, 1.1300, 1.1400, 1.1500, 1.1600

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română