EUR/USD

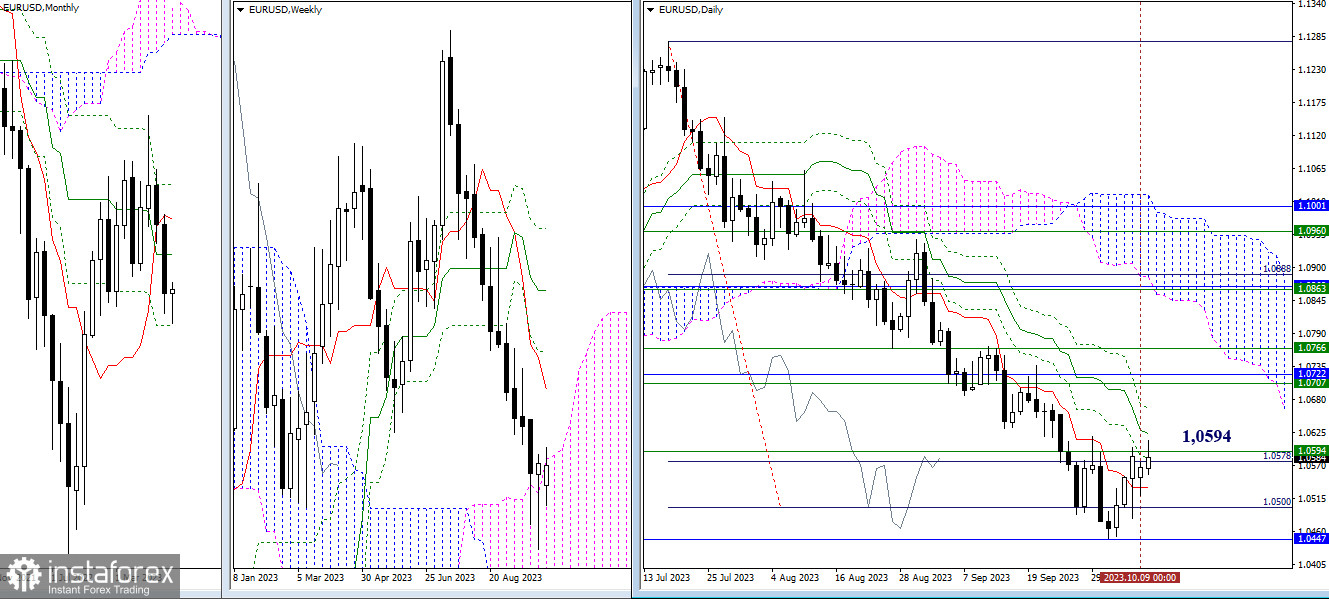

Higher Timeframes

Bulls managed to recover from yesterday's downward gap that occurred at the market opening and updated the previous week's high (1.0601). As a result, the main target now once again boils down to breaking beyond the weekly cloud (1.0594) into the bullish zone. Next, it will be necessary to eliminate the death cross of the daily Ichimoku cloud (1.0624 – 1.0665). Failure to achieve the above could bring bearish sentiments back into play. The nearest supports today remain at 1.0534 – 1.0500 – 1.0447.

