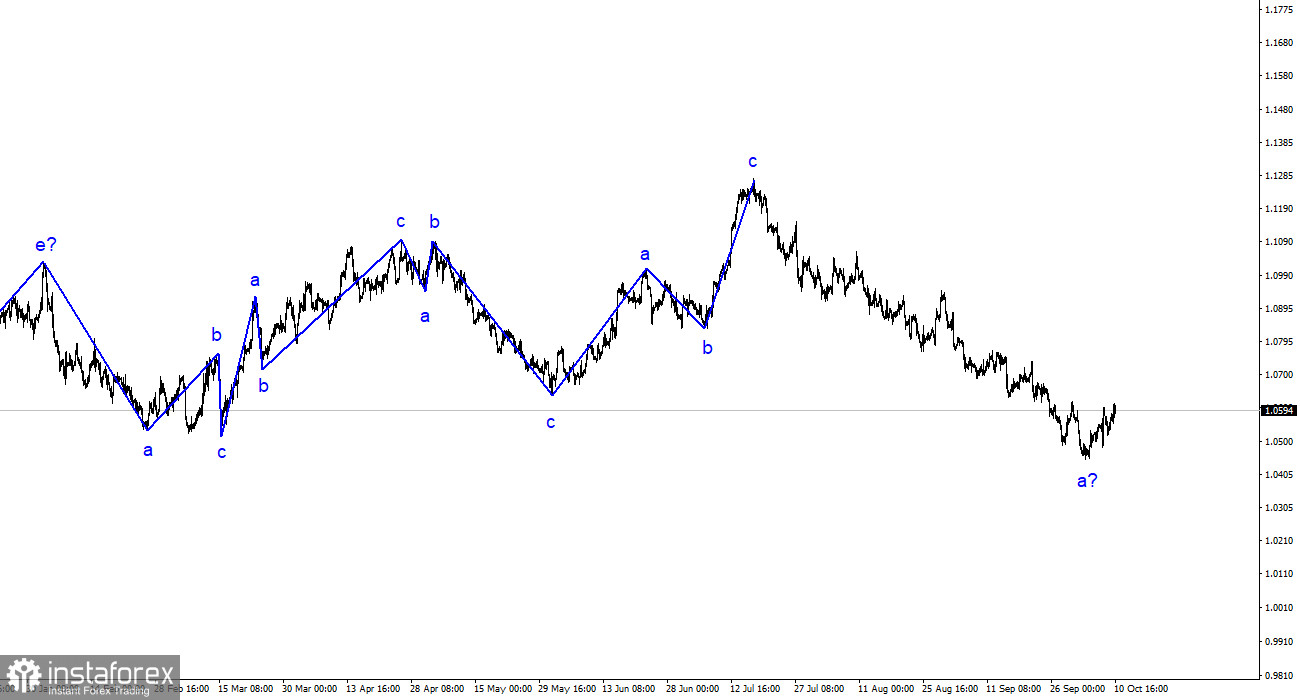

The wave analysis of the 4-hour chart for the euro/dollar pair remains quite clear. Over the past year, we have seen only three wave structures that constantly alternate with each other. Over the past few months, I have regularly mentioned that I expect the pair to reach around the 5th figure, from which the construction of the last upward three-wave structure began. This target was reached after a two-month decline. The presumed first wave of the new downtrend phase may continue its formation, although there are currently certain signs of its completion.

None of the recent price increases resembled a full-fledged wave 2 or b. Therefore, all of these were internal corrective waves in 1 or a. If this is indeed the case, the decline in quotes may continue for some time during this wave. And thus, the overall decline of the European currency will not be completed, as the construction of the third wave is still required. Inside the first wave, there are already five internal waves, so its completion is approaching. The unsuccessful attempt to break through the 1.0463 level, which is equivalent to 127.2% according to Fibonacci, indicates the market's readiness to begin building a corrective wave.

The euro currency has found a "bottom" around the level of 1.0463.

The euro/dollar pair continued to move away from previously reached lows on Tuesday. The increase was 25 basis points, which is not much, but the increase has been ongoing for the fifth consecutive day. Unfortunately, the overall rise in the European currency during this time has only been 140 points, which still makes me doubt the formation of wave 2 or b. There are all reasons to assume that this wave may also be internal in 1 or a and, accordingly, not 2 or b. Let's see, there are more important and interesting events ahead this week, so maybe we will get an answer to this question. Meanwhile, I will focus on the 1.0637 mark, which corresponds to 100.0% according to Fibonacci. An unsuccessful attempt to break through it will indicate the market's unpreparedness to build a full-fledged corrective wave.

There is no news background, and that's all there is to it. What could have influenced market sentiment on Monday and Tuesday? Industrial production in Germany? The speech of Christine Lagarde, which was supposed to take place a few hours ago in Morocco but about which nothing is known yet? These are clearly not the news and events to rely on for a strong impact on the market. However, the pair does not currently need strong news support. While the corrective wave continues to develop, the euro does not require news and reports support.

General Conclusions:

Based on the analysis conducted, I conclude that the formation of the bearish wave set continues. The targets around the 1.0463 mark have been ideally worked out, and the unsuccessful attempt to break this mark indicates the market's readiness to build a corrective wave. In my recent reviews, I warned that it is worth considering closing short positions, as the probability of building an upward wave is currently high. A breakthrough of 1.0463 will indicate another "false alarm," and it will be possible to sell the pair again with targets located around the 1.0242 mark, which corresponds to 161.8% according to Fibonacci.

On the higher wave scale, the upward wave analysis of the trend has taken on an extended form but is likely to be completed. We have seen five upward waves, which are most likely a structure a-b-c-d-e. Next, the pair built four three-wave structures: two downward and two upward. Currently, it has probably moved on to the stage of constructing another extended three-wave downward structure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română