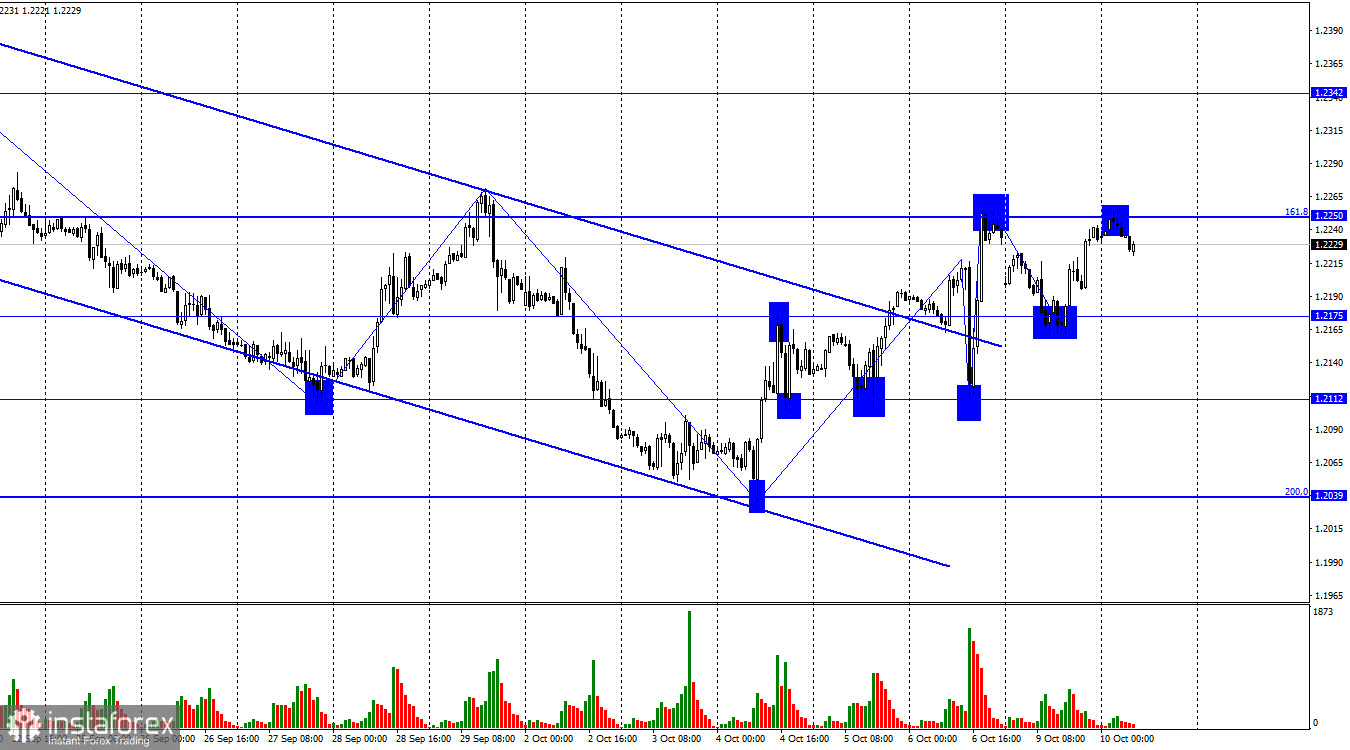

On the hourly chart, the GBP/USD pair on Monday saw a decline to the level of 1.2175, a rebound from it, a reversal in favor of the British currency, and a rise to the corrective level of 61.8%-1.2250. A rebound of quotes from this level will work in favor of the US currency and a resumption of the decline towards 1.2175. If the pair's exchange rate settles above 1.2250, it will increase the chances of further growth towards the next level at 1.2342. Since the pair has left the descending trend corridor, the chances of growth for the British pound are not bad, but I have serious doubts about the bulls' ability to attack.

The wave situation is quite confusing at the moment but may become clearer today. Friday's upward wave is rather random, and without it, we have only one upward wave (October 4-6), which did not break through the peak of the previous upward wave. In this case, it turns out that the "bearish" trend remains intact. Yesterday's upward wave did not break through the peak of Friday's wave, so today signs of a reversal may begin to appear, even if we take into account Friday's waves. The second rebound from the level of 1.2250 indicates a highly probable decline of the British pound, which may lead to a reversal of the trend to "bearish."

The information background for the British pound has been absent for a long time. This week, on Thursday, there will be mediocre reports on GDP and industrial production in August, but both will not have a decisive impact on traders and the British pound. Much more interest will be generated by the inflation report for September in the United States, which will also be released on Thursday. Tomorrow evening, the publication of the FOMC minutes, which everyone calls "FOMC minutes," will be a significant event. This document may contain information that reflects the mood of the members of the Federal Reserve Board regarding the rate hike at the next meeting, i.e., in November. This is important information for the US dollar.