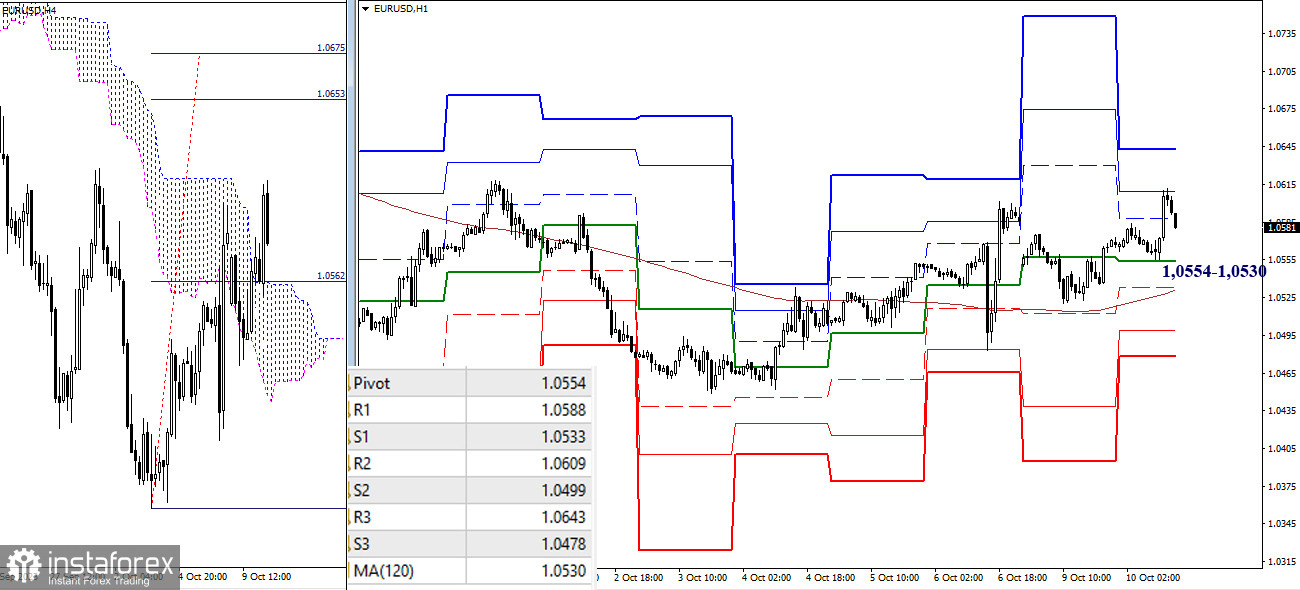

H4 – H1

Bulls' advantage on the lower timeframes allowed testing today's resistance of the classic pivot points R2 (1.0609), with R3 (1.0643) as the next target. Additionally, an upward target has been set for breaking through the H4 cloud (1.0653-75). Shifting priorities and redirecting attention from bullish benchmarks would emphasize the significance of opposing levels. In this case, the nearest and most critical supports would be the central pivot point of the day (1.0554) and the weekly long-term trend (1.0530).

