The EUR/USD currency pair continued its upward correction on Tuesday, which began a few days ago and was expected for a couple of weeks. We believe that the corrective movement should continue in the current circumstances, as the European currency has been declining for two months with very little correction. Therefore, regardless of the fundamental and macroeconomic backdrop, we support the rise of the European currency. Of course, we are only talking about a correction. If the euro has fallen by 800 points in the last 2 months, a logical correction size of 400 points can be considered. At the moment, the pair has moved up by 170, so there is still potential for the euro currency to rise.

However, after the completion of the correction, we inevitably expect a new phase of the European currency's decline. Moreover, there is a high chance that the decline will resume today or tomorrow. To see this, you should switch to the 24-hour timeframe and observe that the price has reached a critical Kijun-sen line and the Fibonacci level of 38.2% at 1.0609. These are two powerful barriers that can hinder further strengthening of the European currency. Furthermore, as we have already mentioned, there are still a few fundamental factors supporting the euro's rise.

In conclusion, the correction may continue for another week or two, but it requires overcoming the level of 1.0609. The resumption of the euro's decline would not surprise anyone.

Francois Villeroy de Galhau adds fuel to the fire. Over the past three months, we have repeatedly witnessed statements from ECB monetary committee representatives that it is no longer advisable to raise the key interest rate. These discussions began in the middle of the summer, and about three weeks later, the European currency began to decline. Coincidence? Recall that in September of last year, the dollar began to fall when inflation in America started to slow down, and the market was already anticipating the end of the tightening cycle of monetary policy. To be more precise, it simply worked out all the Fed rate hikes in advance, as the US currency had been rising for a long time until September 2022.

Now we are seeing the same situation with the European currency. As soon as the market realized that there would be no more tightening in the EU, it immediately started to get rid of the European currency. The ECB rate is 4.5%, while the Fed rate is 5.5% and could increase one more time. Such an imbalance can persist for a very long time, as it is obvious in the European Union that the rate needs to be maintained at this level for 2-3 years to bring inflation back to 2%. And even then, it's far from guaranteed that it will return. In the United States, dealing with inflation is a bit simpler, but it has been accelerating in the last two months, so it may require another rate hike and a prolonged period at the peak. And since the imbalance in interest rates will persist for a very long time, the dollar may have an advantage over the European currency during this period.

Meanwhile, Francois Villeroy de Galhau, the head of the Bank of France, stated that there is no need for a new interest rate hike at this stage. Mr. de Galhau noted that they are closely monitoring the situation in Israel, which could impact oil prices, subsequently driving up inflation. However, he believes that inflation forecasts for 2025 remain unchanged. We believe that in 2025, the consumer price index will return to 2%, according to the head of the Bank of France.

In our view, the ECB will try to achieve its inflation target with minimal economic impact, as the European economy has been hovering near zero GDP growth for about a year already. Now, the European currency can only show growth in the event of a weakened fundamental backdrop in the United States. For example, if there is information about a softer monetary policy. But given the recent statements from FOMC officials, no one will be talking about a softer policy in the near future.

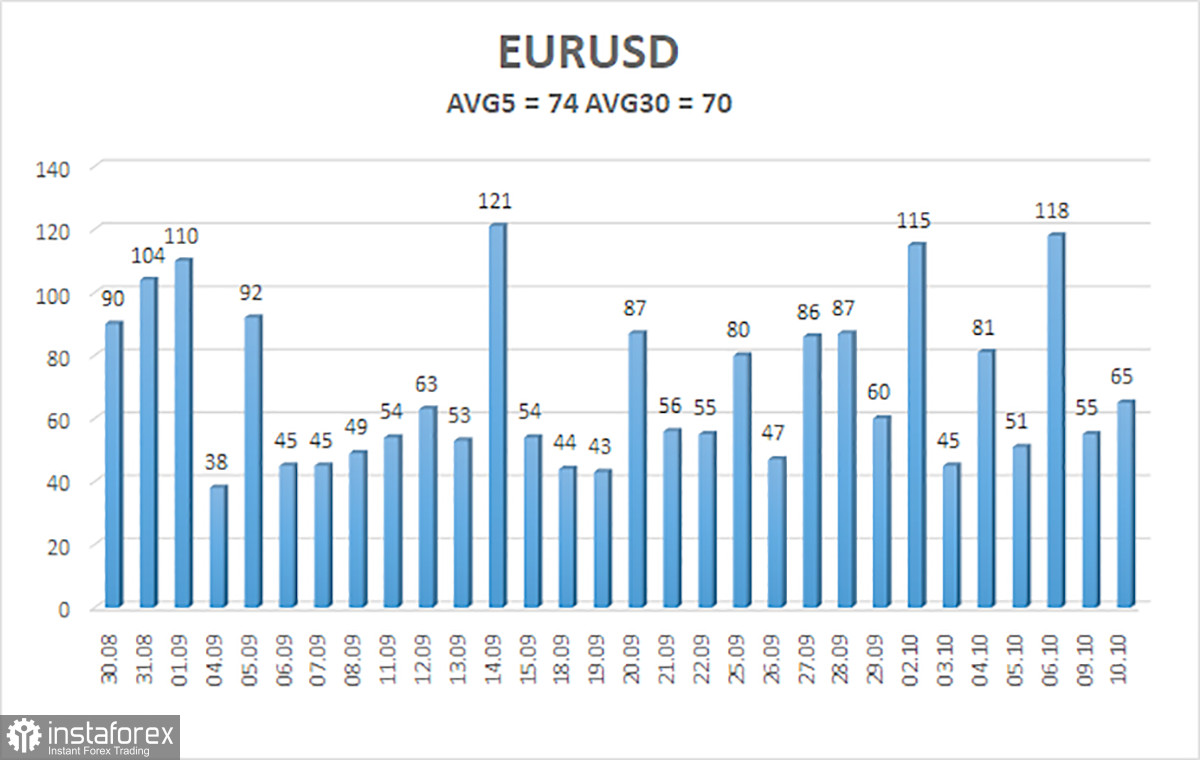

The average volatility of the EUR/USD currency pair over the last 5 trading days as of October 11th is 74 points and is characterized as "average." Therefore, we expect the pair to move between the levels of 1.0531 and 1.0679 on Wednesday. A reversal of the Heiken Ashi indicator back down will indicate a possible resumption of the downward movement.

Nearest support levels:

S1 - 1.0498

S2 - 1.0376

S3 - 1.0254

Nearest resistance levels:

R1 - 1.0620

R2 - 1.0742

R3 - 1.0864

Trading recommendations: The EUR/USD pair continues to move upward within the correction. Short positions can be considered with targets at 1.0498 and 1.0376 if the price settles back below the moving average. Long positions can be considered when the price is above the moving average line with targets at 1.0620 and 1.0679, but we do not anticipate a strong rise in the euro currency.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both are pointing in the same direction, it means the trend is currently strong.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and direction for trading.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price range in which the pair will move over the next day based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) indicates that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română