On the 4-hour chart, the pair made a reversal in favor of the British currency after the formation of a "bullish" divergence in the RSI indicator. The growth process can be continued towards the Fibonacci level of 50.0%–1.2289, but the "bearish" divergence in the CCI indicator allows us to expect a resumption of the decline towards the level of 1.2008. A rebound of the pair's exchange rate from the level of 1.2289 will also work in favor of the US currency. The rebound from the upper line of the descending trend corridor is the same. A strong rise in the British pound can be expected only after closing above the corridor.

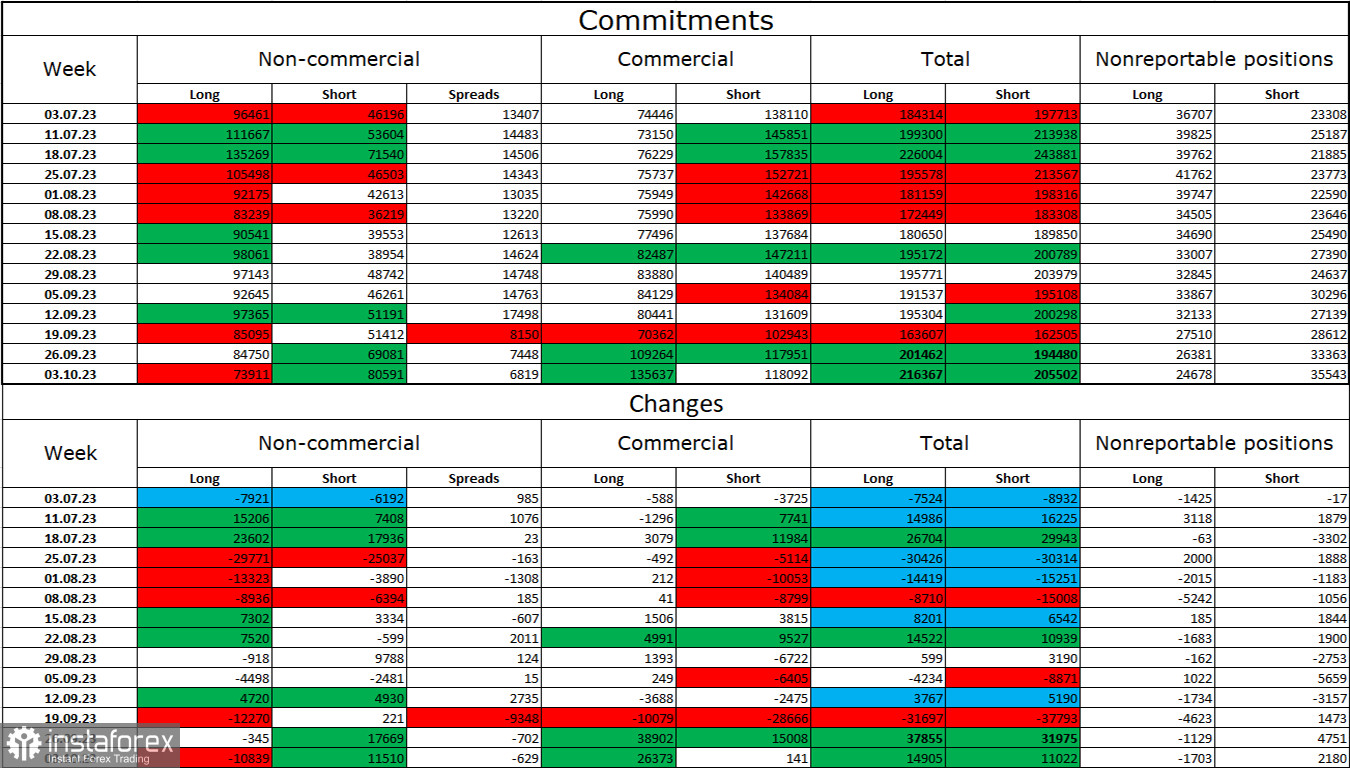

Commitments of Traders (COT) report:

The sentiment among "non-commercial" traders in the past reporting week has once again become less "bullish." The number of long contracts held by speculators decreased by 10,839 units, while the number of short contracts increased by 11,510 units. The overall sentiment of major players has shifted to "bearish," and the gap between the number of long and short contracts is widening, but now in the opposite direction: 73,000 versus 80,000. In my view, there are still excellent prospects for the British pound to fall. I do not expect a strong rise in the pound sterling in the near future. I believe that over time, bulls will continue to unwind their buy positions, as was the case with the European currency. Only a close above the descending corridor on the 4-hour chart will make me consider a new "bullish" trend.

News calendar for the USA and the UK:

On Tuesday, the economic events calendar does not contain any important entries. The impact of the information background on market sentiment will be absent today.

Forecast for GBP/USD and trader recommendations:

Sales of the British pound were possible on a rebound from the level of 1.2250, with targets at 1.2175 and 1.2112. These trades can still be kept open. Buys are possible today in the event of a rebound from the level of 1.2175, with targets at 1.2250 and 1.2342. Or in case of a close above 1.2250 with a target of 1.2342.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română