***

GBP/USD

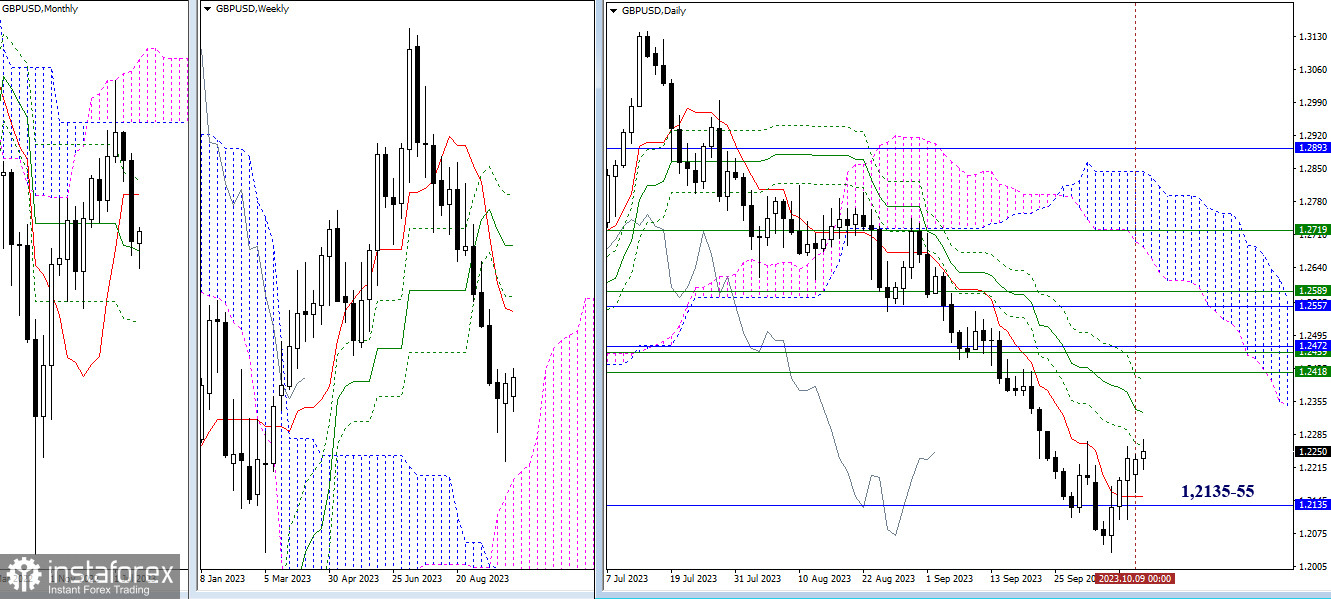

Higher Timeframes

Bullish players have regained their positions lost at the market opening with a downward gap. By now, the previous week's high has been updated (1.2260), and the daily Fibonacci Kijun (1.2263) has been tested. Further development of the upward correction on the daily and weekly timeframes lies through testing and surpassing the resistances of the daily Ichimoku cross (1.2333 – 1.2403), reinforced by the weekly short-term trend (1.2418). Today, the nearest and most significant supports are still 1.2155-35 (daily short-term trend + monthly medium-term trend).

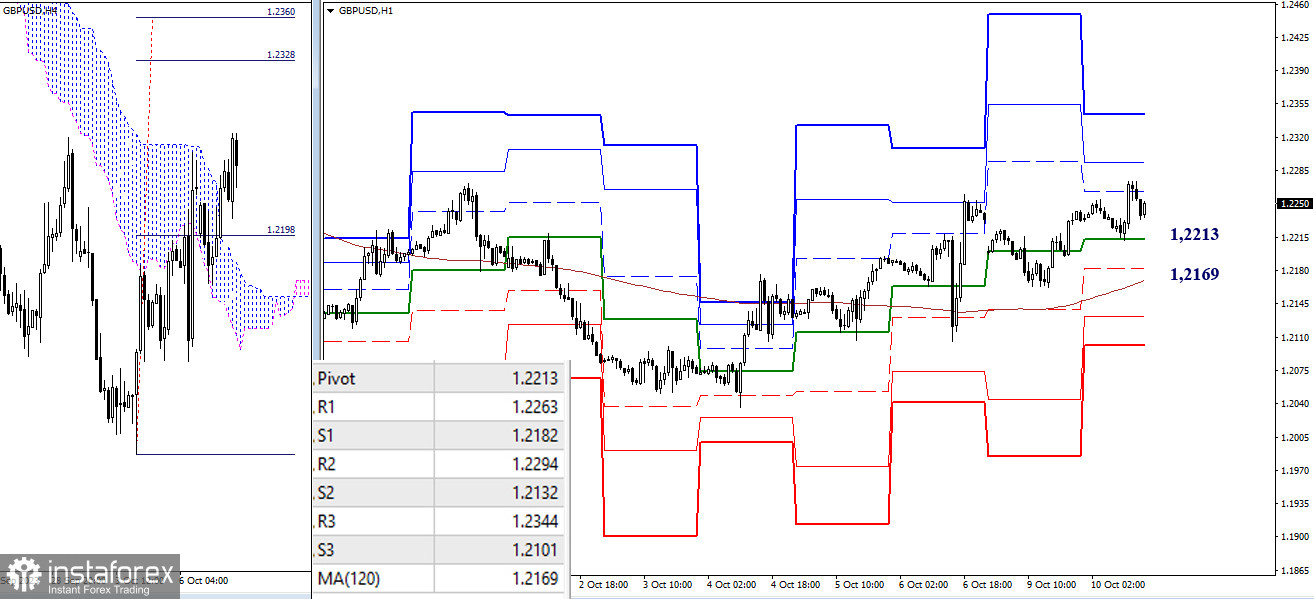

H4 – H1

Bulls maintain their advantage on the lower timeframes, trading above key levels 1.2213 – 1.2169 (central pivot point + weekly long-term trend). Intraday bullish targets include the resistance of the classic pivot points (1.2263 – 1.2294 – 1.2344) and a bullish target formed yesterday for breaking through the H4 cloud (1.2328 – 1.2360). In the event of breaking the key levels, support from classic pivot points (1.2132 – 1.2101) would serve as bearish targets.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română